In 2020, the Certified Financial Planner Board of Standards accredited 68 online certificate programs that meet its educational requirements. Which CFP programs have the best track records and provide the most value? WealthManagement.com decided to find out.

With the coronavirus raging, many campus-based educational programs have been disrupted. Not so with the distance learning programs. Demand for these offerings has soared.

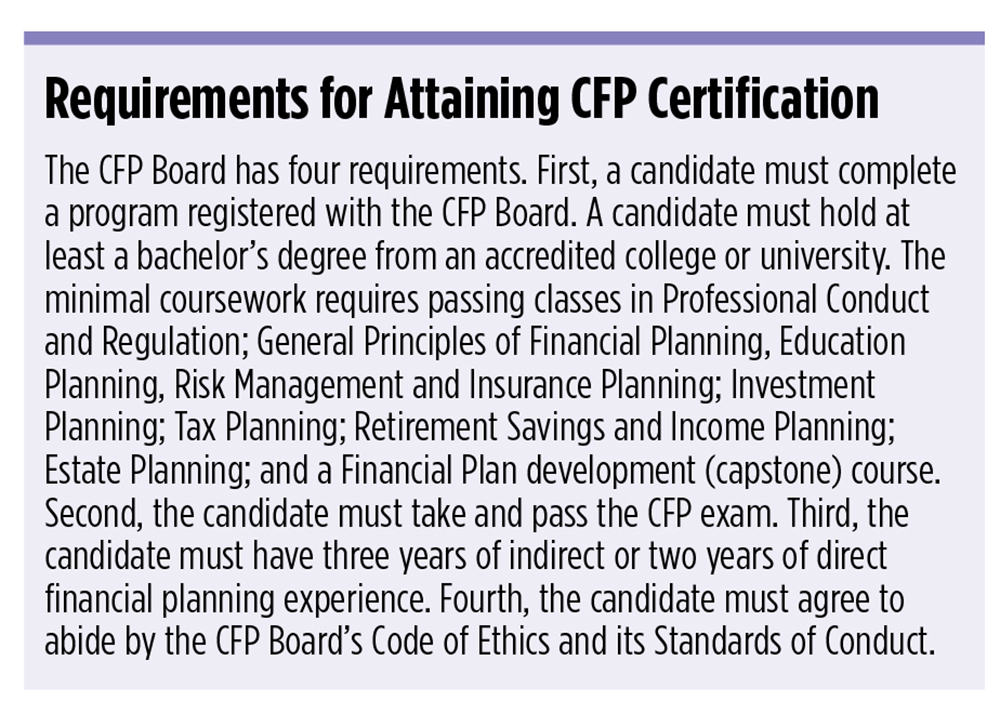

In response, we present the first qualitative ranking of the nation’s online CFP programs. (This ranking is limited to online, instructor-led programs. In a previous article, we evaluated degree-granting on-campus programs for financial planning.) There are two conventional paths for completing the educational requirements to sit for the CFP examination. One calls for enrolling in a college or university accredited by the CFP Board, passing a minimum of six courses covering the core topics in financial planning and demonstrating proficiency in integrating all the lessons by completing a capstone course. This path appeals to traditional students exploring career-entry points into financial services as they earn their undergraduate or graduate degrees.

The other route, favored by working practitioners with some years of experience, is an instructor-led, online certificate program tightly focused on preparing individuals to pass the CFP exam. (Our ranking did not consider courses of study featuring online, self-paced learning without access to instructors.)

Compared with their on-campus counterparts, online CFP programs take far less time and money and are far more flexible for working professionals who may also have family obligations to juggle.

Curriculum and Delivery

Our research found that most of the certificate programs are, by design, similar in curriculum and delivery. The CFP Board mandates the core curriculum. A number of schools partner with Dalton Education, whose faculty teach the interactive courses that fulfill the CFP requirements.

Some public universities offer their financial planning certification education through The Great Plains Interactive Distance Education Alliance, a consortium that provides flexible and affordable online degree and certificate programs. One advantage of this approach is that students can complete the curriculum through any of the participating universities. Other schools deliver their programs through a mix of full-time faculty and adjuncts. In our ranking, we paid close attention to the percentage of financial planning faculty who had themselves earned the CFP certification.

The industry is dominated by the College for Financial Planning, the creator of the CFP designation. Since 1972, the College for Financial Planning, now affiliated with Kaplan Financial Education, has graduated more CFP professionals than all other programs combined. Out of the 55,000 or so testers who have sat for the CFP national examination since the test’s reformulation in 2012, over 18,000 were trained by the College for Financial Planning. The college must appear at the top of any rational list of certificate programs for financial planning.

