Financial advisors who provide generational planning need to understand the changes and opportunities in the corporate trustee industry. At stake is the dependable execution of those generational plans and the $24 trillion of future bequest transfers (after taxes and charitable giving).

A trustee has two key responsibilities: to provide for the distribution and the management of the trust assets. These responsibilities are described inside a trust document (testamentary, irrevocable or living) that is essentially a contract between a trustee, beneficiary and the creator (also known as the grantor or testator) of the trust.

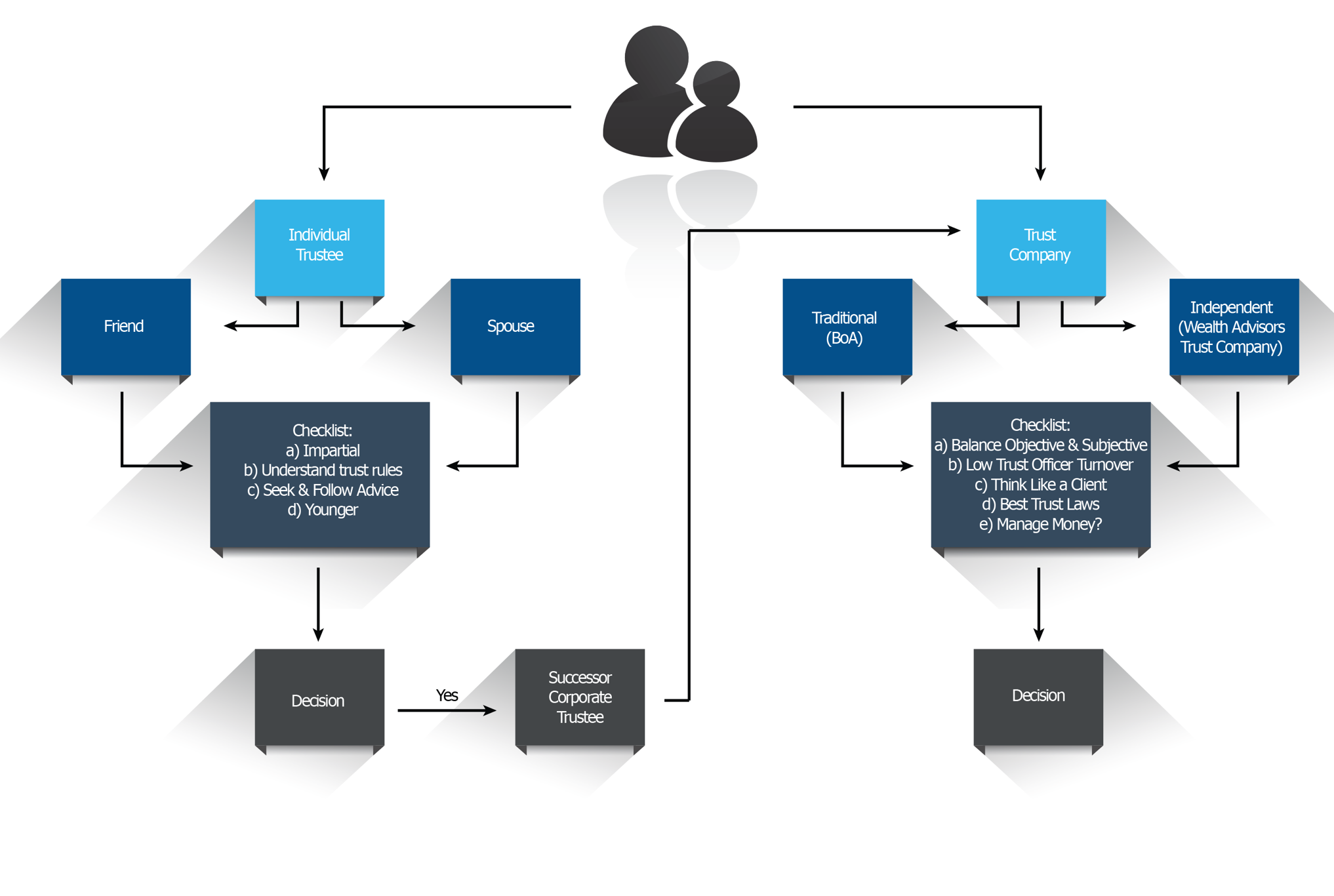

Picking a trustee generally gets less attention and time than choosing a new smartphone. In the first place, it is not a fun moment. When discussing the potential trustee choices for their trust, clients are sitting with an estate planning attorney or hopefully having the discussion with their financial advisor. Advisors see the whole financial picture and ask the questions about the “philosophy of a client’s money and their family.” For engineers and math people this is a logical process. For everyone else it is a winding road of emotions and what-ifs. To sum up, clients have to pick a few key roles in their wills or separate trusts. A trustee is one of those key roles.

