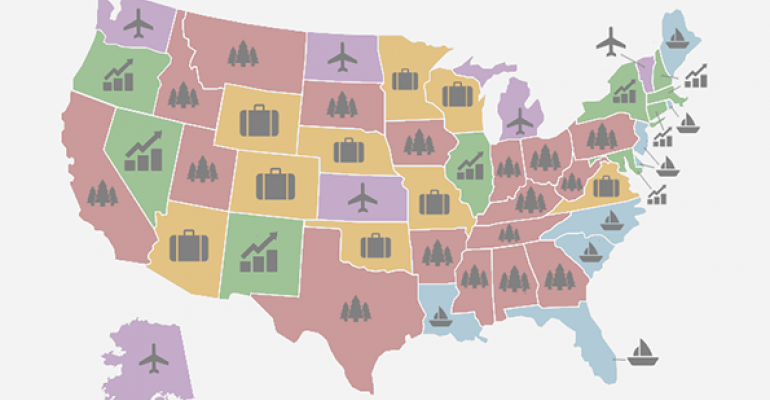

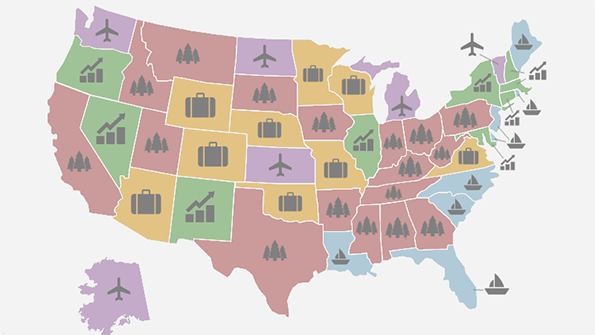

If $1 million landed in the laps of your clients today, nearly 40 percent of them say they would use it to buy land, according to a survey by Mirador Wealth. But the survey gave respondents only five options, and things like buying a home, car, monkey or paying off debt weren't among them. Instead, the researchers wanted to see state-by-state differences in preferences for boats, travel, business investments or small planes. States along the Southeast preferred boats, while land was highest ranked in South, West and Midwest. Investments were the most popular option in the Northeast. Why? You can't buy much land with $1 million there, according to MarketWatch.

There Is Nothing Special About Gold

Gold bugs got some long needed vindication this year; the price of the metal rose over 9 percent in February. That’s its best month since January 2012, and comes after a 45 percent drop over the past four and a half years. But investors who argue gold is a “safe haven” when equity markets turn sour base their faith on scant evidence, says Michael Batnick, the director of research for Ritholtz Wealth Management. He crunched the numbers, and found a spike in the price of gold says nothing about the near-term movement of the equity markets. “Because gold has no earnings or dividends, its intrinsic value is impossible to calculate. For these reasons, gold is an investment that is very susceptible to false narratives. Despite what we might hear, the price of gold tells us nothing about the future direction of stocks,” he writes on his blog, The Irrelevant Investor.

Baird, Edward Jones Among Best Places to Work

Robert W. Baird and Edward Jones landed in the top 10 of Fortune’s 100 Best Companies to Work For, ranking sixth and tenth on the list, respectively. That’s not surprising, given that Edward Jones (ranked 10th) consistently gets high marks on WealthManagement.com’s annual Broker Report Card. One perk Ed Jones advisors and their families can enjoy is the summer regional meeting, where FAs and their families are invited to a resort for a weekend of music, food, games, swimming and golf. The firm also offers college tuition reimbursement, compressed work weeks, job sharing and discounted gym memberships, to name a few. Some of the perks of working at Baird, which ranked sixth on the list? Health insurance for part-timers, an onsite medical care facility, telecommuting and paid time off for volunteering. In addition, the firm’s health insurer will pay up to $75,000 for transgender reassignment.

Personal Capital Reaches $2 Billion AUM

Personal Capital announced Thursday that it became the latest digital-first advice firm to cross $2 billion in AUM. The San Francisco-based company said the average AUM per client is $300,000, while a third have more than $1 million. Bill Harris, Personal Capital’s CEO, said this dwarves the average AUM of clients using Wealthfront or Betterment. Personal Capital also said 1 million people are also using Personal Capital’s free digital tools to track $210 billion in assets. “Most of the new digital entrants—robo advisors—highlight the power of their technology, but they lack the level of personalization that a human financial advisor can provide,” Harris said in a statement. “And while traditional players have human advisors, they’re severely limited by poorly built consumer technology. We blend the best of both worlds to deliver a holistic advisory service that our devoted clients crave to help them make sound financial decisions.”