By Donald A. Calcagni

Trade negotiations between the United States and China broke down last month, with the U.S. responding by increasing tariffs from 10% to 25% on approximately $200 billion worth of Chinese imports. Global markets recoiled, with the S&P 500 Index returning -6.35% and the FTSE China Index returning -12.91% for the month of May, according to FactSet, as of the end of May. Given all the noise around the subject, the purpose of this article is to help answer some of the more pressing questions frequently asked by clients.

First, let’s set the stage. The United States and China are the world’s two largest economies. Chinese exports make up 19% of its GDP, with 18% of all its exports going to the United States. In addition, approximately 3.4% of China’s economy is tied to U.S. exports. In contrast, only 8% of the U.S. GDP is tied to exports with 12.6% of those exports going to China. Moreover, 1% of U.S. GDP is tied to U.S. exports to China. That said, U.S. exports to China have grown 86% over the past 10-years while exports to the rest of the world grew only 21%, according to the U.S.-China Business Council.

What impact do tariffs have on the economy?

Tariffs are a tax. When governments wish to discourage the consumption of certain goods, they subject those goods to a special tax. Excise taxes on cigarettes, alcohol, and sugary drinks all come to mind. Similarly, tariffs increase the price of goods imported from a specific country or countries. The purpose of the tariff is to increase the price of imported goods. The increase in price has two effects: first, consumers demand less of those goods subject to the tariff; and second, consumers pay a higher price for the (reduced) quantity they do purchase. The tariff (tax) revenue paid by consumers is collected by the US Treasury. Subsequently, tariffs are paid by US consumers and reduce imports, both of which have a negative impact on economic growth.

What impact do tariffs have on stocks?

The price of any company’s stock is best defined as the present value of future expected cash flows. In English, this means profits—including dividends and retained earnings—ultimately determine stock prices. When companies expect to sell less goods (due to tariffs), the profits they can expect to earn in the future also decline. When profits decline, the value of the business—represented by shares of stock—also declines, especially for those firms with significant operations in China or other countries targeted with tariffs.

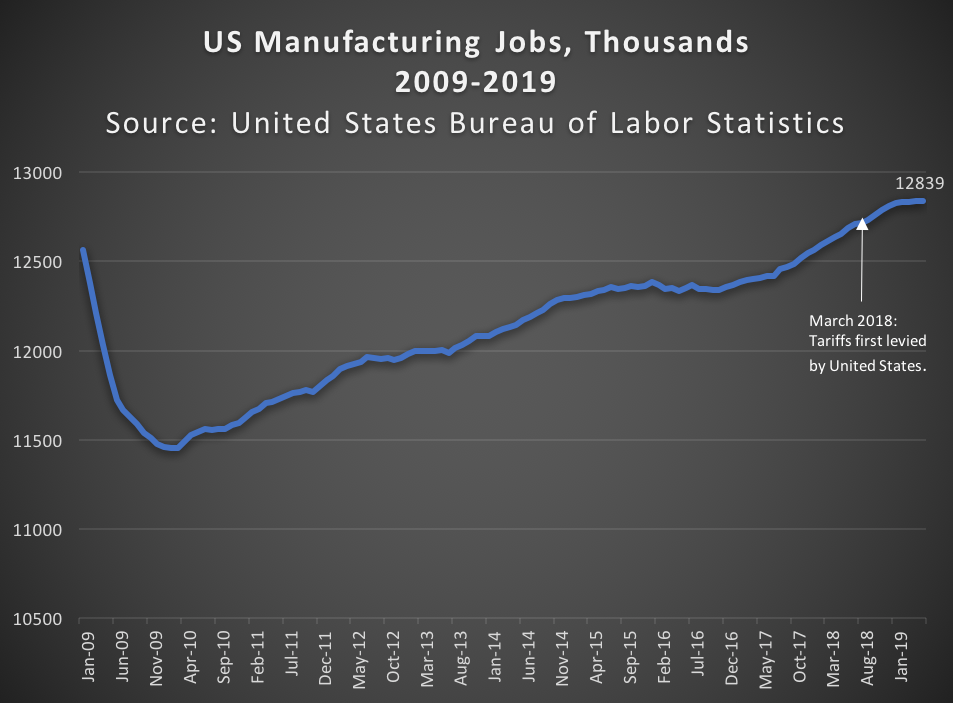

Won’t tariffs help return manufacturing jobs to the United States?

This is probably not true. Proponents of tariffs on Chinese imports highlight that, since first levied in March 2018, approximately 204,000 manufacturing jobs have been created in the United States, according to the US Bureau of Labor Statistics. While this data point is true, it is also true that manufacturing employment in the United States has grown steadily since the aftermath of the global financial crisis. To argue this growth is due only to recently implemented tariffs would be a stretch for two reasons. First, it ignores the fact that manufacturing jobs have continued to rise since 2010. Second, it assumes that U.S. manufacturing companies responded to U.S. tariffs quite rapidly (within days and weeks) of when tariffs were first implemented. That seems unlikely given how long it takes for manufacturers to redesign and implement new supply chains.

