At the end of 2012 the federal gift and estate tax exemption was expected to drop from $5 million to $1 million per person. With estate planning attorneys expecting this, they wisely advised their clients to gift their $5 million exemption so they wouldn't "lose" it. Many of these gifts were made to Intentionally Defective Grantor Trusts (IDGT), a popular vehicle for transferring wealth to future generations.

Since 2012 we have experienced great economic growth, increases in gift and estate tax exemptions, and increased income tax rates for affluent families. These items coupled together means significant wealth has been transferred by the grantor to the children and grandchildren through the IDGT, but now the grantor's taxes have increased. These grantors are now seeking ways to reduce their taxes associated with IDGTs. The purpose of this article is to highlight a unique solution for these grantors that eliminates their taxes from IDGTs. This solution is available to Accredited Investors and Qualified Purchasers, which essentially requires $5,000,000 of qualified investments.

Intentionally Defective Grantor Trusts

IDGTs are the premier vehicles for affluent families to transfer their wealth to the next generation. Assets transferred to IDGTs exist outside of the grantor's estate for estate and gift tax purposes but are deemed owned by the grantor for income tax purposes. As a consequence of the deemed ownership of the assets, the grantor is considered the owner of the income and the resulting income tax liability. Estate planners leverage this tax treatment by:

- Transferring the assets' appreciation outside of the grantor's estate

- Recommending grantors pay the income tax liabilities of the IDGTs to allow the trust principal to grow tax-free - each tax payment akin to an additional tax-free gift

