Managing approximately $19 billion in client assets across thousands of portfolios is a daunting task. But Allworth Financial Chief Investment Officer Andy Stout has a disciplined process to allocating client assets. In fact, the firm has a 20-page manual that describes its entire investment process.

Here, Stout offers a peak inside the Folsom, Calif.-based RIA’s core/satellite model portfolio, the firm’s fund selection process and its use of direct indexing and alternatives.

This interview has been edited for style, length and clarity.

WealthManagement.com: What’s in your model portfolio?

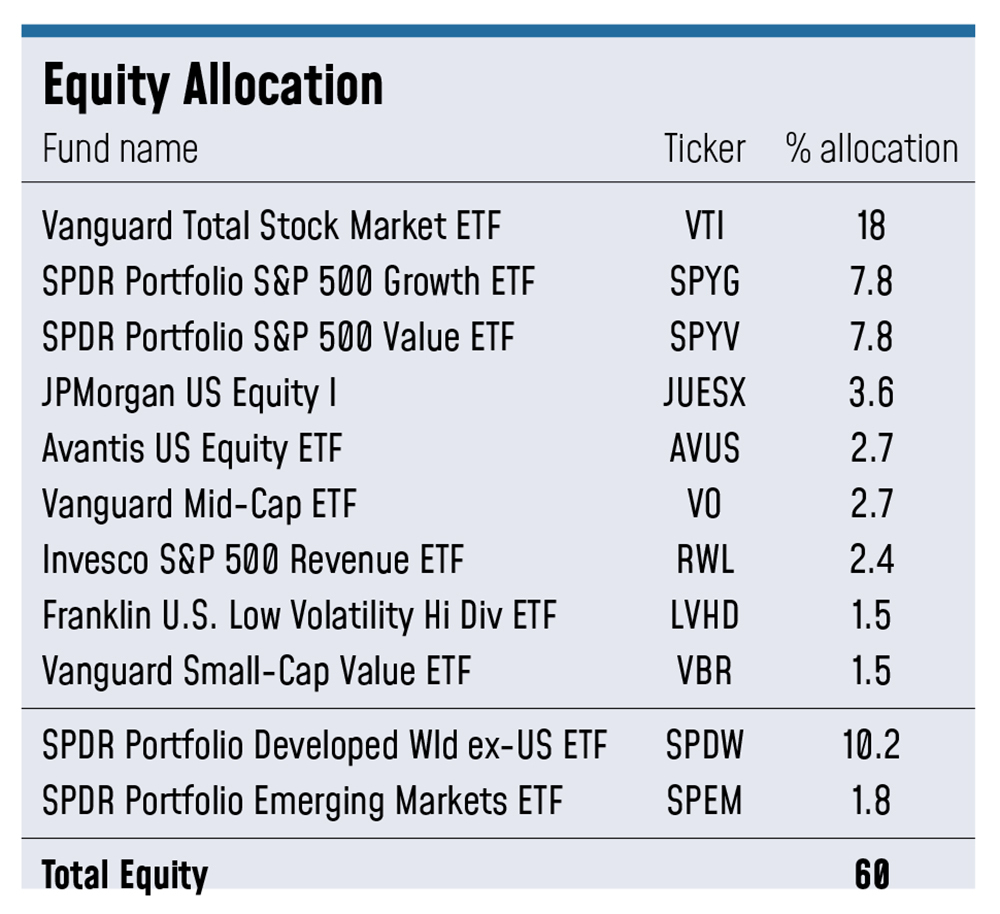

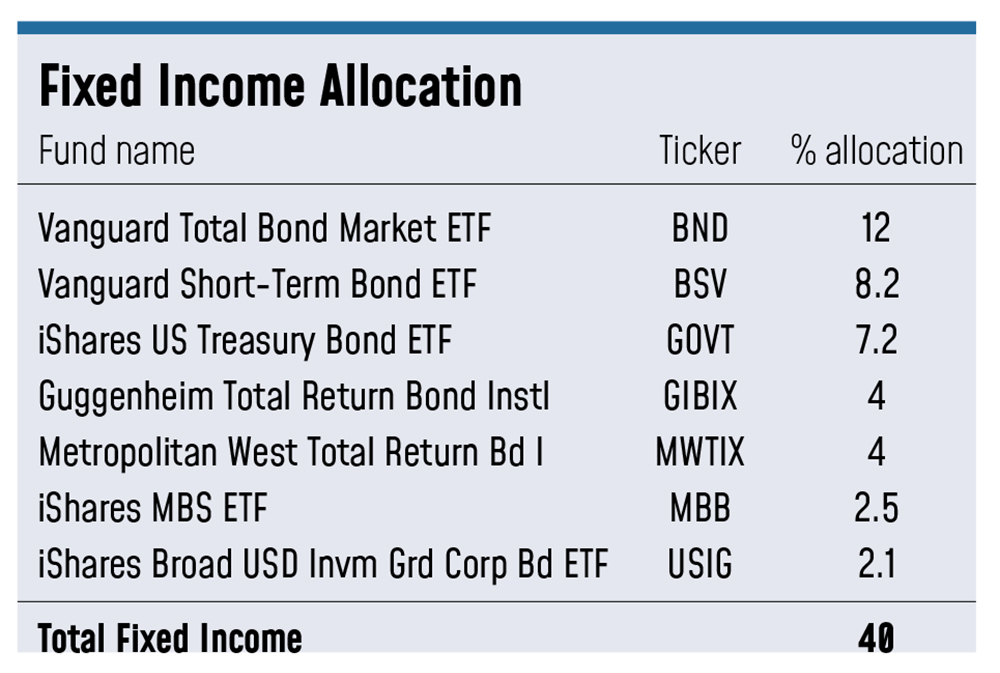

Andy Stout: I’ll use one of our models, our core/satellite 60/40 portfolio as a proxy. We use a mix of active and passive funds. So within the 60 part of the 60/40, we have a split 48% U.S., 12% international stocks. The fixed income portion is a mix of short-term bond funds, investment grade and total return funds. We have a few active managers in there, trying to navigate the market.

WM: What asset managers do you use, if any?

AS: We intentionally spread out our allocations among many different managers, because we obviously don't want to become the market. And that means we have SPDR, Vanguard, BlackRock, JP Morgan. Those often represent what we'll call our core part of the core satellite. More on the satellite side, you might see a little bit more of tilts could be one word for it, or just an active allocation, if you will. For example, we have a slightly more tilt to value than growth.

Now that's more a function of not necessarily us liking value over growth, but the funds that we have chosen on the satellite-side fall more on the value style box, if you will. So, for example, we have a revenue-weighted ETF, and a low-volatility, high-dividend ETF in our satellite portion. That's by Invesco—the Invesco revenue ETF is RWL. And the low-volatility ETF is from Franklin. That's more of looking at the business cycle and seeing where risks are, and where we want to mitigate those risks.

On the fixed income side, we use Vanguard, iShares, SPDR. We also have some active funds in there, such as Guggenheim's Total Return Bond fund, which is GIBIX, and Metropolitan West's Total Return Fund, MWTIX.

