Hello from Hawi Plantation House, I’m Charles Biderman, founder of Informa TrimTabs Investment Research.

When votes were counted in November, it was clear many political experts, pollsters and Democratic Party operatives had badly underestimated Donald Trump’s appeal to voters outside the coastal belts. That may be a lesson which plenty of economists, analysts and financial journalists still need to learn.

Why do I say that?

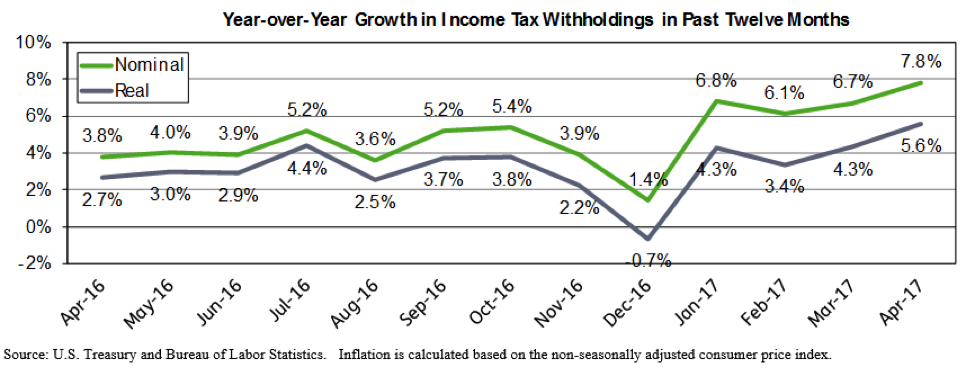

Recent analysis by TrimTabs shows that economic growth has been picking up recently. Our estimate of U.S. job growth for the past two months, based upon publicly available tax withholding data, shows the fastest job growth since April 2015.

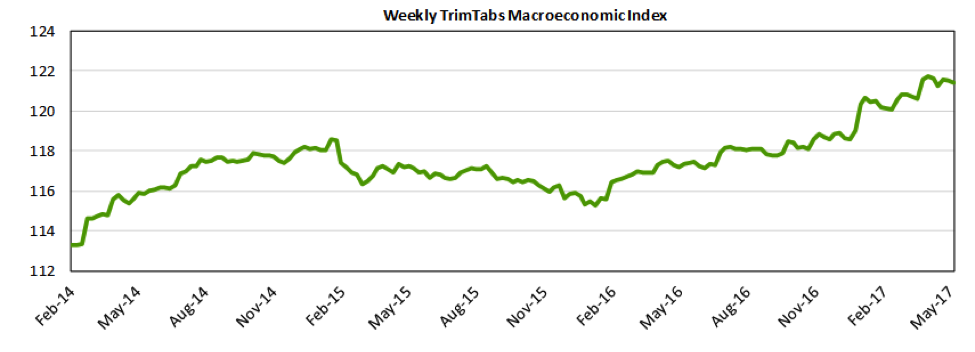

TrimTabs Macroeconomic Index Slips for Second Consecutive Week but Rises 0.6% in Past Eight Weeks

Income Tax Withholdings Increase 2.8% Y-o-Y in Real Terms in Past Three Weeks.

Now I have great faith in our research, after all I founded the company almost three decades ago, but I was taken by surprise. The first few months of the Trump administration remind me of the Gang That Couldn’t Shoot Straight — to steal the late great Jimmy Breslin’s book title on NYC mobsters — and my estimation of their ability to enact their reflationary agenda has been subject to constant, downward, revisions.

What’s going on?

On a recent flight to Hawaii from the mainland I sat next to a former Mountain State GOP party leader, still active in politics. In the face of my concern and doubt that President Trump will be able to get anything significant done in terms of new legislation on tax reform, infrastructure growth or a more effective health care program, she remains a believer in the new administration. She convinced me she still absolutely supports Trump and believes that he will get everything important enacted, regardless of my doubts. Looking at the improving economic data, it appears many other middle American business types are also true believers.

Earlier this year, I had been saying that the boomlet in stock prices would not last when America realizes that the Trump administration just can’t get things done. However, given this almost religious belief that middle American business types hold about Trump, the wake-up call that puts their hiring and capex plans on ice could still be months away.

