After pulling assets out of taxable bond funds for two straight months, investors piled back in last month, with total inflows of $16.6 billion, the highest category of the month, according to Morningstar. The flows were mostly driven by passively managed funds, which gained $18 billion in October. Investors could be anticipating how the markets will react in December if the Fed raises rates, Morningstar suggests. "It’s still uncertain which direction the stock market will go if and when the Fed eventually raises rates. In times of lingering uncertainty, it seems investors prefer the relative safety of bonds."

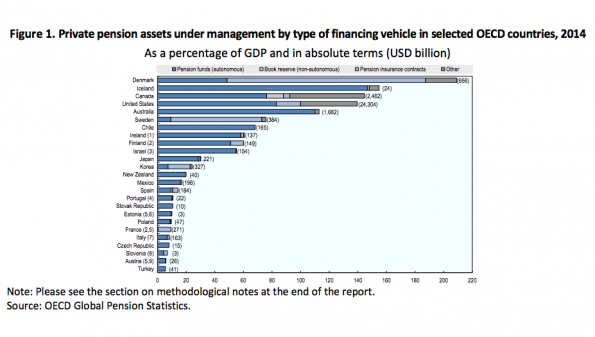

Pension fund assets held within the 34 developed countries that make up the Organization for Economic Co-operation and Development hit $38 trillion at the end of 2014, according to the recent OECD report. Over the last decade, the average growth rate of pension fund assets is lower than pre-crisis levels, but still positive, with a 5.5 percent yearly increase on average. In the U.S., pension funds' real net rate of return on investment was 3.4 percent last year. The report found the gains were primarily due to growth of assets in 2014, underpinned by positive investment returns. A majority of the pension funds in OECD countries invested in "traditional" asset classes, with, on average, about 23.8 percent in equities, 51.3 percent in bills and bonds and 9.6 percent in cash and deposits.

A Financial Plan for Families of Special Needs Children

A unique program has sprouted up in Austin, Texas, that allows families of special needs children to approach finances in a more strategic way, rather than a month-to-month reactive manner. The program, titled the Sustainable Special Needs Advisory Plan (SSNAP), was developed by financial advisor Gus Marwieh. The idea was initially produced for his own family's use, to care for his autistic son, but has since expanded to other families caring for someone with special needs. According to a release on the program, SSNAP takes clients through a multi-step planning process, including determining a direction and goal, creating a strategic road map, and resource allocation. "The real power of the SSNAP process is that it gives families control and empowers them," said Marwieh. "It gives them financial freedom without tapping disposable income, emptying their bank account, or derailing retirement goals."

Starting Financial Planning Early

One Texas school district has decided to help its students learn about saving for college early - in kindergarten. The schools, Arapaho Classical Magnet and Dobie Elementary School, are participating in the Richardson ISD's "Dollars for College" program. The program offers every kindergarten parent a free college savings account at First Convenience Bank with a $25 to $50 seed deposit by the United Way. Once the parents contribute to it, the United Way kicks in up to $50 more. The children learn by talking about salaries and budget in the classroom. And it seems to be working: Half of the students in Gina Buffington's kindergarten class now have a college savings account through the program, she said.