Fans of The Honeymooners will fondly recall one of the iconic lines that Ralph Kramden would shout out when he recognized the error of his ways, “I’ve got a BIG mouth.”

Would that we all could own up to such proclivities, which brings to mind the state of the markets and what’s behind it. There are, of course, many things and it would be unfair to cite a singular source. Still, in the current environment I think it’s fair to put the mike in front of President Trump (or take one away) who just in November said, “The reason our stock market is so successful is because of me. I’ve always been great with money, I’ve always been great with jobs, that’s what I do. And I’ve done it well, I’ve done it really well, much better than people understand and they understand I’ve done well.”

Which begs the question of whether he recently shorted it and covered?

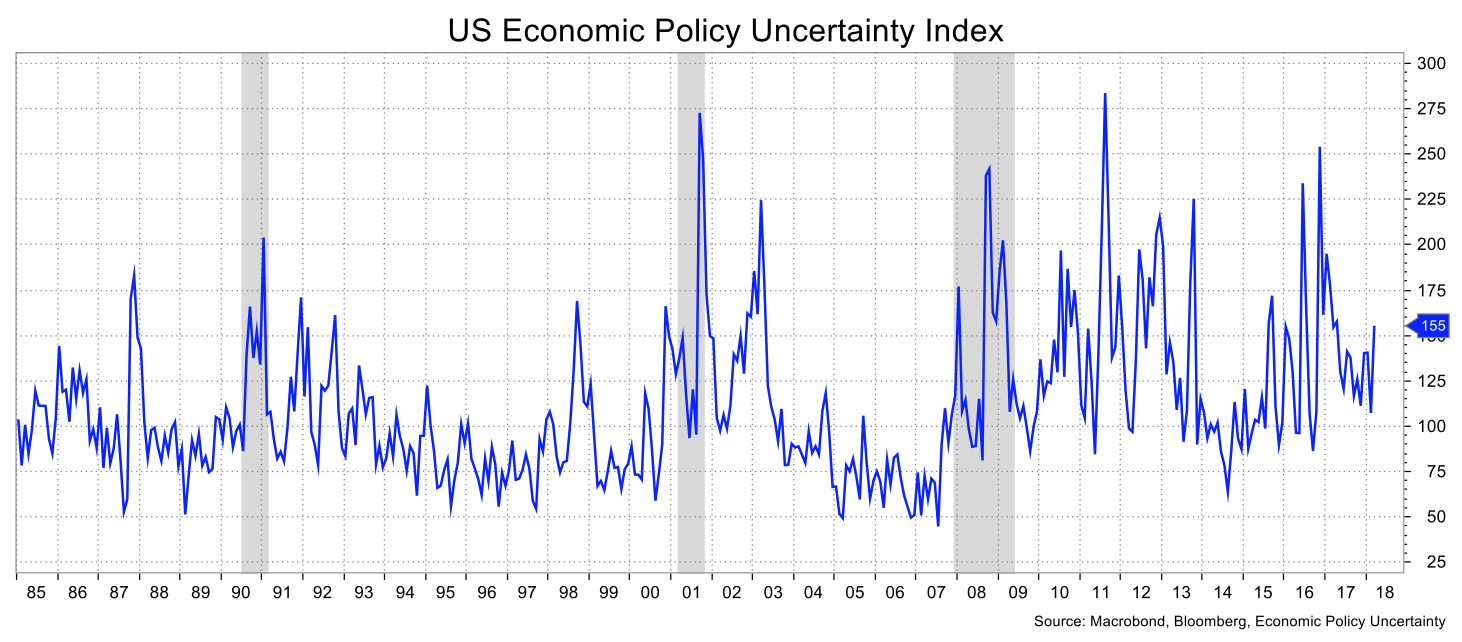

I refer good naturedly, of course, to tweets and the like about Amazon, NAFTA, various sanctions, the revolving door in the White House, the Russian conspiracy and the current silence of responsibility of the markets’ volatility. How does the old expression go? Victory has 100 fathers and defeat is an orphan. Perhaps it’s that very lack of credibility and resulting uncertainty that is behind, at least in some part, the markets’ source of uncertainty. This is a point driven home by a glance at the news-based Economic Policy Uncertainty Index that tallies at 155, much higher—rather much, much higher—than the average for any administration since the index started in 1985 (see chart).