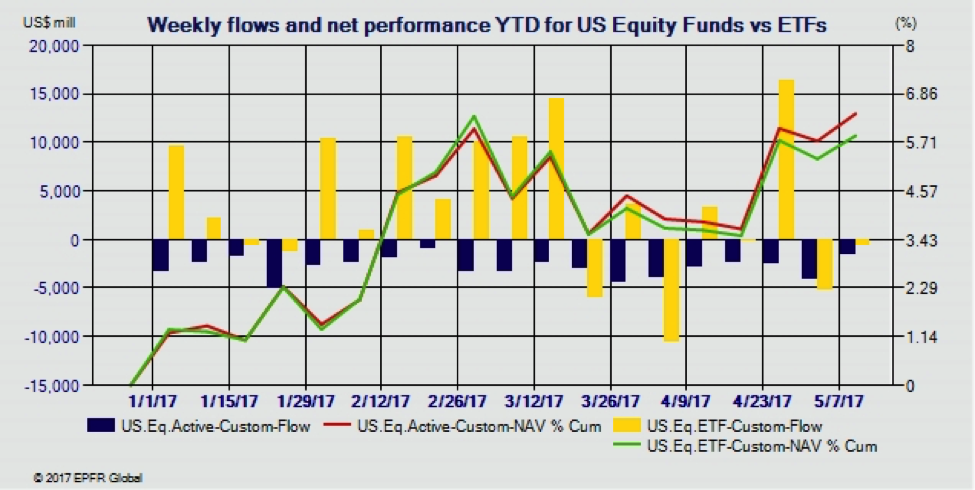

Meanwhile, actual supply and demand data is sending mixed signals for stocks now. Individual investors have stopped pumping big bucks into U.S. stocks in May after a record $160+ billion inflow into U.S. equity exchange-traded funds (ETFs) since the election. Indeed, both U.S. equity ETFs and U.S. equity mutual funds both saw significant outflows since the start of May. According to our historic measures, U.S. Equity ETF outflows have been bullish for near term stock prices more often than not.

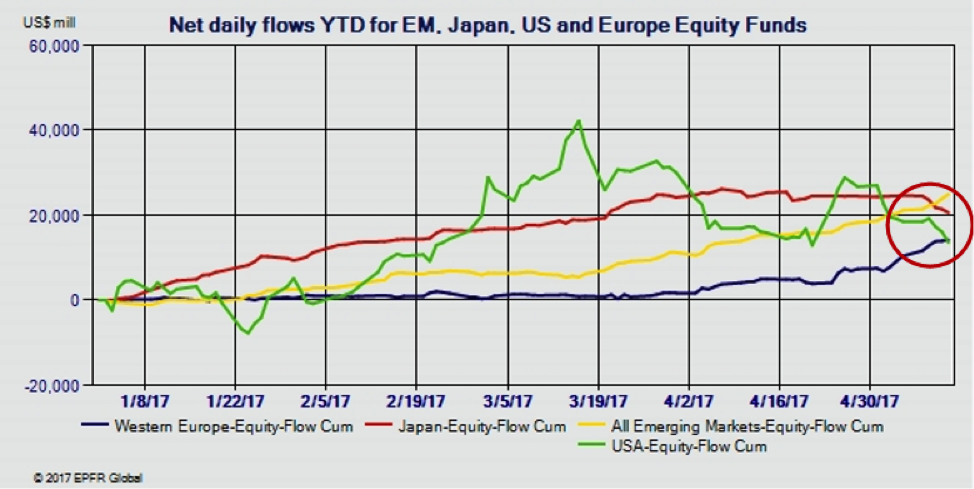

Here’s a chart from fund flow research group EPFR, our stablemate in the Informa Financial Intelligence fold:

