One of the hallmarks of being a good advisor is when an advisor gives advice that makes clients better off, after factoring in the total costs of the advice.

If you don’t measure the value of the investments you select versus the cost of those investments, you’re unlikely to end up in good investments and pay reasonable fees for them. Increasingly, advisors are being held accountable for the benefit-to-cost proposition of the investments they recommend.

There isn’t a widely used method to measure this important aspect of the value of advice, although a number of top experts have put forth concrete methods and ideas on the topic.

Here’s a practical, effective yardstick I like to use in my work. It’s designed to help advisors and their clients achieve better value for fees paid.

It’s called “ROFI,” for return on fees invested. I measure ROFI by dividing the net value of an investment by the cost or fees associated with that investment:

Net Value Provided by Investment(s)

ROFI = --------------------------------------------------

Cost or Fees on the Investment(s)

It might seem odd at first to prioritize calculating a return on fees invested when the amount of fees is usually dwarfed by the amount of money you’ve actually got invested. It might seem much more important to calculate a more conventional ROI, or return on your much larger investment.

But conventional ROIs are one of the refuges where investment mediocrity can hide, with rising markets sometimes obscuring the size of fees and drawing attention away from unattractive performance on a benefit-to-cost basis. By contrast, good advisors can distinguish themselves by allocating their clients’ wealth to investments that deliver strong ROFIs.

Here's an example of how ROFI math works. An advisor might help an investor select a bond strategy that has a fee of 1/2 of 1% annually. The bond strategy generates a gross return that is 3/4 of 1% per year greater than a comparable low-cost benchmark. The net value of the advice received by the investor is 3/4% – 1/2% = 1/4%. That result divided by the total fees of 1/2 of 1% yields a ROFI of 1/2, indicating that the investor is receiving one dollar of net value for every two dollars of fees he or she is paying.

Now imagine a riskier investment such as a private equity fund. The gross return of that fund versus a comparable low-cost benchmark might be 3.5% a year, with annual fees of 2% per year on the fund. In this case, the net value of advice received by the investor is 3.5% – 2%, or 1.5%. And 1.5% divided by the total fees of 2% gives us a ROFI of 0.75.

It’s a positive result—the investor is better off with each of these hypothetical investments than doing nothing—but a very substantial portion of the value added is paid not to the client, but directed instead to the asset manager. And despite the extra risk the investor is taking with the private equity fund, they are getting just 75 cents of net value for every $1 of fees he or she pays.

A ROFI of 1 indicates that the investor is receiving $1 of net value for every $1 of fees he or she pays. A ROFI of 2 indicates that the investor is receiving $2 of net value for every $1 of fees. Any ROFI less than 1 suggests that the investor is not even getting $1 of additional value for every dollar in fees he or she pays.

What Is a Good ROFI?

It’s worth taking a look at the T. Rowe Price New Horizons Fund (PRNHX). As of mid-2019, the trailing 10-year annual return for this highly ranked fund was 19.54% , which was 4.83% per year greater than a comparable benchmark index, and these figures already had fees netted out of them. The expense ratio or fees of the fund were reported as 0.77%. Therefore, the ROFI for this fund is

Net Value of Advice Received By Investor 4.83%

ROFI = -------------------------------------------------- = -------- = 6.33

Cost (Fees) of that Advice 0.77%

In other words, an investor in the T. Rowe Price New Horizons Fund is earning $6.30 of net value for every $1 of fees/expenses the investor is paying. That’s an impressive ROFI! Even if we were to add a 1% annual fee for the services of a financial advisor who recommended that a client invest in this fund, the total annual fees would be 1.77% and the ROFI would be 4.83%/1.77%, or a still-robust 2.8.

The ROFI methodology is designed to be “non-partisan” in not taking a position on whether some investment approaches are inherently better than others—e.g., indexing versus active management, public versus private investments, paying high or low fees, using a personal advisor versus a do-it-yourself approach, etc. The idea is to create a yardstick against which all these approaches can be subjected to a fair, apples-to-apples comparison.

The higher the ROFI is, the more investors can feel confident about being the primary beneficiary of the investment fees he or she pays, which is how things should work in a well-advised relationship. And good advisors and investment product providers can take pride and position themselves for success by delivering a high ROFI through their products and services.

