What’s in My Model Portfolio is a new series in which chief investment officers and analysts from top RIAs in the wealth management industry detail their investments and asset allocation in client portfolios.

Sequoia Financial Group, which was founded in 1991, has a long history of serving entrepreneurial clients throughout the lifecycle of their wealth. The RIA has grown to over $15 billion in assets, and it recently launched a family office division, called Sequoia Sentinel, to provide more specialized services to its ultra-high-net-worth clients,

WealthManagement.com spoke with Nick Zamparelli, senior vice president, chief investment officer, Sequoia Financial Group, who provides a look inside one of the RIA’s model portfolios, which includes a 36% allocation to alternatives.

WealthManagement.com: What’s in your model portfolio?

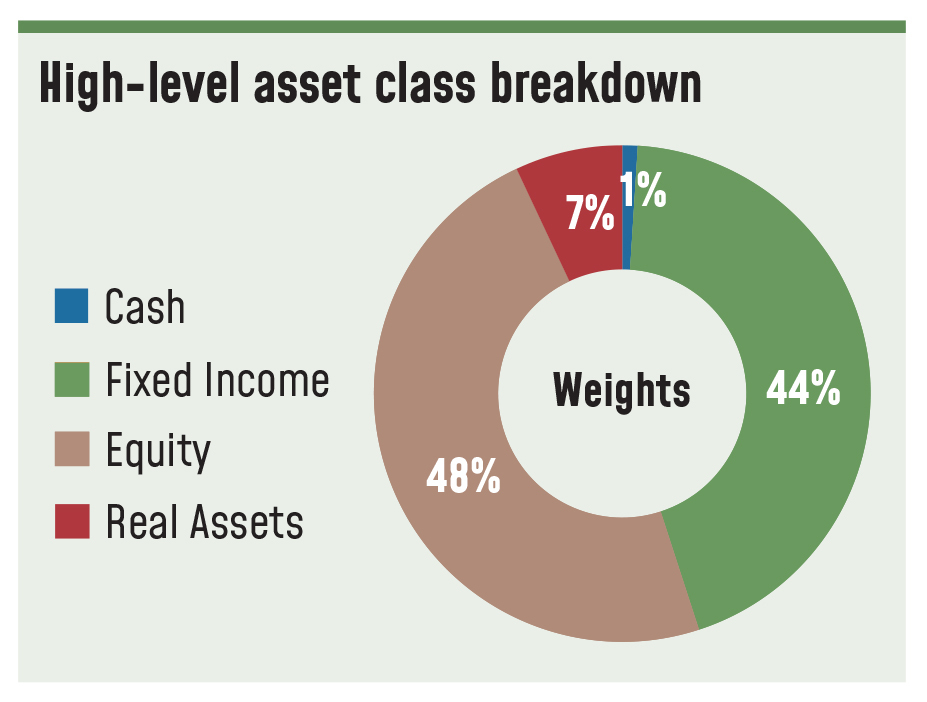

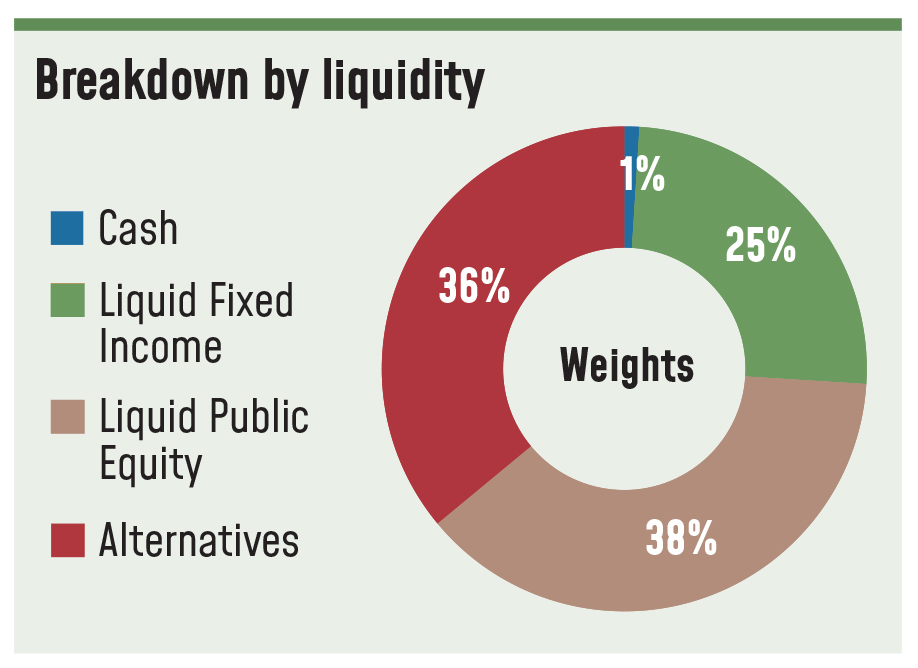

Nick Zamparelli: This is our 50/50 proxy model. At a high level, it includes cash, fixed income (44%), equity (48%), some real assets at 7%. But if you break it out by liquidity, what you'll see is that only 25% is liquid fixed income. Only 38% is liquid public equity and 36% is alts. And then within alts, I have it broken out by private credit, private equity, hedge funds and real assets. We're really doing a good job mixing in these illiquid asset classes, and that's really where we generate outsized risk-adjusted returns.