While it’s tempting to say this age is different, what with fake news so abundant to say nothing of specious interest-rate strategy, it surely is odd to see uncertainty so much higher on average than that experienced in the wake of the financial crisis, the Nasdag bubble or 9/11, among many other episodes, considering how the economy appears to be doing. I’ll cite the U.S Chamber of Commerce’s chief policy officer, Neil Bradley, who said this week, “It’s inappropriate for government officials to use their position to attack an American company … The U.S. economy is the world’s most powerful because it embraces the free enterprise system and the rule of law, whereby policy matters are handled through recognized policymaking processes. The record is clear: Deviating from those processes undermines economic growth and job creation.” To be fair, Bradley did not specifically cite President Trump in his comments, but the timing is precious, and the Chamber is hardly a source of anti-business sentiment let alone dismay with Republican administrations.

To wit, it’s irresponsible not to pay tribute at the gates of 1600 Pennsylvania Avenue and equally irresponsible to suggest we won’t have more of it during the remainder of this Administration. That’s the input side—the mental side. What we don’t know are the deeper repercussions of policy: trade retaliation. China threatened tariffs on a variety of U.S. goods in a retaliatiory move, with particular alarm to our agricultural sector (a region of GOP support I might add as we approach November). Whether this is truly an aggressive stance for better trade deals or bombastic bullying for the benefit of a core support base (that would be hurt by retaliation) remains to be seen, albeit with a dose of warranted skepticism.

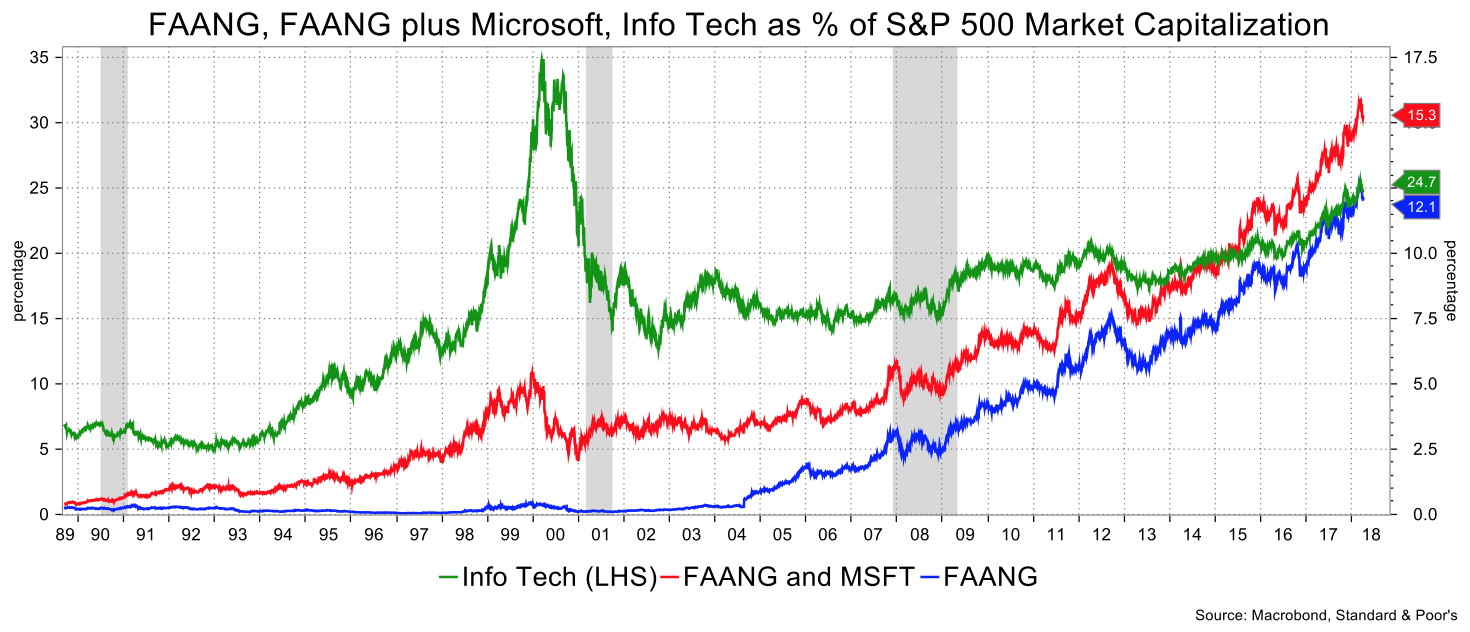

Charts and Thematics: Now concentrate for a moment. Concentrate on the myriad of headlines of late about the stress in tech stocks, for example, The Wall Street Journal’s March 28 front page, “Tech Worries Drag Down Stocks.” I’m hardly the only one to make note of the bearish behavior in tech stocks in recent days either in their magnitude or importance to the overall market. So, wtih “old” news, or at least “observed” news, I think a visual helps put it in context. In that spirit, the first chart below is an eye-opener. It tracks the market cap of the FAANG stocks, the FAANG with Microsoft, and the Information Technology sector capitalization overall as a percent of the S&P 500’s market capitalization. And how.