Finally, if indeed a cause and effect relationship is established between recently passed U.S. tariffs and the 204,000 in new manufacturing jobs, those jobs came at a staggering economic cost to the U.S. economy. For example, it’s estimated that China’s retaliatory tariffs will cost U.S. companies about $54 billion, according to the Peterson Institute for International Economics, as quoted in USA Today. That works out to about $265,000 per U.S. manufacturing job; several economists from the University of Chicago and the Federal Reserve put the estimate at $820,000 per job in certain sectors.

Should investors be concerned about China’s current position as the world’s largest producer of Rare Earth Elements (REE)?

We don’t think so. While a disruption to REE exports might have a short-term impact on certain industries (especially technology) most economists argue the effects would be short-lived. This assessment makes sense when we evaluate the evidence and apply some economic intuition. There are a number of REE projects underway worldwide that could quickly fill any reduction in REE exports by China. The central issue isn’t that the rest of the world doesn’t have REE deposits; it does. The issue is one of economics. At current prices, it’s relatively uneconomical for other nations—especially the US and Canada—to develop REE deposits. This is because REE export prices are heavily subsidized by China’s lax labor and environmental standards (especially relative to Western countries where environmental and labor standards are much stronger). Any move by China to implement tariffs or export bans would push up prices, making other (currently uneconomical) REE mining projects suddenly more economical to develop.

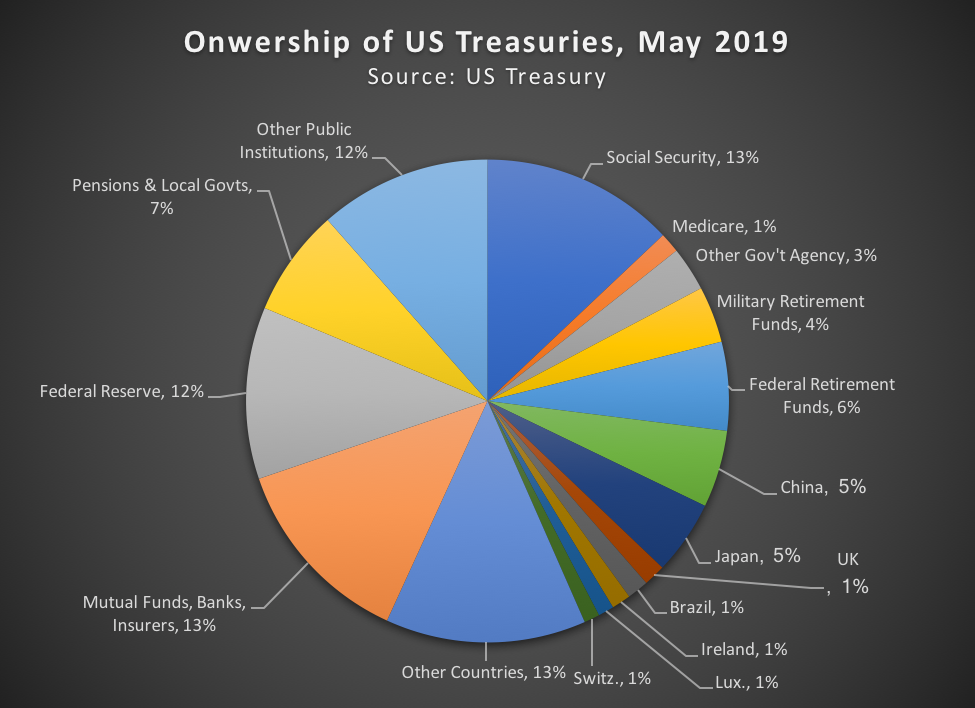

But can’t China just dump its massive holdings of U.S. treasuries and subsequently hurt our economy?

This doesn’t seem likely. It’s true that China holds about $1.12 trillion in U.S. Treasuries, but it’s also true that there are several practical barriers to China dumping all or much of its treasury holdings on the market. First, doing so would likely hurt the value of their own holdings. Second, there’s nowhere else for China to reinvest their proceeds that offers the relatively high yield and low risk provided by US treasuries. Third, it’s not clear that selling all $1.12 trillion of China’s treasuries would move the market that much. There is a total of $22 trillion in U.S. Treasury debt outstanding, and while China is the largest foreign owner of U.S. treasuries, it actually owns only about 5% of total treasuries outstanding with over $600 billion in U.S. Treasury securities changing hands each and every day. Finally, China actually began slowly selling its U.S. treasury holdings in 2014 and has already reduced its holdings of U.S. treasuries by about $300 billion since with no noticeable impact to U.S. interest rates.

Donald A. Calcagni is the Chief Investment Officer of Mercer Global Advisors.

This article is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. Any examples used in this material are generic, hypothetical and for illustration purposes only. Mercer Global Advisors nor its representatives is suggesting that the recipient or any other person take a specific course of action or any action at all.