Given that everyone has a different budget, timetable or preferred style of learning, the decision on which program to select becomes a very personal choice. The data in these rankings represent the first attempt to tease out the important differences between the programs to help each prospective student make the most-informed decision possible. Through their websites, all the programs offer prospective students information about costs, time to completion, curriculum, faculty and other benefits. For example, a number of schools offer variations on a no-cost repeat of the program if a student fails the CFP, or a money-back guarantee. All of the programs are laserfocused on preparing students to pass the exam.

CFP coursework can be completed as part of a stand-alone certificate program or an accredited degree program. For this study, we considered the 68 online instructor-led preparation programs accredited by the CFP Board. (See Figure 1.)

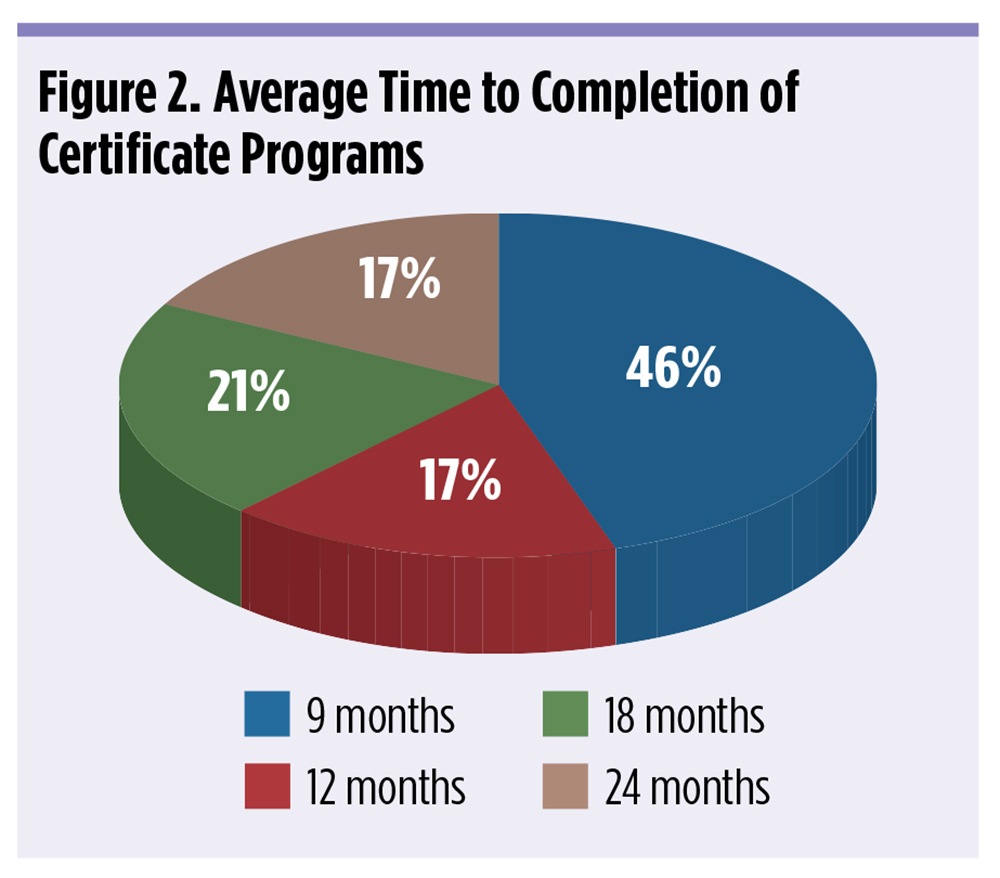

The CFP Board also accredits 29 self-study programs online, as well as 252 classroom/online blended programs. We did not evaluate the self-study programs, and we previously ranked the classroom programs here. Most programs offer a traditional track that guides students to certification in 9, 12, 18 or 24 months. (See Figure 2.) Many programs offer a fast-track option for those who want to accelerate the process.

To rank the online programs, we surveyed the 68 online college courses accredited by the CFP Board. A total of 25 programs (37%) submitted completed responses by the deadline. The lower-than-desired response rate may be due to the pressures educational institutions are facing given the disruptions of the coronavirus. Ideally, a ranking like this would be based on measures starting with verified pass-fail rates on the CFP exam. Unfortunately, the CFP Board declined to provide WealthManagement.com with pass-fail rates by program or to verify self-reported pass-fail rates. Unobtainable, also, are other logical output measures (job placements, investment returns, starting salaries or assets under management after five years). As a result, this survey, like almost all educational rankings, considers inputs that are believed to serve as reasonable proxies for excellence.

Our methodology did not consider tuition and other costs. The cost of each program is public, readily available and constantly updated. The programs are highly competitive with fees in the range of $200 to $400 per credit hour. Instructor-led online certificate programs require a minimum of 18 credit hours of coursework, which translates into total tuition costs of $3,500 to $5,000 plus books and registration fees. While program costs are certainly significant to some students, there’s little evidence that price correlates with program value.