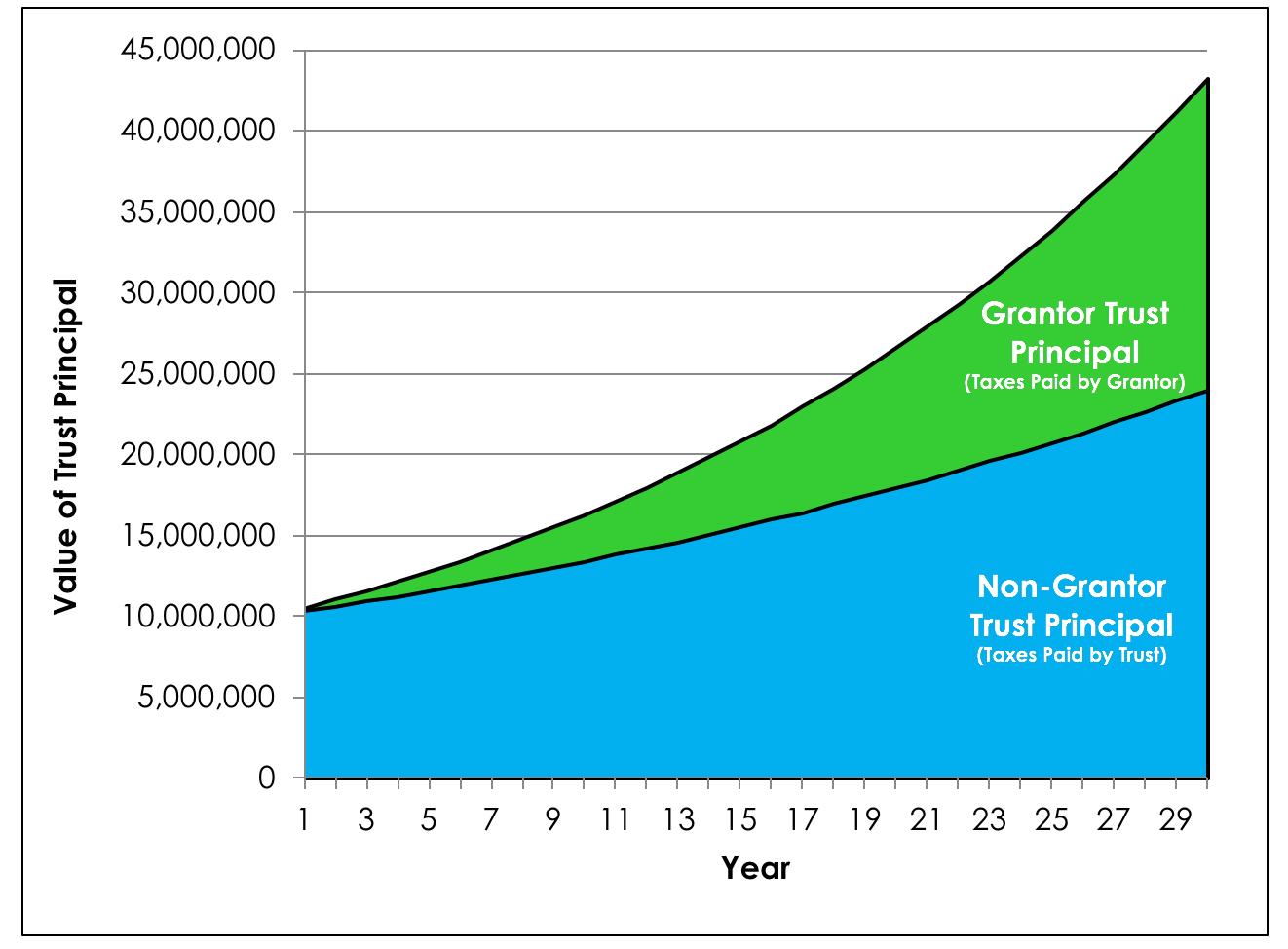

Income Tax Liability. The effect of income taxes on a trust's assets is dramatic. Ignoring management fees, an IDGT gifted $10 million in assets earning a conservative 5% annually in interest over a 30-year period would grow to over $43 million unencumbered by income tax liabilities. Under the same conditions, a non-grantor trust, needing to pay income taxes from its own assets, would grow to only $24 million. The ability to transfer $43 million using only $10 million in gift-tax exemption is a significant planning result.

Unfortunately, this tax assignment can create a cash flow issue for grantors, as they do not have the benefit of paying the tax from the investment portfolios that generated the tax consequences. A grantor may decline to pursue this strategy or opt to terminate the IDGT's grantor trust status early to avoid paying the trust's tax bills.

Private Placement Life Insurance (PPLI). PPLI provides a solution to grantors' tax problems. It defers and eliminates both federal and state ordinary income tax and capital gains tax when structured properly.

Life insurance is backed by favorable tax law, with two primary benefits being tax-deferred growth of cash value and income tax-free death benefits. PPLI is a special type of insurance policy, available only to accredited investors and qualified purchasers, designed to maximize tax-deferred growth by minimizing insurance costs. PPLI also offers investment options not found in traditional life insurance policies, such as hedge funds and alternatives.

If the IDGT assets are invested in a PPLI policy (1) the cash value of that policy grows tax-deferred, so the grantor doesn't have to pay income or capital gains on the cash value appreciation, (2) reallocations between investment options within the cash value don't trigger taxable gains, (3) the cash value can be distributed tax-free via withdrawals of basis and policy loans, and (4) the death benefit is ultimately paid tax-free. This solves grantors' tax problem, as they no longer have to pay income taxes for these trust assets. The beneficiaries of the grantor are also left in a better position because PPLI policy benefits do not have any built in income tax gains that other investments assets carry as a result of appreciation.