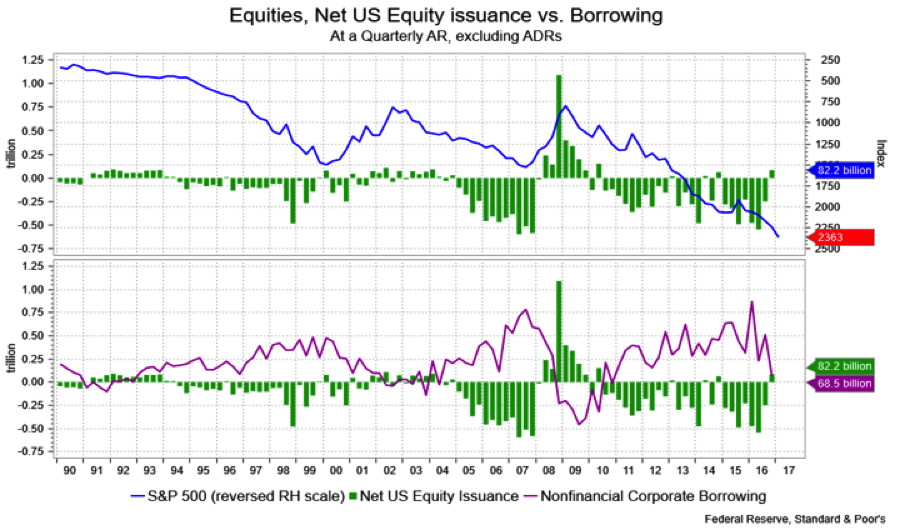

See the outflows? At the same time, companies themselves had been committing less cash to reduce the supply of shares and corporate insiders up until May 2. So far in May there has been a pick-up in new stock buybacks — primarily due to two huge deals announced May 2 by Apple and Goldman Sachs. On the other hand, insiders since the start of this year have been selling shares, net of insider buying, at the fastest pace in six years.

I ask again, what’s going on?

Market players have obviously benefited from a stock market that has surged dramatically since the 2009 market bottom. Market capitalization of the U.S. stock market stands at $29 trillion today, more than two and a half times the $11 trillion at the end of 2011.

What drove those gains? It wasn’t buying by investors. Using U.S. equity mutual funds and U.S. equity exchange-traded funds as a proxy for investment flows, little new money flowed into U.S. equities from investors. Inflows into U.S. equity ETFs were basically offset by outflows from U.S. equity mutual funds.

So why did stock prices soar over the past six years? One reason is U.S. companies have been massive net buyers of their own shares. Corporate buying through cash takeovers of already public companies as well as stock buybacks outpaced new equity issuance by more than $3 trillion since the start of 2011.

With borrowing costs at rock bottom, many companies decided that reducing their share count with cash flow or even borrowed money made more sense than investing in their businesses by hiring people or investing in plant and equipment. All else being equal, stock prices go up when the supply of shares goes down.

Another reason stock prices surged is of course that the Federal Reserve and many other central banks created the equivalent of trillions of dollars out of thin air to buy financial assets, mostly government bonds. Those who sold trillions of dollars, yen, euros, and pounds in bonds to central banks reinvested the newly created money into other things, including equities.

While it is impossible to know how many trillions went into equities because of central bank actions, guess what happens when more money chases fewer shares? Stock prices go up.

Indeed, TrimTabs’ definition of a bull market is more money chasing fewer shares. Conversely, our definition of a bear market is less money chasing more shares.

One more thing, take a quick look at this EPFR chart showing European inflow, versus U.S. outflow over the recent past. As I mentioned to Rick Santelli on Tuesday, huge inflows into Europe:

Bottom line:

If economic conditions continue to improve and the new orthodoxy holds, it is likely to put a floor under stock prices. However, if and when the Trump constituency loses faith, U.S. stock prices may plunge dramatically.

The stock market will not be boring going forward from here! You have been warned…

Charles Biderman is founder of Informa TrimTabs, an Informa Financial Intelligence business. Charles’ market insights are widely cited in financial media including Barron’s, Associated Press, Bloomberg, Thomson Reuters, the Financial Times, Forbes, Wall Street Journal and others. Charles can also be seen regularly on CNBC’s Santelli Exchange, typically discussing what supply and demand data tells us about today’s stock market. For the discussion on fund flows and the U.S. economy aired on Tuesday May 16 click here: http://video.cnbc.com/gallery/?video=3000617922