It’s easy to confuse frequency with duration—especially when you are contending with a high volume of activity. Categorizing things comes naturally to us all. It appeals to our sense of order and perhaps even creates an aura of control. Within the wealth management industry, we organize events into cycles. Bull, bear, business, life … we love a good cycle. It offers order and (often erroneously) helps to inform what we think should happen next.

Right now, the wealth management industry is in the midst of a consolidation cycle—particularly among RIAs. Given the number of transactions hitting the headlines, one would be forgiven to believe the dealmaking involving mega-RIAs, aggregators and consolidators must be nearing its inevitable conclusion.

But where are we, really?

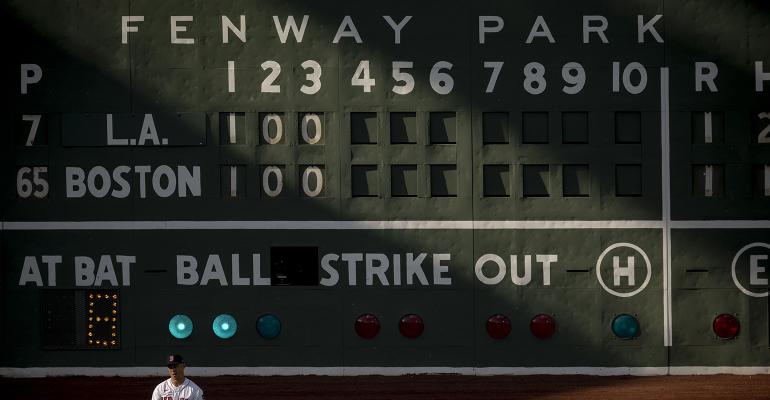

In speaking with industry watchers, the consensus is that we’re closer to the beginning of the cycle than the end when it comes to M&A. To use a baseball analogy, we’re in the second—maybe third—inning. And we have been for the last three or four years… years that have seen outside events impact every area of our lives, including within the wealth management arena.

In 2023, M&A saw a slowdown driven by market volatility, economic uncertainty and an increase in the cost of capital. It wasn’t drastic by any measure, and opportunities remain for both buyers and sellers. Even with all of the consolidation we’ve witnessed, there are net new RIAs dotting the landscape each year.

That’s not to say the landscape hasn’t changed. It has, in meaningful ways. With increasing selectivity among buyers, especially the more established ones, prices are being scrutinized more closely. I’m seeing an environment of bifurcated pricing and segmentation based on quality. Premium practices and firms are still attracting the attention and dollars of buyers despite potentially more aggressive pricing than in previous years. In fact, prices may be peaking. However, the less attractive firms are not garnering as much interest, are courting fewer potential buyers and may be seeing prices compress.

Let’s not forget the impact of private equity. Already a strong presence in the wealth management M&A space, more PE players are looking for an entry on a selective basis. This is one of the indicators that we are still a long way from the maturation of this acquisition and consolidation trend. It might, however, help advance the cycle and propel us into the fourth inning (to continue the baseball analogy) —a significant development given the inertia mentioned earlier.

What will the future look like? Opportunities will be present, for sure. But will they be worth pursuing? We cannot predict the future. The reality is, right now, this industry is still so fractured that there will continue to be great opportunities—in terms of quality and quantity—for both buyers and sellers over the next five years. It’s important to note that as buyers continue to be more selective, sellers must position themselves appropriately to gain traction in an increasingly competitive market.

Jeff Nash is Chief Executive Officer and co-founder of Bridgemark Strategies.