If you happen to be one of the maddening crowd who's casting blame, waiting for the markets to improve so everything can return to normal, you'd better think again. The reality is that our present is a harbinger of our future. It's already a new world.

During times of crisis, significant changes in how people think and behave always occur. Hence, every crisis serves as a breeding ground for a new set of norms. These new norms have already changed the affluent/financial advisor relationship.

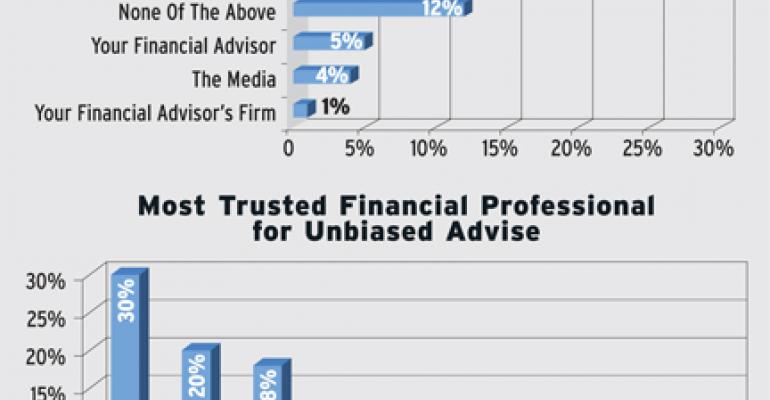

First of all, as illustrated in the chart below, the affluent do not blame their financial advisors for the recent performance (last 12 months) of their portfolios. This is eye-opening. Without a doubt, it is time for financial advisors to stop feeling guilty about client losses.

At the same time, the financial crisis has forced financial advisors to significantly increase their knowledge-based communication with affluent clients. And this has yielded an unexpected benefit: It may be hard to believe, but for the first time in our affluent research, financial advisors rank higher than CPAs and financial planners as the most trusted financial professionals for “unbiased advice” (see chart below).

Alternatively, it is important to note how few affluent individuals place trust in stockbrokers and insurance agents. Although this shouldn't come as any surprise, it highlights a critical challenge for financial advisors. Two uncomfortable questions needed to be honestly addressed:

- How do your clients refer to you (when you're not around) to family members, friends and colleagues?

- How are you positioned in the mind of your affluent clients?

You better NOT be perceived as a stockbroker or an insurance agent in the minds of your affluent clients. Brokers have been attempting to re-brand themselves for over a decade. But fancy brochures, well crafted value statements, and expensive marketing campaigns do not cut it. Re-branding in this new world requires walking the walk, one client at a time, one day at a time. There are no shortcuts. What this means is that advisors need to be knowledgeable about all aspects of personal finances and have the resources to fully coordinate the different components of their clients' financial affairs.

In a recent financial advisor study, only 5 percent of respondents claimed to have “excellent skills” at penetrating their affluent clients' centers of influence. And this is in an environment where 9 of 10 affluent investors would consider getting a second opinion about their families' financial health. Yet it's important to remember, they aren't interested in a second opinion from a stockbroker.

This is an opportunity for every advisor who provides true comprehensive wealth management. Trust in advisors is on the rise and affluent investors want a second opinion. It doesn't get much better than this.

Wtriter's BIO:

Matt Oechsli

is author of Building a Successful 21st Century Financial Practice: Attracting, Servicing & Retaining Affluent Clients. oechsli.com