To attract millennial investors, financial firms and advisors need to offer personalized advice, not products.

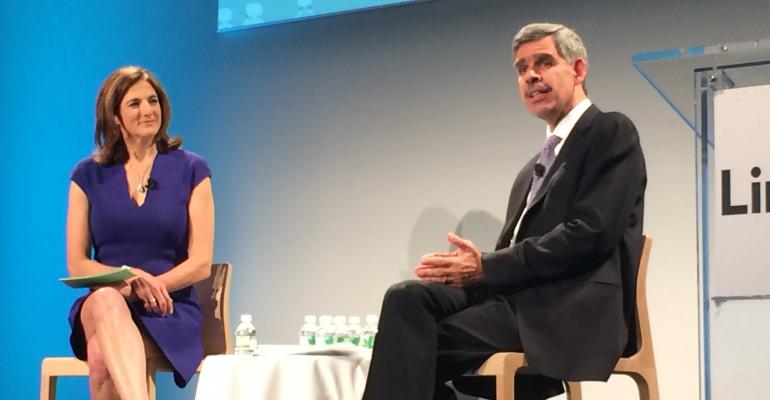

Millennials are looking for a different type of communication, Mohamed El-Erian, the chief economic advisor at Allianz and former CEO and co-CIO of PIMCO, told the audience at LinkedIn's FinanceConnect conference on Thursday. “Millennials are different. They have grown up expecting and empowered to have a more self-directed life.”

To engage millennials, firms have to get off the “product-orientation approach,” El-Erian said. “The old approach is that you come up with a product and sell it. The new approach is that you need to understand the problem you’re trying to solve and then customize. Give people modules they can put together because they want more control over their financial destiny.”

El-Erian said that millennials are hesitant to work with financial advisors because of a mistrust of the industry as a whole. "If you don't have trust, then you don't engage,” he said.

But perhaps more troubling is that with the consolidation of broker/dealers, there may be a structural imbalance, El-Erian said. “The core of the financial world, the broker/dealers, is being shrunk by regulation, is being shrunk by shareholders not willing to see that banks take massive risks. Meanwhile the end user community has grown enormously.”

When the paradigm changes, when suddenly the end-users believe in something different and want to re-position themselves, there’s no liquidity, so you get massive price moves and market disruption. “We are all living under the delusion of liquidity,” El-Erian said.