Our methodology did not consider tuition and other costs. The cost of each program is public, readily available and constantly updated. The programs are highly competitive with fees in the range of $200 to $400 per credit hour. Instructor-led online certificate programs require a minimum of 18 credit hours of coursework, which translates into total tuition costs of $3,500 to $5,000 plus books and registration fees. While program costs are certainly significant to some students, there’s little evidence that price correlates with program value.

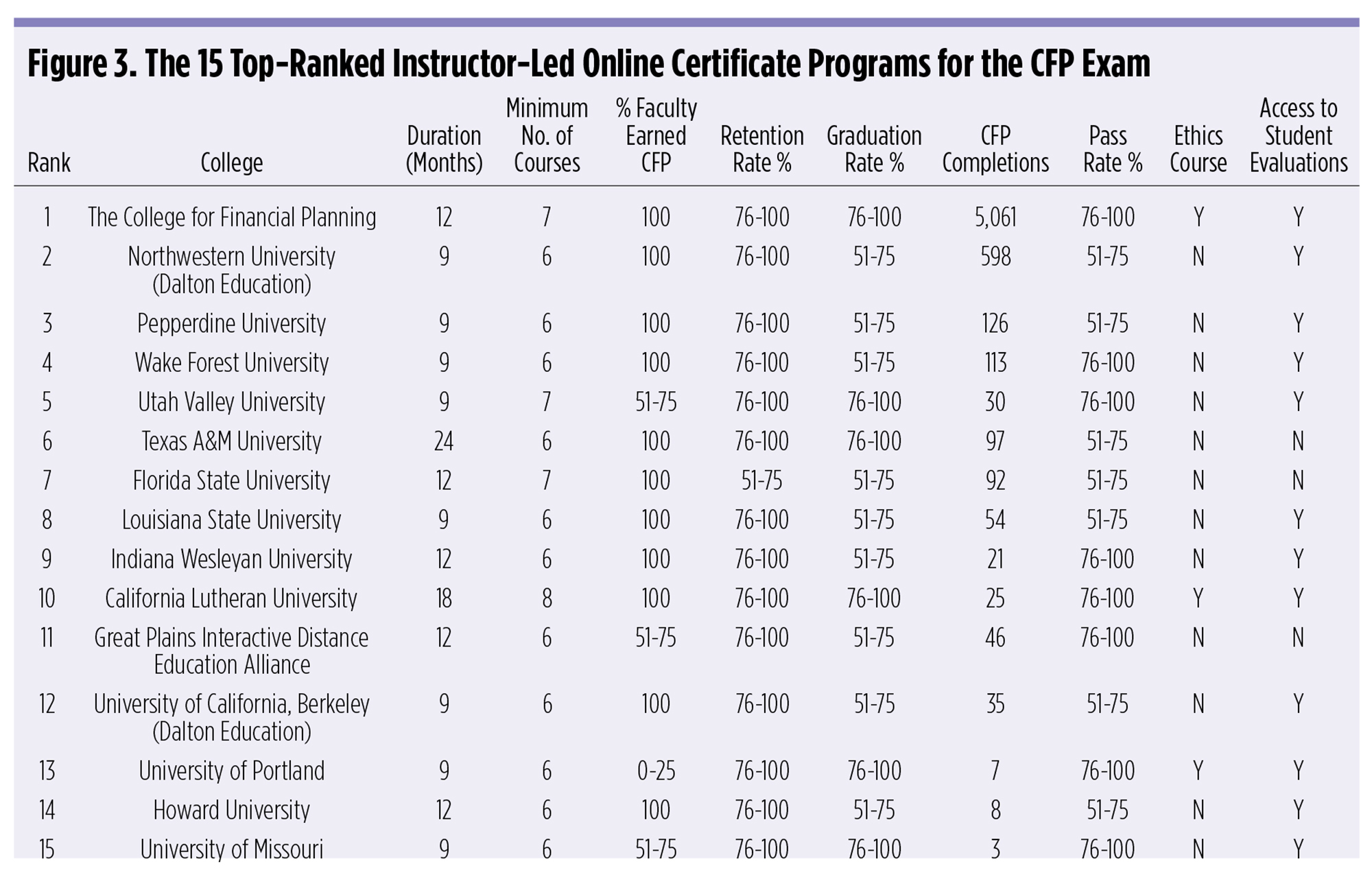

WealthManagement.com ranked the certificate programs on a weighted average based on the following indicators: Expected Time to Completion; Minimum Number of Courses Requirement; Fulltime Equivalents (FTEs); Percent of Faculty with Earned CFP; Retention Rate; Graduation Rate; Number of CFP Completions (over two years); Pass Rate for the CFP Exam; and whether the program offered a Dedicated Ethics Course and access to Evaluations by Previous Students. The raw data used to calculate scores were self-reported by the surveyed programs.

The weighted scores were totaled and the corresponding programs ranked highest to lowest. The programs with the 15 highest scores are presented in order.

View the gallery