The National Association of Hispanic Real Estate Professionals released the “Hispanic Wealth Project Blueprint” on Tuesday, a 10-year plan to triple the wealth of Hispanic households in the U.S. to $2 trillion. According to research from the Pew Hispanic Center, Hispanic household wealth dropped 66 percent between 2005 and 2009, and the median Hispanic household wealth is $13,700, less than 10 percent of the median non-Hispanic White population. The Blueprint aims to rally individuals, corporations, government and other organizations around three goals: achieving a 50 percent rate of U.S. Hispanic homeownership, increasing the first-year success rate of Hispanic-owned small businesses by 50 percent, and increasing the number of Hispanic households owning non-cash financial assets by 25 percent. NAHREP said it will partner will recognize initiatives conducted by businesses that support the goals of the Blueprint and advance the financial literacy of the Latino community.

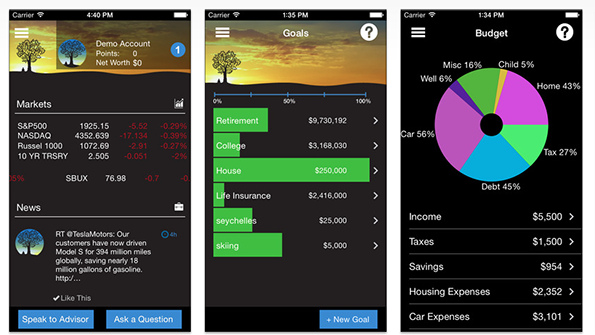

An App with a Built-in Advisor

Financial advisory firm Gerber Kawasaki Wealth & Investment Management has launched my Money Page, a mobile application that provides financial planning. The app includes a budgeting tool, a net-worth calculator, and a goals tracker. But users can also seek advice from one of the firm’s financial advisors in Santa Monica, Calif. “While many of these so-called 'robo-advisors' allow for low-cost access to a host of retirement and investment vehicles, ultimately such services are failing investors by not providing them with the opportunity to interface and seek the ongoing counsel of an experienced, real-life financial advisor who has a long term track record of success working with clients,” said Ross Gerber, president and CEO.

The head of advisory services at Voya Financial Advisors, Karl Lindberg, is retiring after 24 years with the broker-dealer. After stepping down as President to make way for Tom Halloran in October 2013, Lindberg spent the last 17 months developing and overseeing the firm’s advisory practice, infrastructure and service model for advisors. The broker-dealer’s advisory business grew to $9.92 billion in 2014, a 25 percent increase from the previous year. With Lindberg’s departure, Andre Robinson will step into the role. Robinson has been leading the consultancy, practice management and business development initiatives for the firm’s advisory platforms and products for the past four years and has nearly two decades of advisory industry experience.

A total of 35 student-athletes at Ole Miss are expected to participate in a pilot course this spring that if successful, could spread to several colleges throughout the southeast United States. The topic of the class – financial literacy – is something that college students notoriously struggle with. According to a 2013 report cited by the Clarion-Ledger, nine out of 10 first-year college students scored a “C” or below on financial literacy knowledge. The program, developed by Regions Bank, has already been rolled out in grade school and high schools nationwide. The bank has contributed $500,000 to this new, multi-year effort, which will customize the lessons for the athletes.