Nick Zamparelli: This is our 50/50 proxy model. At a high level, it includes cash, fixed income (44%), equity (48%), some real assets at 7%. But if you break it out by liquidity, what you'll see is that only 25% is liquid fixed income. Only 38% is liquid public equity and 36% is alts. And then within alts, I have it broken out by private credit, private equity, hedge funds and real assets. We're really doing a good job mixing in these illiquid asset classes, and that's really where we generate outsized risk-adjusted returns.

The Sequoia Sentinel, Sequoia’s family office division, client has the luxury of affording a material amount of illiquidity in their portfolio of assets. It's great for me as an asset allocator because it really opens up our universe of investment opportunities into alts, into illiquid assets. It allows us to really go out and seek the best risk-adjusted returns and capture illiquidity premiums and just be really thoughtful about how we're building out their investment portfolios. The overall goal clearly is to build out thoughtful portfolio of assets in the most opportunistic way possible.

We use our own set of capital market assumptions, which is one thing that really differentiates us, particularly in the private space. Private equity screens great in optimizers because the standard deviation of returns appears artificially low merely because it doesn't get marked as much. So, it looks like you're generating better than average equity—better than a public equity returns at a lower level of risk, which we all know as investors is not true.

So, we make some adjustments in our model, particularly on standard deviation to show that there is in fact more risk in private equity than public equity, for example. But we come up with our standard set of capital market assumptions that we review on an annual basis.

WM: Have you made any big investment allocation changes in the last six months or so?

NZ: For, perhaps, the first time in my career the most contentious conversations within the research team and frankly with clients are happening in what should be the risk mitigating segment of the portfolio. All of the interesting conversations are going on in the fixed income segment of the portfolio. So, to that end, the question really for the last 18 months is, when to start leaning into duration within your fixed income segment, when to take on a little bit more interest rate risk?

A lot of folks were very early—and understandably so given most would have thought that the economy would have been more sensitive to the hiking cycle than it has turned out to be. Now, there's a lot of reasons why that's the case, and I think it was overlooked by many market participants that both consumers and corporations were able to term out their debt at really, really low rates for a long time.

So, this rapid increase that we saw on Fed funds really didn't affect their lives yet. Now the question will become just how much longer. The Fed talks about lagged and variable effects of interest rate hikes. All of that stuff is still seeping into the economy. And there will come a time when both consumers and corporations will have to refinance their debt. And if they had to do it today—which they don't, thankfully—then you would see that economic sensitivity that people were worried about. But we haven't seen it yet.

So, the biggest change we've made over the past six months is leaning into duration of bid as rates have backed up.

I'm trying to establish a ballast in the portfolio from a risk perspective that offsets my return seeking assets, my equity risk, if you will. And where rates are today, I think you can finally say that, hey, if we really get a contraction in the economy, that fixed income today is going to help offset some of that equity risk because rates will come in and they'll come in pretty aggressively. Everyone's waiting for rates to come down, but if they come down for the wrong reasons, it's not a good thing for the equity market. So, if they're coming down because there are real economic concerns, it's not going to be favorable to equities because, while multiples may benefit, the denominator certainly is not going to benefit.

I'm trying to establish a ballast in the portfolio from a risk perspective that offsets my return seeking assets, my equity risk, if you will. And where rates are today, I think you can finally say that, hey, if we really get a contraction in the economy, that fixed income today is going to help offset some of that equity risk because rates will come in and they'll come in pretty aggressively. Everyone's waiting for rates to come down, but if they come down for the wrong reasons, it's not a good thing for the equity market. So, if they're coming down because there are real economic concerns, it's not going to be favorable to equities because, while multiples may benefit, the denominator certainly is not going to benefit.

WM: Have you made any changes on the equity side?

NZ: We've added some short exposure to our equity book. We did that around April or May. We're not betting that the market goes down, but we want to take some of the volatility out of the potential changes in equity markets. It's turned out to be a real benefit to the portfolio because it served the purpose of tamping down the volatility of our equity returns.

WM: What differentiates your portfolio?

NZ: The research process, in and of itself, really differentiates us from our competitors. If we're looking for exposure to a certain asset class, I've got seasoned professionals that are subject matter experts that can really find the best ways to articulate those desired exposures. And these guys have a Rolodex. They're not out doing a fresh search every time. They've got enough experience in their area of expertise where they've got a bench, they've got a roster, they've got a Rolodex to choose from.

WM: What are your top contrarian picks?

