MassMutual is turning to cats and dogs to get people to save more for their retirement. The insurance company has launched a direct marketing campaign promoting the popularity of pets. People’s interest in pets gets them in the door; the firm then directs their attention to the importance of retirement plan contributions. "By connecting to something that is top of mind for consumers, our campaign is encouraging retirement plan participants to boost their savings,” said Kris Rice, vice president of marketing. The campaign points people to RetireSmartPets.com, where they can post and share photos of their furry friends. The site also provides tips on saving for retirement. One example includes, “Just like a pet, your retirement plan needs care, nurturing and your attention.” The site also encourages visitors to take steps to save for retirement, such as signing up for a 401(k), boosting current contributions and reallocating current investments.

Congress and Financial Services Discuss Cybersecurity

Members of Congress gathered with experts from Goldman Sachs and Morgan Stanley this week for a roundtable discussion on the state of cybersecurity and the role the financial services industry should play in funding security initiatives. According to a PwC study, the number of hacker attacks in 2015 increased 154 percent year-over-year, so the roundtable focused on ways the industry could help develop tools necessary for mitigating risks, how to combat threats, and current trends. According to Melissa Gorham, the vice president of equity research on the software industry at Morgan Stanley and a participant in the discussion, firms are faced with limited human capital, limited security expertise and a lot of noise in the security industry. “All of those constraints are really driving a need for change in the security landscape,” Gorham added.

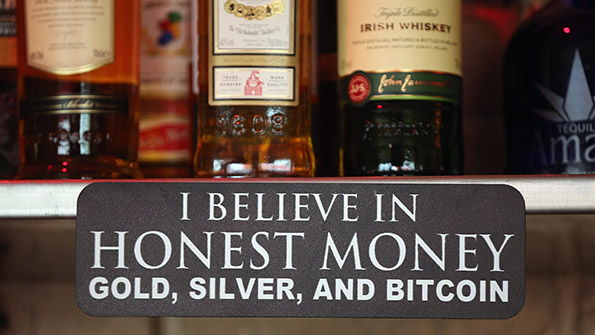

Bitcoin Isn't Real Money—Judge

A Florida judge has ruled that the virtual digital currency bitcoin is not real money. Judge Teresa Pooler of Miami-Dade State Circuit Court made the ruling as part of a criminal case in which a man was accused of selling $1,500 worth of bitcoins to undercover detectives, Bankrate.com reported. The policemen told the man, Michell Espinoza, they intended to buy stolen credit card numbers with the bitcoin. However, Pooler threw out the charges against Espinoza, writing that it wasn't clear if Florida's law on money laundering applied to bitcoin. "The Florida Legislature may choose to adopt statutes regulating virtual currency in the future," Pooler wrote. "At this time, however, attempting to fit the sale of bitcoin into a statutory scheme regulating money services businesses is like fitting a square peg into a round hole."