Implications and Uses of ROFI in Investment Analysis and Selection

For several decades, investors, advisors and analysts have had at their disposal a number of useful measures to evaluate various investments, such as “alpha” and “Sharpe Ratio,” among many others.

ROFI can be a useful addition to such widely used measures. Unlike other measures in broad use today, ROFI can help you judge how skillfully assets are being invested and how the fruits of investment skill are being distributed among investment managers, financial advisors and investors. ROFI can help investors and advisors make more informed decisions when choosing investments across the fee spectrum—from index funds to active managers to alternative investments, and help distinguish one investment from another within a particular asset class. A high ROFI can indicate an advisor or provider who knows how to (a) invest well and (b) treat their clients well, too. Good investors and advisors have good reason to invest with those who generate attractive ROFIs.

A New High Ground Is Emerging

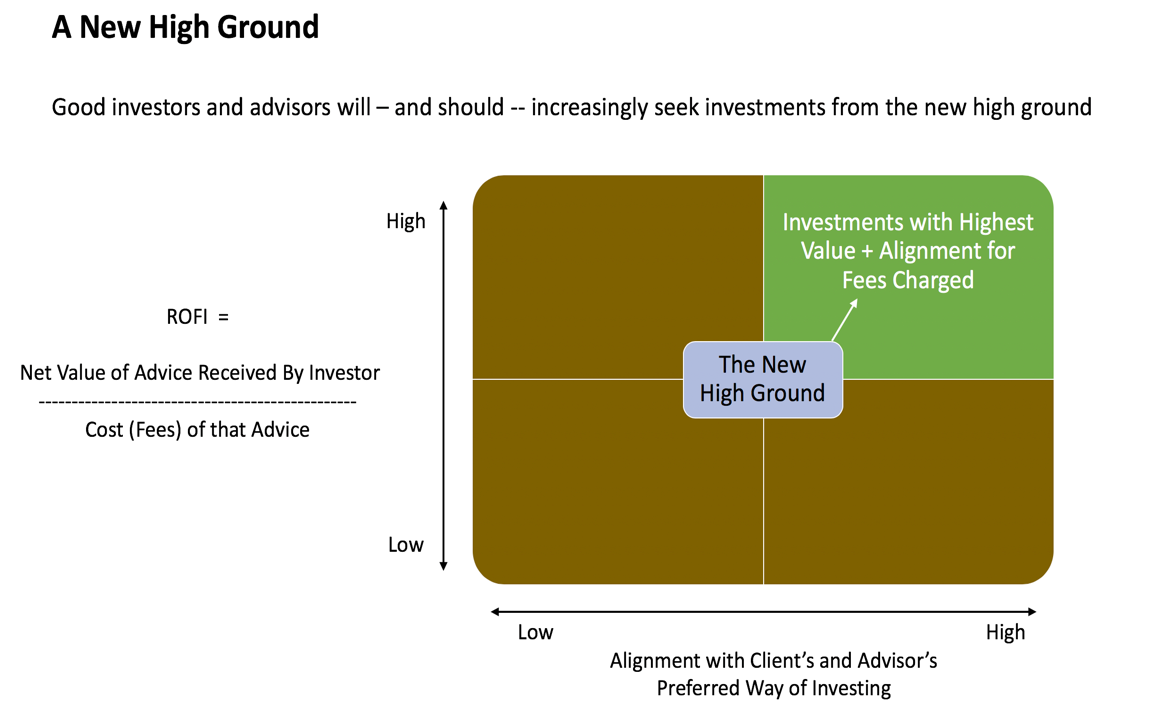

As fee pressure grows and wealth advisors continue to become less dependent on product-based compensation, the emphasis for those advisors and their investment providers will shift to a new high ground.

This emerging high ground is illustrated below.

The ROFI measure can play an important role in finding a path to this high ground, which is where worthwhile investments and growth in well-advised relationships will also be found.

Stephen Bodurtha is a long-time financial industry executive who has served as vice chairman of Merrill Lynch Global Wealth Management and head of investments at Citi Private Bank, North America. He founded Flexbridge Partners in 2017.