Trust is an essential part of our social fabric, and the COVID-19 pandemic left many Americans feeling bereft of trust in institutions, governments and businesses. Part of the current recovery will boil down to understanding how to rebuild those disrupted relationships.

Trust in the financial services industry is even more crucial, as many investors participating in financial markets look for calm in a sea of instability. However, uncertain times attract bad actors that seek to capitalize on people’s fears and worries. A survey by the Association of Certified Fraud Examiners found fraud levels rise during times of economic distress. According to their findings, “the majority of respondents said they experienced an observable increase in the number of frauds, and 80% said they believe fraud levels increase in times of economic distress. With the current historic drops in markets around the world due to the coronavirus pandemic, many of the factors that were present then are likely to apply today.”

As distrust in many government and media institutions continues to erode, businesses have an opportunity to step in and provide transparency, leadership and reliable information or solutions. Here’s how wealth management firms can build trust with their clients and the public as a whole

Why Trust Is Hard to Come by Today

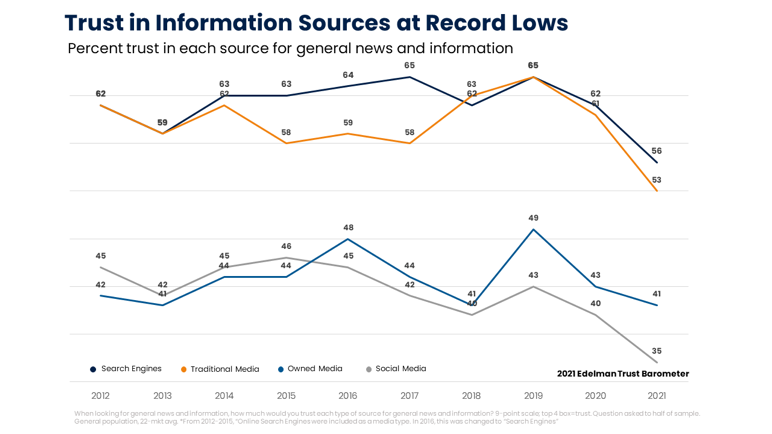

Trust in information sources is at record lows, according to the 2021 Edelman Trust Barometer. Their online survey of over 33,000 participants globally found that distrust in search engines and media and news organizations is leading to an infodemic. An infodemic occurs when disinformation spreads quickly and widely. This makes it more difficult for members of the public to sift through what’s true and what’s fake news.

Since 2020, trust in information sources has dropped dramatically. Respondents were asked, “When looking for general news and information, how much would you trust each type of source for general news and information?” Traditional media dropped 8 points to its lowest point since Edelman began tracking in 2012.

Respondents also expressed distrust in journalists and their mission, with 59% of them agreeing with the statement, “Journalists and reporters are purposely trying to mislead people by saying things they know are false or gross exaggerations.” This has had disastrous consequences as governments and other leaders try to shepherd the public through a global pandemic.

Generally, in a crisis, the public looks to trusted leaders and institutions to provide reliable information. Not today. As people have increasingly come to believe that their information sources are driven by ideology or biases, a significant void has grown; divide communities, companies and even families.

In their survey, Edelman found the public expects businesses and executives to acknowledge and provide solutions to problems like the pandemic impact, job automation and local community issues. Over 80% of respondents expected CEOs to speak about these issues and 68% of respondents believe that CEOs should step in when the government doesn’t fix societal problems.

This is a tremendous undertaking for any business. Still, organizations, particularly in finance, wealth management, and technology, have a lot to offer the public and governments with partnerships and other initiatives. Embracing this new mandate allows companies to lead out on important issues that their customers care about, provide trustworthy information, prioritize transparency, and work for the greater good with governments and other organizations.

How Businesses Can Fill the Trust Gap

We are a long way from the days of Enron and WorldCom. Corporate greed, for a lack a better word, has been replaced by the conscious capitalist.

The public is increasingly looking for new trusted sources of information and leadership. Businesses leaders have an opportunity to create trust and contribute to solving some of the toughest societal challenges. Here are some strategies wealth managers can build that create client-focused and transparent experiences:

Don’t Just Meet Regulatory Requirements, Put them at the Forefront: While the industry has bent itself sideways looking for ways to avoid fines and penalties from new regulations, such as Reg BI, the savvy firm can lead by clearly explaining the standard and laying out how they go above and beyond to do what’s best for the client.

Advocate for the Right Policy: Of course, it is not just about adhering to regulations, taking a proactive approach with lawmakers in formulating the appropriate rules is a step higher. By working with organizations like the FPA, SIFMA or the Financial Services Institute (FSI), financial advisors can provide real-life examples of how regulations benefit or harm the end consumer. These conversations are craving for stronger advisor voices.

Lack of Gender, Race and Cultural Diversity is Inescapable: The finance industry’s overwhelming lack of gender, race and cultural diversity is its biggest “black eye.” For too long, industry leaders turned a blind-eye to inappropriate client behavior, booze-filled horror stories from industry conferences and trading floor “bro culture.” However, with women in the U.S. controlling nearly $11 trillion in assets and social movements like #MeToo and Black Lives Matter documenting the ongoing struggle of women and minorities in the workplace, the tide has turned. Forward-thinking firms should not only consider diverse candidates for open positions, but they should also look for ways to broaden diversity in their client service models, product portfolios and marketing materials.

Leverage Expertise for the Greater Good: Despite a dramatic increase in financial literacy efforts across business and governmental entities over the past decade, too many Americans are not receiving sound financial advice or guidance. A recent Transamerica poll showed roughly 67% of Americans received no retirement advice from a financial professional. The country needs the expertise wealth management firms have and forward-thinking firms should seek out ways to carry that advice to the underserved around them. While “picks and shovels” charitable efforts are wonderful, putting your community on sounder financial footing can have a multi-generational impact.

These are just a handful of ways wealth managers can respond to this call by building experiences that are client-focused, transparent, and offer products and services that align with their values.

Ryan George is the Chief Marketing Officer at Docupace. He is responsible for the company’s brand awareness, early-stage sales pipeline, content strategies, customer and industry insights, internal and external communications, design, and events.