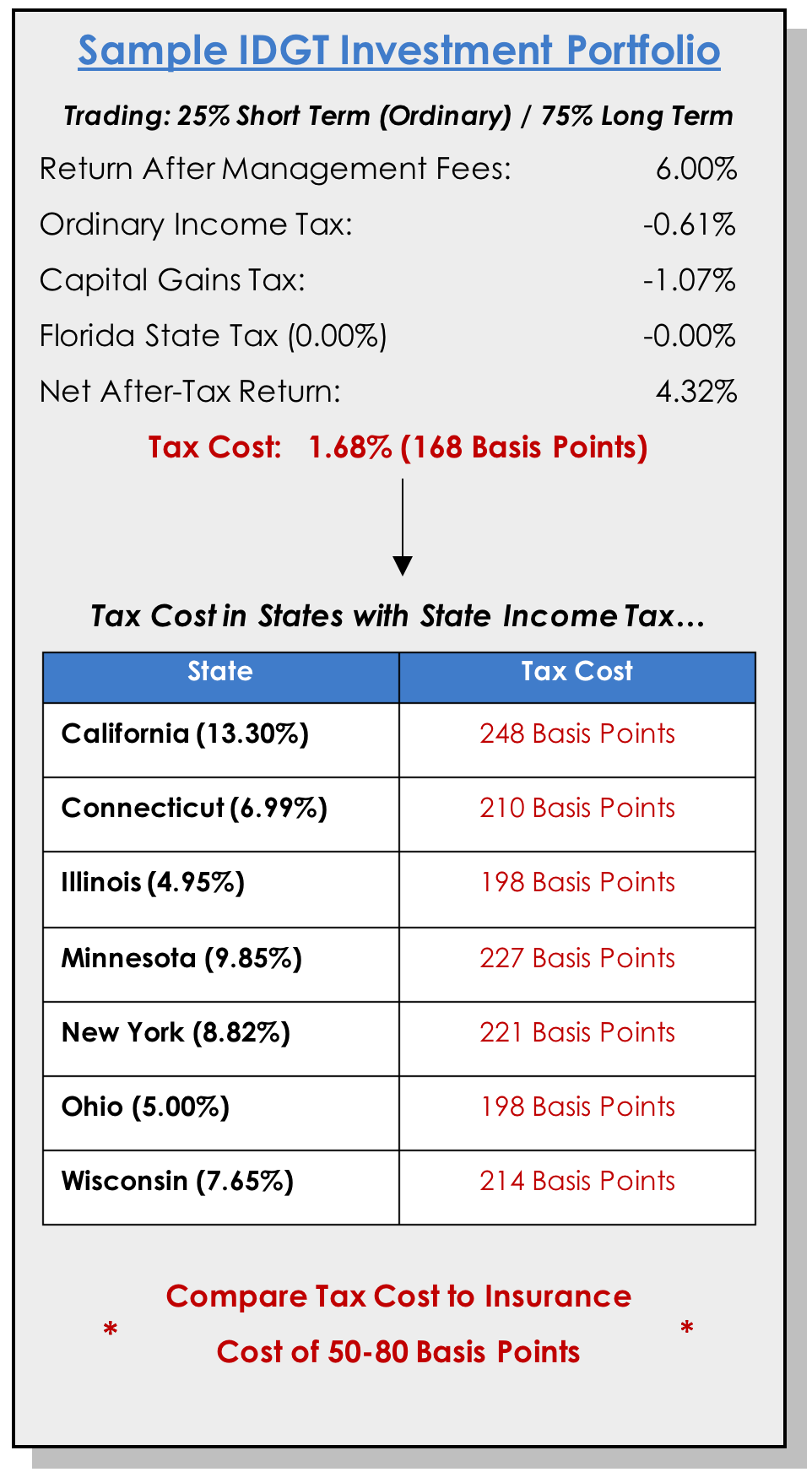

Adding PPLI does add an expense to account for the cost of providing insurance, but the insurance cost is typically much lower than the tax-cost, and usually ends up around 50 - 80 basis points per year measured over the life of the policy.

As demonstrated below, the federal income tax costs are significant. Regardless of domicile, every grantor will benefit from tremendous tax savings. The tax savings benefits of PPLI are even greater for grantors in states with high income tax rates. From a wealth preservation and accumulation standpoint, there is significant value in these compounded tax-savings, adding to the current cash flow improvements experienced by the grantor.

Scott Blackburn is a principal of Benson Blackburn and Lauren Galvani is a partner at Greenspoon Marder LLP.