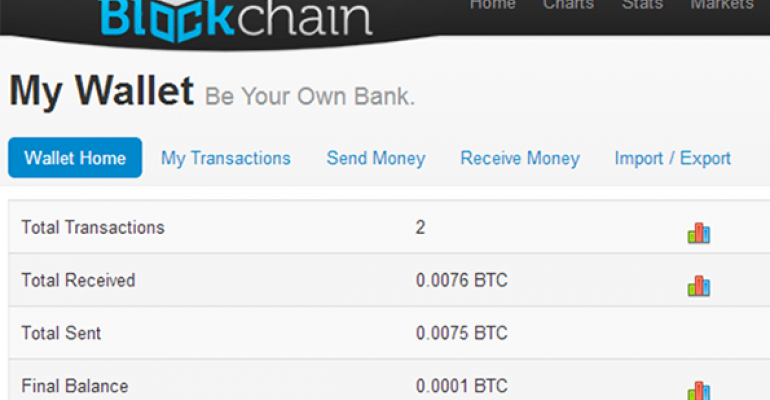

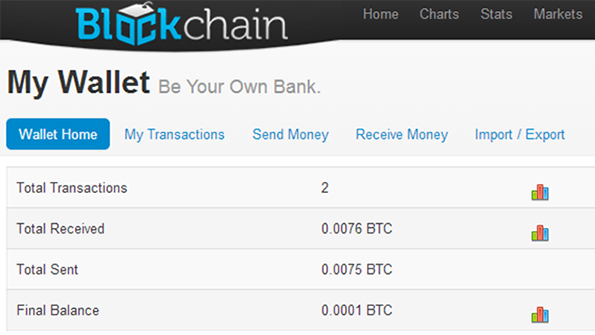

In an interview with the magazine of Skillbridge, a freelance consultancy shop, CFA Institute policy analyst Sviatoslav Rosov predicts we’ll likely see more flash crashes on Wall Street due to high-frequency trading; Though the retail investor benefits from the narrow spreads between buy and sell orders, trading is now so dispersed across a number of exchanges, and dominated by computers trading with each other, that no one really knows what the response will be to a future market shock. He also suggests that blockchain software, currently used to track and record transactions of cryptocurrencies like Bitcoin, has the potential to change the industry even further. “I can see a world in which the blockchain is either assimilated into existing market structures or makes them redundant. As we are seeing with many other industries, the big changes happen when software starts to dominate hardware - you get a whole new set of players and a whole different industrial economy as a result.”

Aftershocks of Yuan Overrated?

The Chinese government surprised markets last week with its decision to devalue their currency. They dropped the value 2 percent Tuesday, the largest one-day decline ever. Additionally, the yield on benchmark 10-year U.S. Treasuries fell more than 5 percent in trading on Tuesday. The impact led some to predict that the move could provide the U.S. Federal Reserve with another reason to delay raising interest rates. A poll by the Wall Street Journal showed 82 percent of economists expecting a September rate hike. But Treasuries rebounded on Friday to 2.20 percent on strong U.S. producer prices, after having fallen to a near four-month low of 2.04 percent on Wednesday. So perhaps the aftershocks are overblown? About 77 percent of economists in a Bloomberg survey are standing by their belief that we’re in for an increase next month.

Medicare.gov Home Health Care Ratings

Earlier this year, Medicare.gov released its five-star online rating tool for nursing homes. Now, as the trend towards urging seniors to age in place picks up steam, home health care agencies are receiving the same treatment. The system rates about 9,000 agencies out of five stars based on an average of nine criteria, including how quickly agencies responded to requests for visits after hospital discharge and patient improvement (It’s important to note that these ratings are comparative, so an agency that receives 2 stars isn’t necessarily providing poor care, it just scores lower than others). These standards are organized into two categories: 1) Process of care measures, and 2) Outcome of care measures, to attempt to capture the full spectrum of duties such companies are expected to provide.

Millennials Do Care About Retirement

Life is not all about outdoor music festivals, Snapchat and brunch for millennials. Generation Y also seems to care about their retirement, based on data from Vanguard and the Transamerica Center for Retirement Studies. According to Vanguard, the percent of young adults ages 25-34 participating in 401(k) plans rose from 57 percent in 2005 to 67 percent in 2014. A recent Transamerica survey also stated that millennials start saving for retirement at age 22, compared to 27 for Generation Xers, and they also make retirement benefits a major factor in accepting future job offers. One reason, however, for the high levels of 401(k) involvement is the automatic enrollment into employer plans. But Transamerica President Catherine Collinson added, "I also believe it’s also due to heightened levels of awareness.”