After funding an irrevocable trust with significant wealth, clients may wonder how to use trust assets to help a beneficiary buy a house without sacrificing the trust’s tax and asset protection benefits.

As we advise clients on these fundamental questions, advisors should be sensitive to the fact that home ownership is almost universally viewed as a positive step for a child gaining financial independence and starting their own family.

Outright Gifts

A client may prefer not to use a trust. It’s simpler, and clients can use assets included in their taxable estate and reachable by their creditors to help the child purchase a home.

Substantial cash gifts may be disfavored because cash can’t be leveraged out of an estate using valuation discounts, and a simple gift affords no protection for the cash given. The annual gift exclusion has increased. In 2024, a married couple can split a gift of up to $36,000 (or $18,000 each) to a beneficiary without a gift tax consequence (double that if they gift to the child’s spouse). Straddling two years would allow for $144,000 in annual exclusion transfers.

Cash Distributions From Trust

Clients who funded significant irrevocable trusts for their children and future descendants may seek distributions to the child for the child to purchase a home. Because these funds may already be outside the client’s estate and protected from creditors, such distributions may be disadvantageous as compared to using non-trust assets. Trustees should consider:

- Does the trust instrument permit the trustee to acquire non-income-producing assets, for example, an interest in the child’s new home?

- Can a trust with multiple beneficiaries be broken into subtrusts to segregate trust assets and avoid the disproportionate benefit to

- one beneficiary?

- Are additional acknowledgments warranted from other trust beneficiaries, particularly when significant cash distributions will reduce the growth potential of the trust?

- If generation-skipping transfer (GST) tax exemption was allocated to the trust, might distributions to nonskip persons undermine the dynastic purpose?

Further, distributions shift economic value from the protective envelope of the trust to the beneficiary, possibly in contravention of the settlor’s original intent to create an asset protection plan. Property purchased by a child with trust distributions would be subject to the child’s creditors, including an ex-spouse.

Loans might be a better alternative.

Using Loans

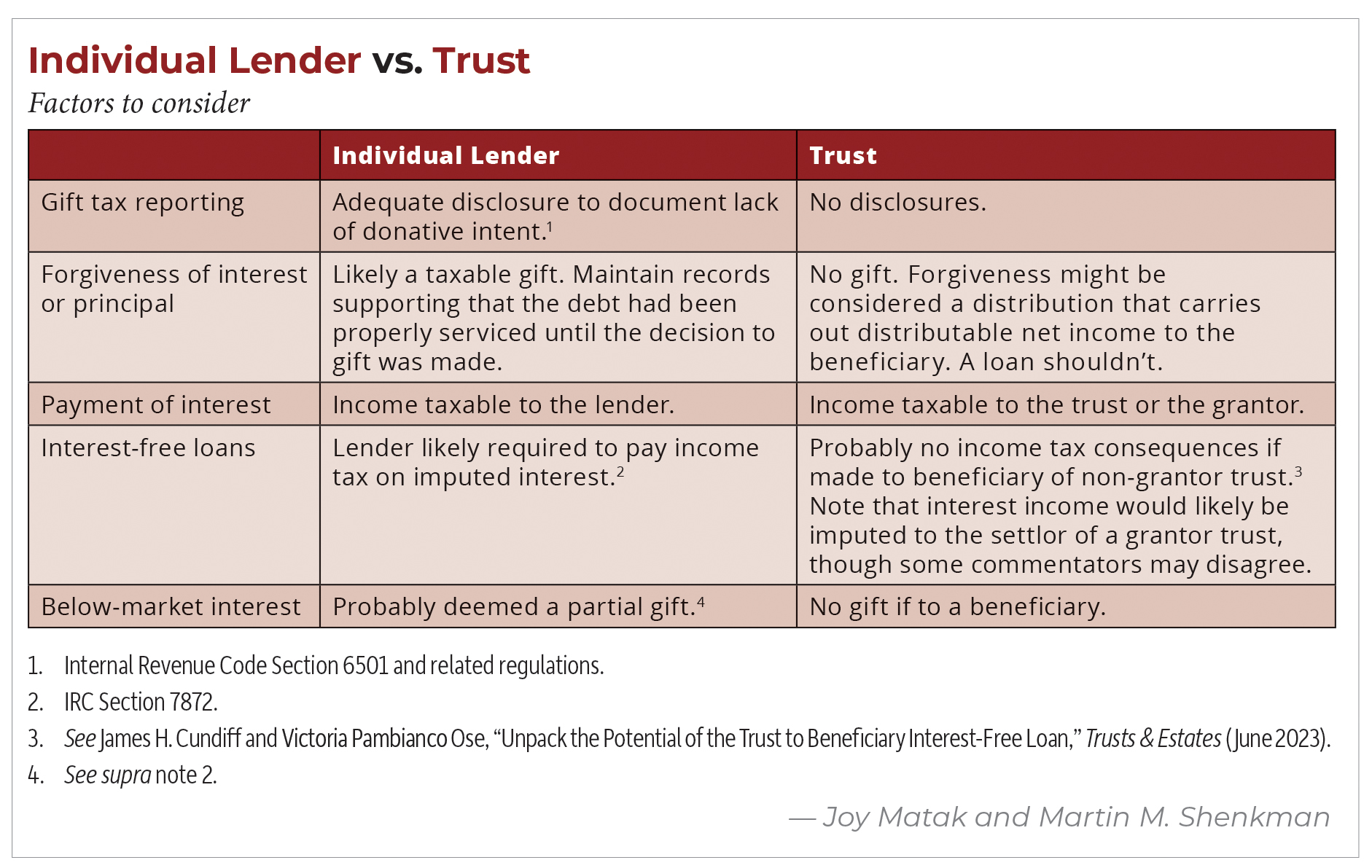

When the home purchase price is substantial, a loan may make sense. To the extent that the trust has sufficient liquidity and adequate terms, a trust might be preferable to an individual lender. See “Individual Lender vs. Trust,” p. 18.

