Starbucks' Unicorn Frappuccino, which changes colors as customers mix the beverage with the straw, is one of several things helping drive the company's growth this year. The stock is up more than 10 percent so far in 2017, but there might be more to come, Business Insider reports. UBS equity analyst Dennis Geiger wrote in a client note that limited-time offers this year, like the Unicorn Frappuccino, will continue to drive profits for the company, as well as its plan to boost revenue from food. Currently, food makes up 20 percent of Starbucks' revenue and the chain is aiming to make it 25 percent in five years.

New FPA Partnership Tackles Succession Planning

The Financial Planning Association has partnered with FP Transitions, which provides valuation, succession planning and M&A services to financial advisors. As a key partner, FP Transitions will help FPA members develop succession plans. The company’s content and thought leadership will be integrated across the organization, including its NexGen community. The partnership also includes a sponsorship of the 2017 FPA Annual Retreat, the FPA NexGen Gathering, the FPA NexGen Lounge at the 2017 FPA Annual Conference, and a series of columns to be published in the peer-reviewed Journal of Financial Planning. “The greatest challenge for owners of successful financial planning firms is finding qualified next generation leadership,” said Brad Bueermann, CEO of FP Transitions. “We want to make sure professionals entering the industry understand this opportunity and are prepared to act on it. Partnering with FPA was a natural decision to deliver that message." This is the latest of several new strategic partnerships FPA has made in the last year aimed at benefitting its members.

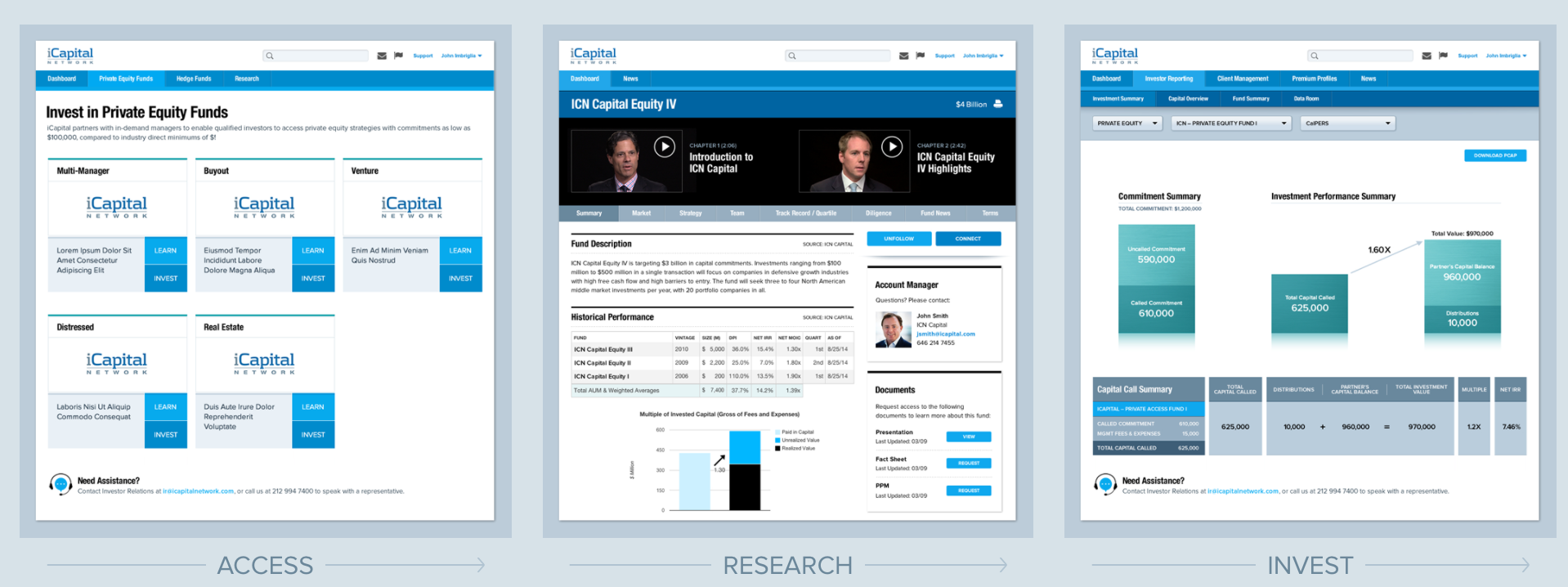

iCapital Expands to Support Accredited Investors

iCapital Network announced Monday that it is expanding its technology platform of alternative investments to accredited investors. According to Capgemini’s 2016 World Wealth Report, the market of accredited investors is 10 times as large as the qualified purchaser market, and iCapital Network says it has an increasing demand for alternative investments. The company also believes the market can be a critical source of capital for alternative asset managers who offer their products on its platform. iCapital will use an internal due diligence team to curate a suite of products tailored to accredited investors. The online platform, launched two years ago, now services $2 billion in assets for 3,000 investors.