We like these funds because they've historically done a good job of navigating a full business cycle and full investment cycle. They won't always be hitting home runs every quarter, but we're looking more for the singles and doubles and consistency. When we think about serving our clients, you don't need to hit a home run all the time, but if you strike out a lot, you're going to put the clients in a tough situation, and we don't want to jeopardize their financial goals. So, it's really critical to make sure that we focus on consistency and lower volatility while still being able to participate in the upside.

WM: Where are the risks right now?

AS: Recession risk is elevated, and I don't think anybody would really question that. I know there's certainly a difference of opinion on whether or not there'll be a soft landing or not. I'm not trying to make a recession call here at all. But what we're trying to do is position the portfolios in a manner where we take into consideration multiple probabilities of various possible future states of the economy. That leads us to see that the economic risks are more elevated. That's where the downside risks are. As a result, we want to increase exposure to security types that would better weather in the economic storm that manifests.

WM: What factors go into your fund selection?

WM: What factors go into your fund selection?

AS: Every month we have our own proprietary scorecard where we score more than 20,000, basically the whole investable universe of mutual funds and ETFs. This proprietary scorecard looks at more than 100 different variables and allows us to essentially think about the universe in a much smaller sample, based on those indicators. And that essentially bubbles up funds that we think are worth a closer look. Then we will talk with the various portfolio managers that are on that list to determine if we believe they have some sort of repeatable process that could lead to alpha.

WM: What are some examples of those 100 variables you’re looking at?

AS: It’s everything from expense ratio to Sortino ratio, Treynor ratio, Sharpe ratios, over various time periods. It tracks returns relative to benchmarks as far as alpha goes, then also volatility. We're looking at a myriad of return measures, risk measures, and risk-return measures over various time periods.

Then, we'll separate them by different asset categories or asset classes because some sectors might just always have a lower score than other sectors. So, we will apply a percentile rank within each sector or asset class to see the top scoring funds, and then essentially we determine how much weight we want to put into each asset class as well.

WM: Have you made any big investment allocation changes in the last six months to a year? If so, what changes?

