If you’re like many advisors, there’s a good chance you’re spending too much time on tasks that distract you from servicing your clients and growing your business.

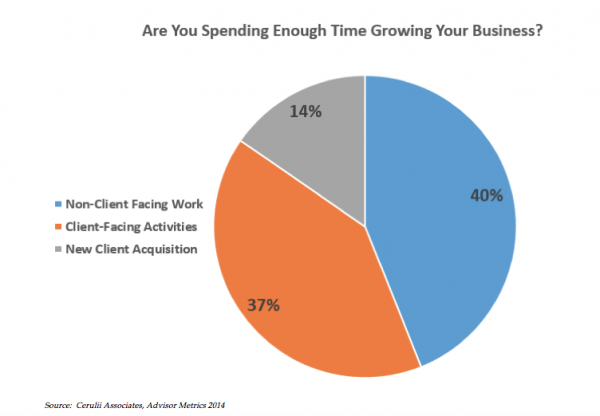

Research by Cerulli Associates has found that, on average, independent advisors spend 40%of their time on non-client-facing work, which includes administrative tasks, research, asset management and professional development. A mere 37% of their time goes to engaging with existing clients, and only 14% is devoted to new-client acquisition.

In my experience, advisors who spend more time engaging clients and manage more client assets, have stronger business growth rates. The challenge, of course, is to find time in an increasingly complex business. Outsourcing can provide a repeatable process for investment selection and monitoring, streamline client account management and simplify back-office tasks. It can also help make an advisor’s practice more sustainable and scalable—and thus more valuable to potential future buyers.

Leveraging Your Time More Effectively

To assess whether outsourcing would be helpful for your practice, start by performing an organizational diagnostic. This will help define your core value proposition and determine your strengths across the key functions of sales and marketing, research and portfolio management, operations, HR, and client service.

For each of these functions, ask yourself the following four questions: Do I provide a level of service in this role that creates a unique client experience? Can I deliver this level of service profitably? Would outsourcing this role result in better service for my clients? And would outsourcing free me up to better engage my existing clients or find new clients?

Your answers will suggest the degree to which you might profit from optimizing your business through the use of strategic partnerships. The potential benefits include:

- Reducing operating costs by limiting your need for expensive new technology or increased staffing.

- Developing a more consistent investment management process.

- Increasing your potential to generate client income, while reducing the risk exposure associated with portfolio construction.

- Improving greater operational scale.

- Customizing client relationships with investment proposals, account administration, reporting, billing, and branded marketing support.

Building Long-Term Value for Your Practice

Along with adding to the time available for guiding clients towards their financial goals, strategic partnerships can increase the scalability and sustainability of your practice. The ability to offer efficient service and robust product suites to more clients, without significantly adding staff, can provide much needed scalability. Additionally, your access to new technology and practice management solutions can help generate healthy revenue and cash flow over the long term, enhancing the sustainability of your firm.

Scalability and sustainability are key components to valuation when advisors prepare for a change in ownership or leadership. The more easily a business can be scaled up in size, the more valuable it becomes in the eyes of potential acquirers. Similarly, the ability for someone new to take it over with minimal disruption goes hand-in-hand with that business’s sustainability and, ultimately, its value.

Whether or not you have a formal succession plan in place, outsourcing can help you strengthen your practice management process, expand your client base and enhance the transferability of your business. Integrating strategic relationships today can make your practice more scalable and transferable—and more valuable to potential buyers—tomorrow.

Matt Matrisian is Senior Vice President and Director of Practice Management at AssetMark, Inc. (www.assetmark.com), an independent provider of investment and consulting solutions serving financial advisors, and author of “The Power of Practice Management: Best Practices for Building a Better Advisory Business.”