Either way, advisors should work with the trustee/lender to document the loan and secure it with a mortgage. A mortgage protects the loan as a trust investment and could enable the borrower to deduct mortgage interest. The loan and attendant documents should evidence the intention of the parties for the debt to be repaid. By administering the debt properly, with all formalities of a loan observed, it’s more likely that the debt will be upheld and prioritized against challenges by the beneficiary-borrower’s creditors.

Trust as Guarantor

A trust might assist a beneficiary in acquiring a home by offering to guarantee the beneficiary’s purchase money mortgage. For a working beneficiary with sufficient income but a limited credit history, an independent lender might require a guarantor to approve or issue a loan at a more favorable interest rate. A beneficiary may not be required to pay a fee to the trust for such a guarantee.1 Advisors should be able to structure this transaction so that there are no income tax consequences.

Financial Implications

When the child of a high-net-worth client seeks to purchase a property, it may be essential to analyze at the outset whether the child has the money to cover the carrying costs of the property involved. While this point may be obvious to practitioners, many clients might forgo the required budgeting.

While a child may have personal reasons for wanting a particular home, advisors should assess whether the child appreciates the associated financial and personal responsibilities with ownership. Together with the trustees, advisors should quantify the mortgage, property taxes and ongoing costs for the client and the child-beneficiary. The advisors should guide clarifying discussions about the resources available to cover expenses.

Advisors might present different options if the child doesn’t have sufficient cash flow to cover the costs of maintaining the home. Advisors should run cash flow projections to evaluate whether the trust has adequate resources to cover expected costs. Determine whether the trust allows for, can afford to and should make supplemental distributions to the beneficiary. If the decision to make such distributions is discretionary, consider how to handle any shortfalls if the trustee refuses to make a distribution in any given year.

For a trust with multiple beneficiaries, regular distributions to cover maintenance costs of one beneficiary’s house could lead to dissent among the other beneficiaries. Perhaps the trust should be split into separate shares, or the trust should treat all disproportionate payments as advances to that beneficiary to assure future equalization. The parents might make gifts at or under the annual exclusion amount to help the beneficiary.

Perhaps the beneficiary might be able to present a reasonable plan, particularly when the beneficiary’s income is expected to rise in future years and the beneficiary is otherwise fairly responsible.

The advisors may need to help the client dissuade a child from purchasing a particular home that isn’t a reasonable choice, given the child’s circumstances and the ability of trust cash flow to cover anticipated expenses.

Consider the personal perspectives on the transaction. Individuals typically expect to own their home, usually with their spouses, regardless of any legal or tax consequences stemming from the source of the funds.

Advisors might need to have difficult conversations with the client and, in certain circumstances, the child, about whether it’s reasonable for the child to own the property with their spouse. The advisors should review the prenuptial agreement, if there is one, to determine how to address such issues and perhaps consider whether to entice the child’s spouse to execute a post-nuptial agreement.

Purchase by Trust

A dynastic trust may purchase the desired property and retain it in trust for as long as state law permits. Some thoughts:

1. Trust ownership can facilitate growth outside the client’s and child’s taxable estate and protect the property from the child’s divorce and creditor claims. Further, this structure may make it easier for the trust to pay the maintenance and carrying costs for the property.

2. The trust instrument should have an express provision to permit the trustee to hold personal use property. If using an institutional trustee, the advisor should determine whether such a trustee might have any issues with holding personal use property. When an institutional trustee is serving but is unwilling to administer personal use property, the trust might be structured as a directed trust that names an individual (for example, an “investment director”) who’s able to make trust investment decisions and empowered to direct the trustee to purchase and hold the personal use residence.

3. To the extent that the trust separates investment and distribution functions and allows different fiduciaries to make those decisions, the draftsperson should identify with specificity which fiduciary will be responsible for the decisions to purchase and hold personal use property (or make a loan to the beneficiary for that purpose). Without specificity in the trust instrument, it may not be certain whether purchasing and maintaining a home would be viewed as an investment or distribution decision.

Payment of Rent to Trust

The trustee should review the trust instrument to determine whether it either contains specific language or grants the trustee discretion to permit a beneficiary rent-free use of the property.

The trustee or the family itself might wish for the beneficiary to pay rent, perhaps to teach responsibility, to have the beneficiary take ownership responsibility to maintain the home, to equalize among other beneficiaries of the trust particularly when only one beneficiary is presently receiving such a benefit or to augment the trust cash flow to meet expenses of the home.

These interests should be weighed against the income tax consequences of collecting rent:

- If the trust were a grantor trust, the grantor would have taxable income to the extent that the rental income exceeded the expenses.

- If the trust were a non-grantor trust, the trust would have taxable income to the extent that the rental income exceeded the expenses. If the trustee made any distributions to the beneficiary, distributable net income might flow out, possibly from the rental income paid by the beneficiary.

Whether the trust were a grantor or non-grantor trust, the basis of the real property would have to be depreciated and eventually recaptured as ordinary income on the sale of the property.

Endnote

1. Internal Revenue Code Section 6501 and related regulations.