A client should consider an independent trustee (e.g., individual or corporate) when the beneficiary will have challenges with money, needs an impartial advocate, needs asset protection or wants to keep the assets out of a future estate. Whatever the choice, all trust documents should allow for the trustee to be removed without cause, without filing with the courts and allow the trust governing law to be changed based on the location of the successor trustee. Trustees should not have the ability to stymie change or remove the choices from a beneficiary.

The fiduciary needs and wants of beneficiaries, corporate trustees and advisors can and must work collaboratively. Advisors and corporate trustees have the moral and legal fiduciary obligation to place their needs and wants second to the beneficiary; this is also known as the “sole interest rule.” A beneficiary’s fiduciary needs are very simple—distribution and investment decisions are made for their and future beneficiaries’ betterment.

A beneficiary’s fiduciary wants are more subtle—keep me informed, make decisions quickly, don’t make me feel guilty when asking questions about distribution requests and provide a collaborative experience with reasonable and customized responses and solutions. A corporate trustee, acting as a fiduciary, is required to follow rules inside the trust document and have a clear process of who has the investment fiduciary risk and responsibility.

Trustees, whether an individual or a company, want their services to have open communication between the advisor and the beneficiary. Corporate trustees who accept that their services are a solution—not the solution—will remain innovative, collaborative and thinking always on the beneficiaries’ behalf. When a trust document delegates or directs for the use of an independent financial advisor, advisors want a seamless process. From the investment management to the mechanics of trust distributions, advisors want the trustee, whether an individual or a corporate trustee, to reduce and not add to their compliance concerns and daily workload.

Advisors managing trust fund assets with an individual as the trustee are required, as a fiduciary, to be aware of the rules of the trust. Fiduciary roles and responsibilities around trust fund administration are paramount for advisors, so they need to use trustees who are well-schooled on these issues.

Additionally, advisors can hire firms to private label trustee services under the name of the financial advisory firm. This brings a few extra complications and benefits. The benefits allow those advisory firms to show they offer a full suite of wealth management solutions including trustee services. The complications involve clients confused as to who is serving as the ultimate trustee (i.e., decision maker), higher regulatory scrutiny, and risk of the financial advisory firm unknowingly acting in a trustee capacity (e.g., approving trust distributions).

Setting aside that complicated solution, there is one last issue for advisors to consider. When choosing a corporate trustee, advisors need to consider the following four key questions:

- Does the corporate trustee really understand the advisor’s business and clients?

- What legal and technological innovative solutions does the corporate trustee offer to make the advisor’s daily workflow and client experience better?

- Does the corporate trustee allow the advisor to choose the custodian and investment process?

- Apart from making a profit, why is the corporate trustee offering these services to advisors?

The Future

Time, technology, creativity and transparency are the pivotal points for the future of the trust industry. Trust companies delivering on all these points in an easy-to-use, innovative, and collaborative process will gain the confidence of the advisor community. The majority of clients and advisors demand a perfect blend of user experience, technology, and human touch.

For example, today, with a traditional corporate trustee, the process of a beneficiary requesting a trust distribution involves the following four steps:

- Beneficiary calls or emails trust officer explaining reason for distribution.

- Trust officer reviews request and sends to trust committee in another state.

- Trust committee reviews distribution request and approves, denies, or requires more information.

- Trust distribution made to beneficiary personal account.

Best practices involve collaboration and communication between advisors and trust officers. Today trust companies have automated the collection of the manual distribution request and communication between parties. The time between steps, communication gaps, and approving the distribution request has shrunk dramatically.

Another example is the administrative reviews all trust companies must perform on trusts. Currently this is a manual process of collecting information from trust transactions, required trust document actions, trust committee decisions, advisor notes and beneficiary notes. In the near future, the collection and initial annual administrative review will be completed using machine learning. The back office of any trust company will shrink, and trust officers’ time on this manual process will almost disappear. Trust officers will have more time to solve issues in creative ways. Some trust companies and financial services companies' use of technology robs key employees of creativity but provides extra time that they will use on sales efforts versus more customized client service. That is a misaligned use of extra time given by technology. Also, trustee fees will become more transparent and initial quotes will be provided more quickly. All trustee fees are based on risk and time and can be broken down into the following seven factors:

- directed or delegated trust

- number of beneficiaries

- number of annual distributions

- number of trust(s)

- size of trust(s)

- type of trust assets

- custodian selection

Using algorithms and data across all trust accounts, corporate trustees will provide consistent and transparent trustee pricing based on those seven factors. As those factors change over time, a trustee will change its pricing. Today, advisors and clients generally choose a corporate trustee based on the trustee fee and state location. Tomorrow, users will demand that corporate trustees also provide services that are innovative, collaborative, and easy to use.

As much as the trust industry has changed and will continue to change, one tenet remains rock steady: The duty.

Christopher N. Holtby, CPWA, is co-founder of Wealth Advisors Trust Company. He earned a BA in psychology from University of Arizona. Contact him at [email protected].