NZ: One is small cap stocks. Have they underperformed and for a good reason. With the rate environment that we're in, a lot of small cap stocks, the iShares Russell 2000 Value ETF (IWM) for example, is riddled with companies that have less than stellar balance sheets and need to access the capital markets to fund their growth. And they can't do it in this environment. That said, it's an area of growth that we certainly want exposure to, and we're very cognizant of the fact that over long periods of time, small cap stocks have outperformed. So that's an area that we're looking to lean into right now.

International equity is another area of the market that has underperformed for 15 to 16 years now. When we start to see growth opportunities broaden out globally, you're going to see an opportunity for international stocks and emerging markets to really start to outperform. You also will get a benefit if we ever see the dollar weaken. That will be a big benefit of owning international equities and emerging market equities. We're also starting to look at some bond proxy equity sectors that have just been decimated.

WM: What investment vehicles do you use?

NZ: We will go from passive to very, very active. We'll use passive ETFs where we don't think the market is inefficient enough to pay for active management. For example, we will try to employ passive tax advantaged strategies to get our U.S. large cap exposure, which is a very efficient market and very difficult for active managers to outperform, particularly given the concentration in that space. But in the areas where it's less efficient—international markets, emerging markets, small caps—we will go out and find who we think are the best strategy managers. So, we'll use ETFs, we'll use mutual funds, we'll use private partnerships.

NZ: We will go from passive to very, very active. We'll use passive ETFs where we don't think the market is inefficient enough to pay for active management. For example, we will try to employ passive tax advantaged strategies to get our U.S. large cap exposure, which is a very efficient market and very difficult for active managers to outperform, particularly given the concentration in that space. But in the areas where it's less efficient—international markets, emerging markets, small caps—we will go out and find who we think are the best strategy managers. So, we'll use ETFs, we'll use mutual funds, we'll use private partnerships.

We have our own internal partnerships that we've created to get exposure to a lot of illiquid asset classes. We have our own strategy called Niche Credit, which is in non-traditional areas of fixed income, like dislocation funds, distressed funds, more opportunistic areas of the market that go beyond just merely picking high yield, for example. And on the private equity side, we have a series of vintage funds. We'll find strategies across the spectrum of venture all the way to late stage buyout. Some of those are accredited funds, some are Qualified Purchaser funds. Most of our clients in the family office are QPs.

WM: What are the opportunities you see in real estate right now? Are there any particular segments that you're going after or structures you’re using?

NZ: In private markets, we actually go out and buy direct deals. So we own some commercial office buildings in suburban Philadelphia. We own some student housing projects—one at Penn State, one at University of Delaware, one at the University of Alabama. Our student housing portfolio is performing very, very well. Our commercial office is struggling a bit.

We found that by owning and operating individual real estate assets, we could generate a pretty healthy yield for our clients. And rather than underwriting the credit quality of a company in fixed income, you're really underwriting the credit quality of the tenant and the intentions of the tenant.

We will use from time to time real estate funds. For example, we've invested in an industrial real estate fund where it was just industrial and warehouse real estate space.

And we also will use public REITs. Right now I would suggest that public REITs, which have already discounted the values of the underlying assets via the public markets, may be more interesting ways, at least tactically, to get exposure to real estate than what you can do in the private markets. It is really difficult in this financing environment to get a real estate deal to pencil out when you're taking on debt at these levels. It's been very, very difficult to add new direct real estate opportunities to the portfolio. There will be distress, and we have capital to deploy. So, we will be opportunistic there for sure.

WM: How are you addressing the inflationary environment within the portfolio?

NZ: Equities can be a real hedge against inflation. Right now, if we're worried about anything, we're worried about the consumer. The consumer in our view, from what we can see for the real time data that we're hearing from companies, is getting more discerning, and the more discerning they get, the more difficult it's going to be for companies to pass through pricing. The more difficult it is for companies to pass through pricing, the more they run into margin issues. So, you throw that margin headwind up against interest rates and all of a sudden you've got a potential for earnings to underperform versus estimates.

WM.com: How much are you holding in cash and why?

NZ: For us, there are two reasons to hold cash: One is frictional just for client expenses, which typically is 1% all the time, not a material amount. Or, we could use it as a tactical allocation within our fixed income portfolio. If we were really smart, we would've gone to all cash and T-bills at the beginning of this year, and then right around now we would've swapped that into something long duration. We will do that from time to time to manage the duration of our fixed income portfolio.

WM.com: Are you incorporating ESG into the portfolio? If so, how?

NZ: ESG has been really tough for us because it's an area where we don't necessarily trust a lot of the information that we're getting as far as what makes something attractive from an ESG perspective. We haven't gotten completely comfortable with the data. That said, a lot of our ESG-related investments are client driven. So, when we have a client that has a particular hankering for something or they have a particular view or they want exposure to something or they want to avoid something, we will work with them and find the best ways to do that. We’ll dig in and do some real diligence to find them areas where they can feel good about their investments.