The majority (56%) of full service investors still don’t completely understand the fees they pay their wealth management firm, and nearly that many (46%) admit they don’t know their portfolio’s return over the past year, according to the J.D. Power 2015 Full Service Investor Satisfaction Study.

There are a variety of things wealth management firms can do to try to increase client understanding, including re-designing account statements and making clear, concise information more readily accessible online and in mobile-friendly formats, but ultimately much comes down to whether or not advisors are consistently having effective conversations with their clients.

Fees can be complicated, and performance can be disappointing, so many advisors probably would rather not have those conversations. But research suggests that advisors should be making the effort consistently for a variety of reasons:

- Providing transparency around fees and performance significantly increases client satisfaction, loyalty and advocacy.

- The dialogue provides advisors an opportunity to talk about the overall value they provide, not just the fees.

- Advisors can effectively shift client perceptions of portfolio performance away from beating the market and towards alignment with personal goals, which makes more sense for the client, helps build the relationship and underscores advisor value.

Understanding Fees Drive Loyalty and Referrals

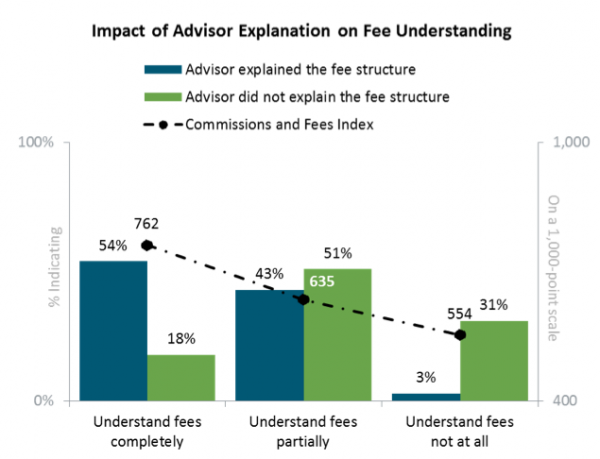

When clients report that their advisor has explained fees to them, complete understanding increases to 54 percent from 18 percent and those reporting no understanding declined to just 3 percent from 31 percent. Clients who completely understand their fees are significantly more likely to remain with and recommend their current firm than those with a partial (or no) understanding.

Transparency Builds lient Trust

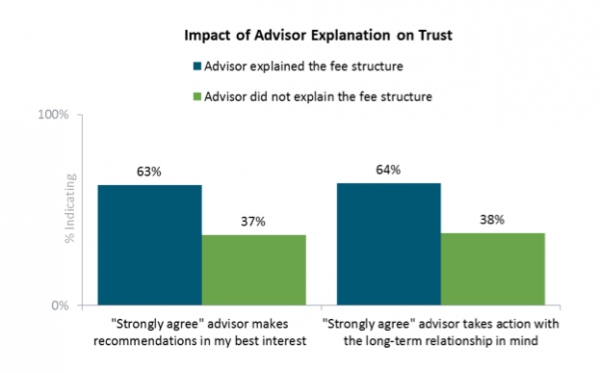

Beyond just increasing understanding, these conversations build client trust in the relationship. Specifically, 63 percent of clients who say their advisor explains their fees “strongly agree” their advisor makes recommendations that are in their best interest, compared with only 37 percent of clients who said the same without an explanation. Similarly, 64 percent of clients who receive an explanation “strongly agree” their advisor takes action with their long-term relationship in mind, compared with only 38 percent of clients who say the same without an explanation.

Advisors also have a chance to position the costs against the holistic value they provide. So, while the client may pay a set fee for portfolio management, they may also receive things like financial planning services that don’t have a price tag on them but nevertheless are part of the overall value the advisor provides.

Meeting Your Goals vs. Beating the Market

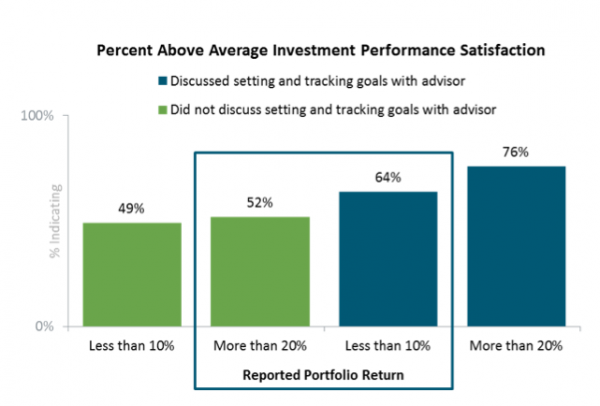

Similarly, when left to their own devices, clients are likely to evaluate their portfolio performance against the market or some market-derived benchmark rather than based on whether it’s keeping them on track to meet their long-term goals. Advisors have an opportunity to re-position the performance assessment, especially when they have set the foundation for it by collaboratively setting those goals. Clients who recall a discussion with their advisor about setting and tracking toward their goals, and indicate a portfolio return of less than 10 percent, are still significantly more satisfied than clients who do not have a discussion about goals and perceive a return of greater than twenty percent (64% highly satisfied vs. 52% highly satisfied).

The Bottom Line

The bottom line for advisors is don’t avoid difficult conversations about fees and performance; clients will be more loyal and trusting when you address these issues head on. And, while robo-advisors may put downward pressure of the price of portfolio management, trust is one area where human beings still have a competitive advantage over technology.

Mike Foy is Director of the Wealth Management Practice at J.D. Power