Risk of illness and fear of job loss proved the value of behavioral finance, according to a recent Charles Schwab study.

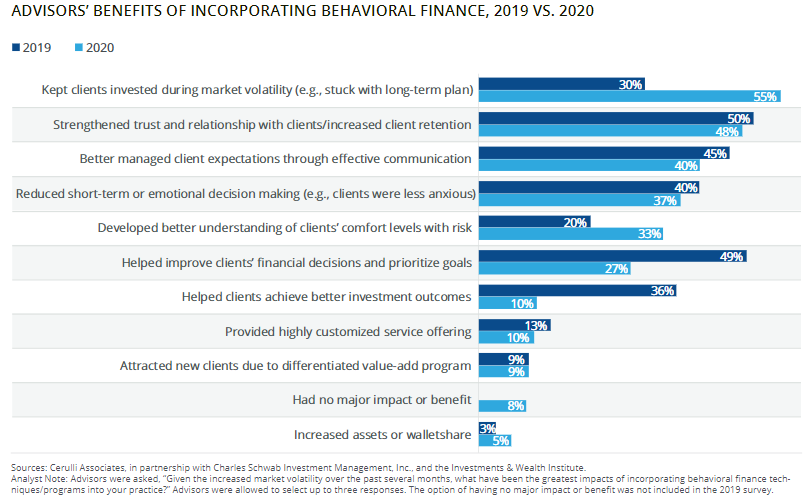

As investors were tempted to panic sell when market volatility seemed unwavering in February and March, advisors who use behavioral finance strategies noticed an improvement in their investing behavior. More than half of advisors (55%) said the approach helped to keep their clients invested during that period. The year before, 30% of advisors cited clients sticking with the long-term plan as a benefit of applying the methodology.

The study, Behavioral Finance “BeFi” Barometer 2020, surveyed over 300 advisor members of the Investments & Wealth Institute who work at wirehouses, registered investment advisor firms and broker/dealers in May and June. Schwab published the study in collaboration with IWI and the research and consulting firm Cerulli Associates.

Advisors in the study said they benefited from the behavioral finance approach by reiterating to clients their long-term financial goals established prior to the pandemic.

Asher Cheses, a research analyst at Cerulli Associates, said understanding clients’ emotional triggers and including clients in portfolio structuring early on in the relationship were critical to the advisor’s success.

Developing options in advance also gives clients confidence to walk through their financial plan, added Devin Ekberg, the chief learning officer and managing director of professional development at the Investments & Wealth Institute.

Behavioral finance comes out of behavioral economics and examines the intersection of neuroscience, the study of the brain’s effects on behavior and cognitive functions, psychology, the study of the mind and behavior, and economics.

The 2020 study also looked at client bias to investigate what issues were influencing clients’ decisions the most during the pandemic. Client bias increased in areas outside of loss aversion and the influence of recent news, which topped the bias list for 2019 and 2020. Clients sought more familiarity in their investments and wanted to step up their shares in U.S. stocks, according to the study.

Like their clients, advisors exhibited bias too. According to Cheses, advisors’ fears of losing client capital and desiring confirmation of their own biases are creeping into client relationships and possibly influencing their decisions. He recommended advisors to recognize whatever biases they have while working with clients to ensure a fiduciary standard.

Omar Aguilar, the chief investment officer of passive equities and multi-asset strategies at Charles Schwab Investment Management and a practitioner of behavioral finance in asset management, believes this year has presented a strong case for behavioral finance and the study reflects it.

“People will be searching for income anywhere and, on the other hand, the incentives are there for potentially taking risks in risky assets,” he said. “And those are two perfect examples because people ignore valuations, people ignore economic growth, people ignore risk altogether, which is why you want advisors to use behavioral finance to basically mitigate some of those temptations.”