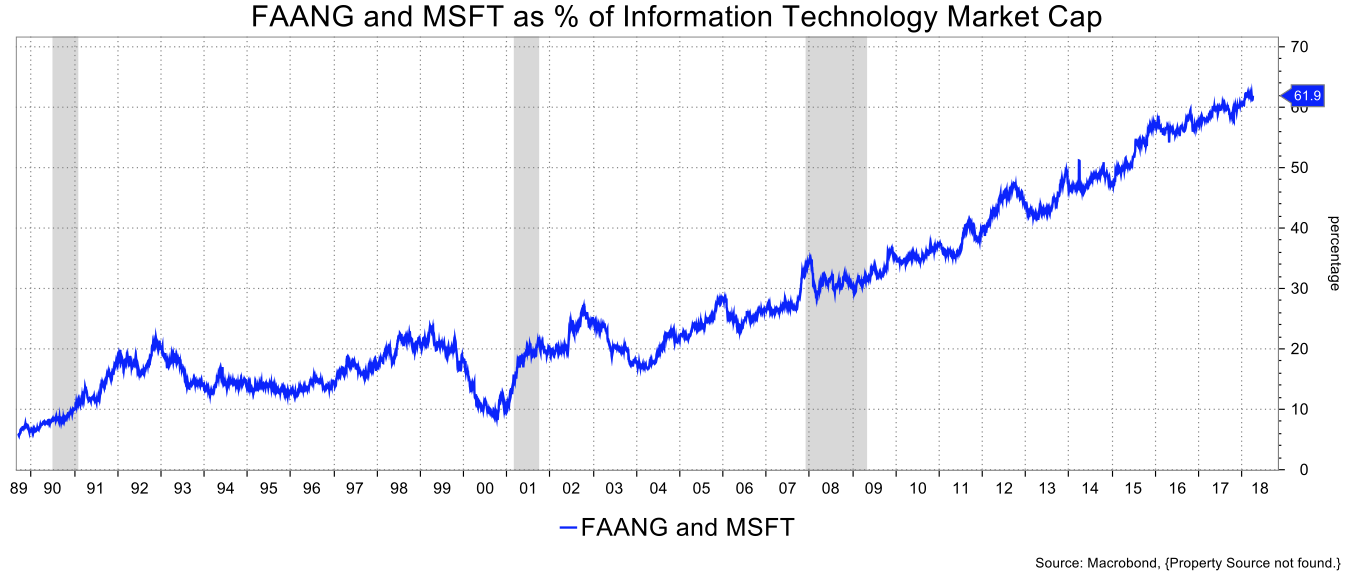

What you see is that Info Tech makes up nearly 25 prcent of the market cap of the S&P 500, the highest proportion since the end of 2000. Hmm. This is all fine and good (or perhaps the very opposite) but it’s the concentration of FAANG and Microsoft that really warrants attention. That group makes up 15.2 percent of the S&P 500’s capitalization. Coming off the last recession that was just north of 5 percent, though Facebook’s IPO came later in 2012 and exaggerates the gain, I still don’t think that detracts overly from the story: these tech stocks and technology in general have had an overweighted influence on the overall stock market.

FAANG is 12.1 percent of the S&P 500 market cap, basically a record, and with Microsoft a whopping 15.2 percent of the S&P 500. Comparisons with the Nifty 50 of the 1960s and early 1970s are reasonable, considering that stocks in that group included GE, Kodak, DEC, Polaroid, Avon and some I bet you never heard of like Simplicity Patterns. But I digress. Of that broad tech index market cap, FAANG and Microsoft constitute 61.4 percent of the total.

Now consider that as these handful of stocks correct, they’ll take down the broad index so that even if the causes are specific to those high valuation entities, the whole construct of the S&P 500 will feel the influence. So, while Trump attacks Amazon, Amazon isn’t the only firm dependent on the U.S. Postal Service to be its delivery boy. And as I’m on the topic, isn’t the whole point of the U.S. Postal Service to be about delivering?

