Today, David Lenok, senior editor at WealthManagement.com, is joined by Damien Martin, tax partner at BKD CPAs and Advisors.

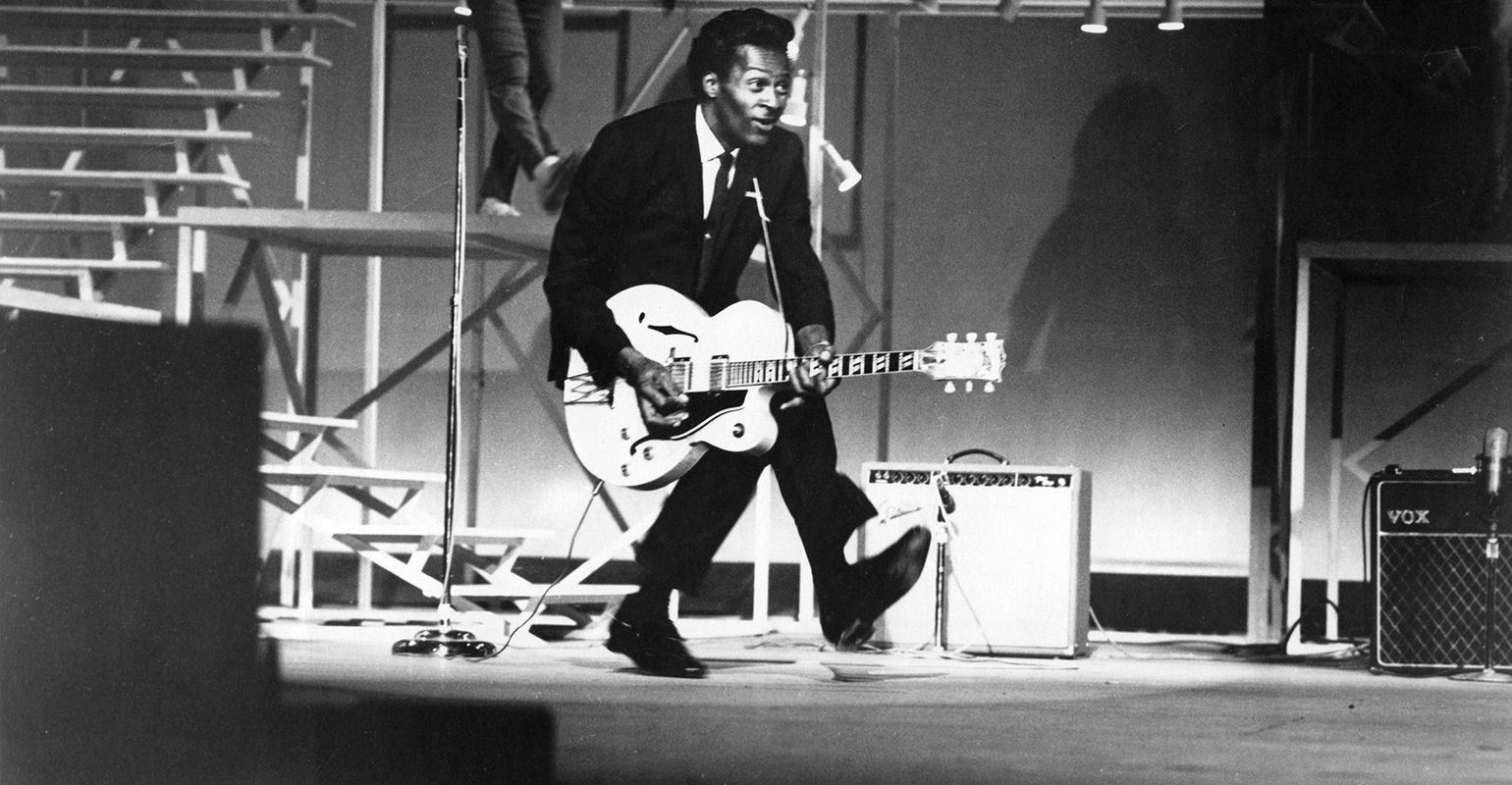

This episode focuses on the father of rock ’n’ roll, Chuck Berry, the legendary musician who worked up into his 80s, amassing a sizable estate upon his death in 2017 at the age of 90, despite his conviction for tax evasion in 1979. Berry was convicted of $110,000 in back taxes, and was sentenced to serve four months in jail and 1,000 hours of community service.

David and Damien delve deep into the reality of taxes and why communication, planning and having a strong team in place are the keys to a successful financial future.

Chuck Berry performs his "duck walk" while playing guitar in 1964.

You will learn:

- The tax planning issues advisors face with clients;

- How tax planning affects your retirement and how it can help to maximize your estate;

- How estate tax planning can assist your income tax planning;

- The importance of creating open communication with your whole team of advisors;

- And more!

Listen now and intentionally plan for the future!

Listen to the podcast

Browse more episodes in this podcast series. ...

The Celebrity Estates: Wills of the Rich and Famous podcast is available on Apple Podcasts, Android, Stitcher and wherever podcasts are found.