The ranks of Certified Financial Planners just crossed 75,000, the CFP Board announced Tuesday. The CFP designation dates back to 1973, when the first group completed a course at the College for Financial Planning. In 1985, the College created an independent, non-profit entity responsible for certifying and setting industry standards. The College transferred ownership of the CFP marks to the new organization, which eventually became the CFP Board. The group has grown the ranks of CFPs by more than 35 percent since 2007.

Are You Talking to Your Clients About Life Insurance?

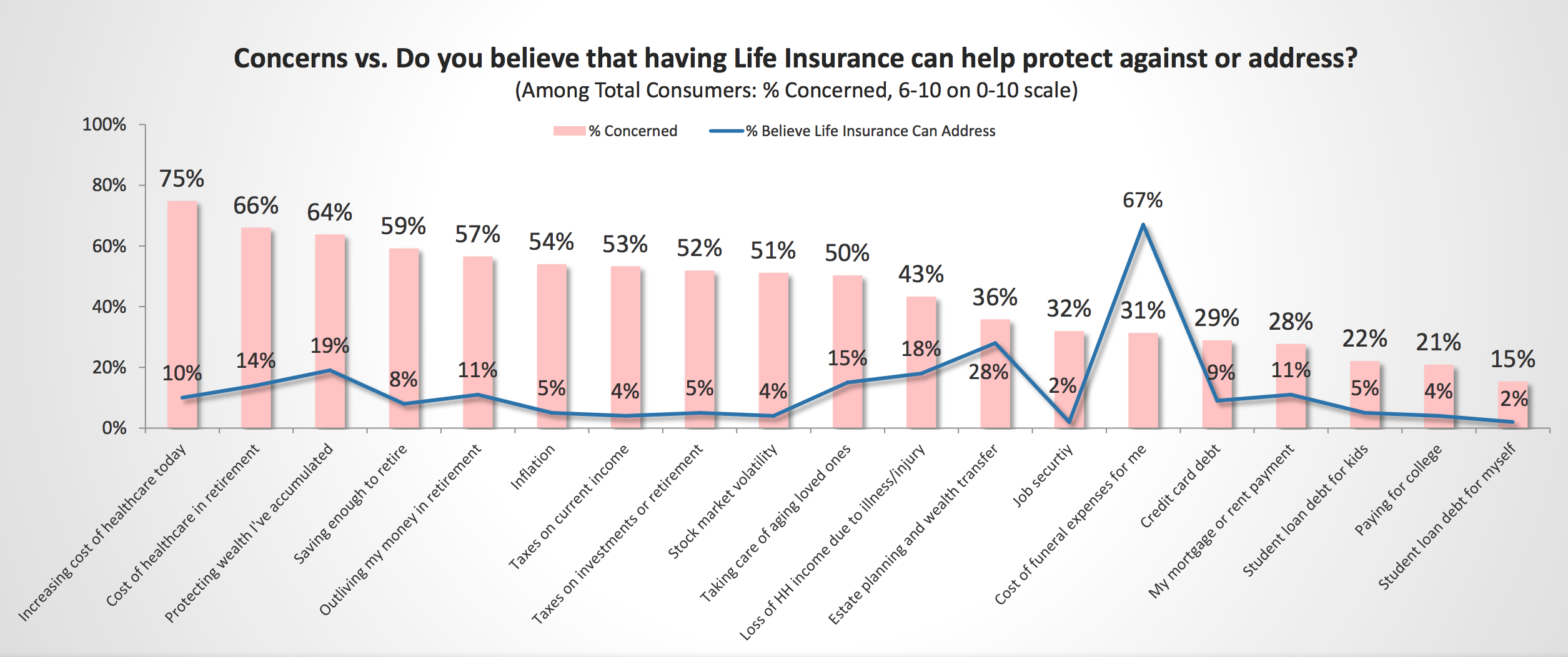

New research from Lincoln Financial Group suggests investors don't understand how life insurance may help them financially. The study, which surveyed life insurance policy holders and those considering purchasing insurance within the next year, revealed 65 percent of investors believe life insurance is a necessity to help protect loved ones from the death of a breadwinner and to cover final, end-of-life expenses, but few know the other ways it can be used. For example, 66 percent of respondents cited affording healthcare during retirement as a top concern, but only 14 percent of people were aware that life insurance can help offset those costs. Likewise, more than half of investors worry about outliving their retirement savings, but only 11 percent said they knew life insurance can also help counter longevity risk. “Today’s advisors must educate their clients on the realities of life insurance, and what it can help them to accomplish,” said Andrew Bucklee, senior vice president and head of Insurance Solutions Distribution for Lincoln Financial Distributors. “Starting these conversations early is critical, as life insurance provides value across generations—for any age and stage of saving and retirement planning.”

Financial advisor Sophia Bera has a simple but good tip for clients who want to avoid the temptation of dipping into emergency or vacation funds to pay for more pressing needs. Keep checking and savings accounts at different banks. "It adds some friction between these accounts," she said. "If you don't see your savings account every time you log in to your checking, then you're much less likely to spend it."