From Herbers & Company’s vantage point, mergers and acquisitions activity in the financial advisor industry is slowing down, thanks to higher costs of borrowing and fluctuation in firms’ asset levels as markets struggle. And that’s putting the spotlight back on organic growth.

For many firms, the term “organic growth” is synonymous with marketing. But at Herbers & Company, our experience of marketing, while it’s an important growth engine, is a less potent growth driver than other more fundamental actions, including delivering a strong, consistent client experience and a robust service offering. Getting these things right can drive more organic growth than marketing alone, because, done right, they turn your clients into vocal rainmakers for your firm.

If you’ve got a solid client experience and a strong core service offering, the next most effective step in boosting organic growth might is to add a service or expand an existing one. Three services firms might target are tax planning, estate planning and retirement planning. Yes, I know, you’re already offering those services. But, what if you became the best at offering them?

The demand for these services is hiding in plain sight. Take tax planning. Just 18% of accountants offer tax planning advisory services: they mostly provide tax advice, like preparing returns. But what about tax planning? Accountants who provide tax planning typically only do so for about a third of their clients. That’s despite tax planning being lucrative; the average annual total of hourly fees charged per client is $2,351.

In other words, tax planning is a wide-open opportunity with a large addressable market. Clients across different wealth segments need the service. The story is similar with estate planning—where most Americans are far behind—and retirement planning, specifically income distribution strategies. While retirement planning is positioned as a core offering for most advisory firms, what’s missing is a deeper analysis on distribution and accumulation under inflationary economic cycles.

Adding services where there’s a clear need helps advisor firms retain clients: the more of a client’s needs a firm is taking care of, the harder it becomes for the client to replace that firm. Adding and deepening services also significantly drives organic growth. Our experience with thousands of firms over the past two decades has taught us that increases in services that focus on asset accumulation rates, decreases withdrawal rates.

If advisors choose to charge additional fees for the new services, their revenue increases. If they use their new service as a loss leader, lead ratios increase. In either case, adding services increases client referral rates, which is a critical metric for firms that want to maximize sustainable organic growth.

So, how should firms go about adding and/or expanding services like tax planning, estate planning and retirement planning? The first step is to clearly understand the goal: What is the business purpose of adding the service? Then the firm should identify the key performance indicator (KPI) that it wants to move.

Let’s say you’re going for long-term organic growth. Your goal would likely be to increase asset accumulation and decrease withdrawal rates. Your KPI in this case is simple: total AUM.

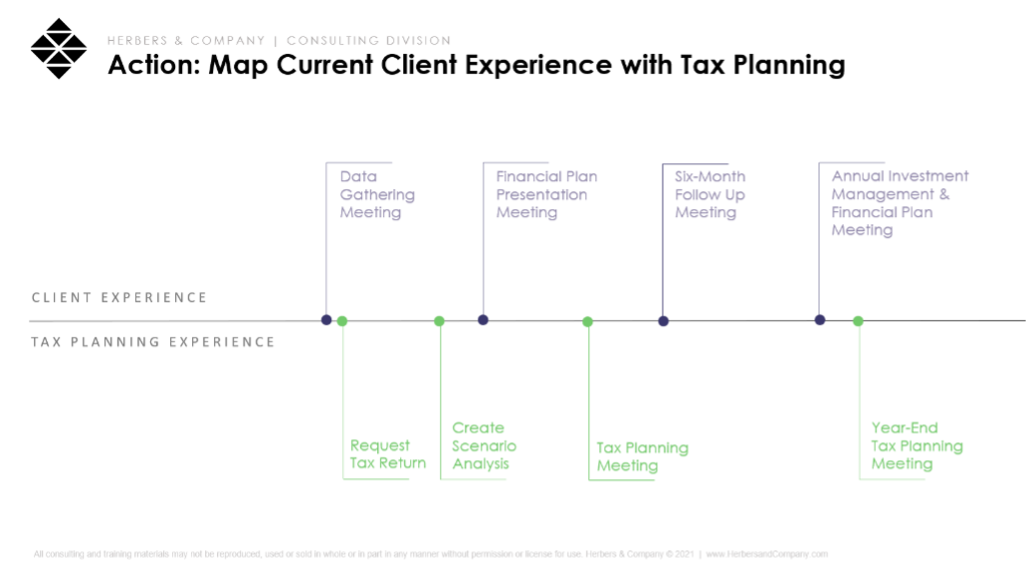

Once you know what you want the new service to accomplish, and have a way to measure your progress, you’ll need to implement it. We tell clients to start by looking at their existing client experience, charted out visually on a timeline, without the new service. The pillars of most firms’ client experience are a data gathering or discovery meeting, a financial planning presentation meeting, a six-month follow-up meeting and an annual investment management and financial planning meeting.

The next step for such firms is to build a separate journey of tax planning, estate planning or retirement planning into the visual client experience. Using the tax planning service as an example, the client experience might unfold as having the data gathering meeting, requesting the client’s tax return shortly after that meeting, and before the financial presentation meeting creating a tax-planning scenario analysis. After the financial planning meeting, a tax planning meeting is scheduled. And then after the annual investment management and financial planning meeting, a year-end tax-planning meeting is scheduled (See Figure 1).

What if your primary goal is not long-term organic growth, but rather short-term organic growth? You simply want to increase client revenue, so your KPI will be total fees charged for tax planning. The action you’ll need to take is to build a tax planning schedule into your existing client experience, decide how to price it and then offer it to clients for that additional fee. Those four client experience points pertaining to tax planning, for example, might be valued at a combined $2,500 for the year.

Or suppose that your goal is to increase short-term lead flow: you want to attract more prospects. Your KPI in that case could be lead rates per month. And your action would be to build a tax planning loss-leader service model. In this case, your plan is to review tax returns—continuing to use tax planning as our example—for free. This client experience would happen before the prospect is a client—you’d request the tax return, create your scenario analysis and use a tax planning meeting to get to know the prospect’s situation and needs. The goal, of course, is for that lead to become a client, with the full client experience including the foundational elements and the new service.

A different goal might be to increase long-term client referrals. Your objective in this case would be to increase your client referral ratio, with the KPI being the total number of referrals from your clients each month. The action required in this case is to build a separate service offering and offer it to clients on an ongoing basis.

Portrayed visually, the client experience would involve the advisor requesting the tax return, creating the scenario analysis, then holding the getting-to-know-you tax planning meeting. The data gathering meeting for core services would be next, followed by the financial plan presentation meeting and the six-month follow-up. Shortly afterward, you’d request the tax return and create an updated scenario analysis. The annual meeting would then be followed by a year-end tax planning meeting.

Firms may have some of the expertise needed to add or deepen services in-house, or they may need to hire experts. In some cases, it can make sense to acquire a small firm funded out of profits of the firm to add the service ability.

Sustaining organic growth depends on firms’ ability to continue providing a consistently great client experience. That’s true when firms offer just a few core services, and it remains true as they grow and add services. So, if you plan to drive growth by adding services, do it with a clear objective, implement the service with care, and carefully measure the results. It will prove to be more work than doing a marketing push, but the rewards will almost certainly be greater and more durable.

Angie Herbers is the founder and CEO of Herbers & Co, a consultancy firm for financial advisors.