AS: A couple of things that we have intentionally done over the course of 2023 is to improve the overall credit profile, meaning it's higher quality fixed-income compared to where we were earlier in the year. But if you look at credit spreads, they're very tight right now. Also, we have actually increased our duration over the past few months intentionally. We had a much lower duration to start 2023.

Now we're up to the point where our duration is at about 5.6 years, so it's much higher than what it has been anytime in the past few years. It was probably around 4.2 years a year or so ago. When you look at the interest rate environment, it does appear that the Federal Reserve is—if they're not done hiking rates—they're likely very close to done hiking rates. And most likely, at least based on market probabilities, they would cut rates in 2024. Four quarter point rate cuts are currently priced in. We want to take advantage of that. So, we still get the strong yield, which you can get on longer-term and shorter-term bonds, but we would get more price appreciation by being a little further out in the yield curve.

On the equity side, we added the revenue-weighted fund and the low-volatility fund within the last six months. It's keying off of our view that if you are looking at the various economic states that could occur, there's some slightly more risks to the downside than there are to the upside. We don't believe it's ever prudent to go all in one way or another, and we won't market time either. That’s typically a fool's errand.

WM: What differentiates your portfolio?

WM: What differentiates your portfolio?

AS: It's really important to have diversification, exposure to broad asset classes and have a disciplined process when you're building these portfolios. All too often I would see people making emotional decisions, even professional investors. Our process is both qualitative and quantitative in terms of identifying investments, but also identifying asset classes that might be more attractive than others. And by sticking to our disciplined process, that allows us to not fall victim to emotional decision-making. We have a 20-page manual that really describes our whole investment process behind the scenes.

Also, a firm like ours, we're going to have a lot of different investment options. We have other mixes of active and passive, some where we include liquid alternatives. We have an all passive, we have income-oriented strategies, factor-oriented model suites. When I think about what makes us different, it is that we understand there isn't a one-size-fits-all model portfolio. We want to make sure that we have investment offerings that are attractive to clients and advisors across the board.

WM: Do you allocate to private investments and alternatives? If so, what segments do you like?

AS: We do have alternative assets that the advisors can choose if they believe it is in the client's best interest. That includes private equity, hedge funds, private debt, private real estate. There's a market-neutral fund. We have a Qualified Opportunity Zone fund as well.

We have an internal limit where we wouldn't put more than 25% of the client's assets in alternatives or illiquid alternatives. It depends on what the client needs. Some clients don't need tax deferral, like you can get with a qualified opportunity zone. We have a couple funds that do a pretty good job at generating income. Another one is focused on enhancing returns.

WM: How much do you hold in cash? Why do you hold cash?

AS: We're not overweight cash from a firm-wide perspective. Typically, we keep 1% in cash. We do that outside of the model, day end. If they have any ongoing distributions, we'll usually keep about four months of cash on hand for that as well.

Our advisors do have the ability to invest in cash outside of whatever we might pull typically. So, we have many different cash options for advisors to choose from. The high-yield money market funds, whatever CDs are available—usually we'll go through the custodian for that.

If the clients have these short-term cash needs, we are more than happy to satisfy that. Because you don't have to just keep your money in a bank if you want to earn some interest. You could probably get a little bit more outside of a bank anyway, compared to most places. You can typically get higher rates buying a treasury bill.

WM: Do you use direct indexing? If so, why? Do you use an asset manager or tech provider for that?

AS: Yes, we use Aperio for our direct indexing needs.

There are so many statistics out there that suggest it's hard for active managers to beat their index. Does that mean there is no such thing as alpha? No, there's tax alpha. It just takes some work. This takes a lot of just getting down into the weeds and figuring things out. The reason I like Aperio, is because they have shown results where they have added a lot of tax alpha on a pretty regular basis for their investors. And another thing I like about direct indexing is, if a client happens to be charitably-inclined, then we can donate the most appreciated stock and lower the client's overall tax basis.

WM: Are you incorporating ESG into the portfolio? If so, how?

AS: We do have an ESG model suite. We do not incorporate ESG into any of our other models. So if the client wants ESG, and they explicitly ask for it, that's when we would offer them our ESG strategies. But in all the other strategies, ESG is not a consideration at all.

The ESG model suite was designed by screening for funds that had an explicit investment objective to be focused on ESG, or SRI, or whatever nomenclature you want to use. It’s explicitly stated in their fund's objective that's what they're doing. Then what we've done, is look at the rankings out of Morningstar, or risk control metrics for environmental, social, and governance. Then, we optimize it to minimize those for poor governance control. Then, during that optimization process, we are applying constraints so that the overall stock, U.S. stocks, international stocks, are similar to our other strategies. And corporate bonds to government bonds, those are also similar to our other strategies. So while we do have many different investment strategies and model suites available, they all sing from the same songbook, if you will.