A Streetwise piece in the WSJ makes note of the fact that logic would suggest that if these stocks falter due to high valuations, their competitors should reap the benefits as cheaper options. But we’re talking about rather duller companies and largely different business models—Walmart vs. Amazon for instance. Anyway, the point is most likely that buyers of FAANG were buying a sex story and momentum vs. comparisons with similar competitors. In short, rising tides lift all boats and if these fall out of favor it’s not about sector rotation so much as a comment on the stock market overall. Think about 2000 and 2008 if you dare to.

Oh, and by the way, it’s not merely a valuation story, is it? There are implied threats about raising postal fees, which surely cannot be singled out to Amazon alone. Further, President Trump’s complaints about the sales taxes lost (which isn’t really accurate given Amazon collects local taxes in the 45 states that demand it) surely spreads to the other sellers on Amazon, eBay and the list goes on. That may not be such a bad thing to complain about (if it were accurate vis à vis the target of the complaint), but maybe it makes some sense in the form of a VAT or national sales tax to offset the insult to budget responsibility imposed by the recent tax cut.

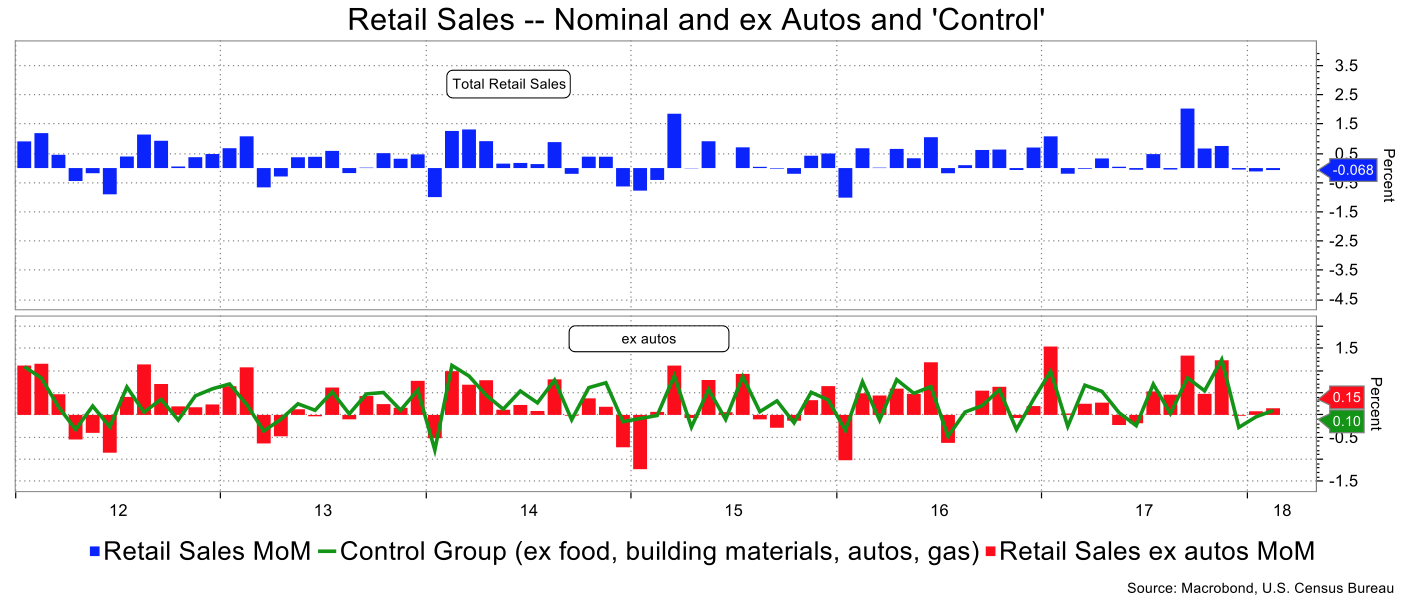

Which reminds me of Retail Sales, which haven’t exactly been stellar in the wake of the tax cuts. At the headline level it’s been three months of negative figures and even with ex-food, building materials, autos and gas, it hasn’t been much better. This provoked a news story headlined, “Mall Vacancies Reach Six-Year High as Sector’s Slump Deepens” and the fact that last month the savings rate rose. In looking at the chart below, the robust gains in the September to November period look like the anomaly (lest we forget the various hurricane rebuilding and replacements), forcing us to consider a mean reversion. In short, a rather tame consumption side uninspired by the tax gains.

David Ader is the Chief Macro Strategist for Informa Financial Intelligence. Read more of his report here.