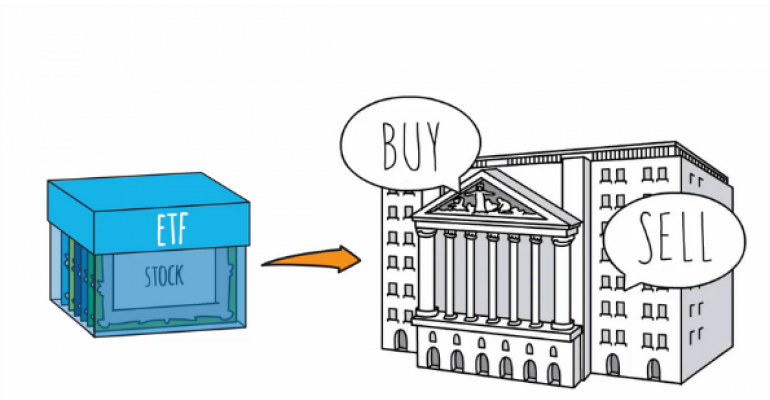

Looking for a new way to help investors better understand ETFs? BlackRock's ETF shop iShares is hoping a new animated series of educational videos will be more helpful than your typical whitepaper by explaining ETF mechanics in a simple, straightforward language with accessible visuals. The videos will give an introduction to ETFs, show how the funds can make it easier for investors to access the bond market, and how some ETFs can add liquidity to a portfolio during market volatility. Jennifer Grancio, the managing director of BlackRock, said the decision to use animation was in order to make key topics “easily understand by a broad range of sophistication levels.”

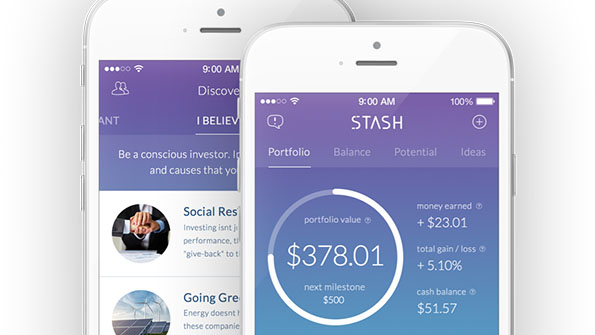

Investment App Scores $3 Million

Stash Invest, an iPhone app that provides investment recommendations to an investor with as little as $5 to put into the market (not to be confused with Stash Wealth), announced Tuesday that it secured $3 million in venture capital funding. The company said 40,000 people have opened accounts since the app launched in October, and that users deposited 10 times more money than they withdrew during the two-week market correction that kicked off 2016. Stash Invest said it would use the new funding to add features to the app and expand it to Android devices.

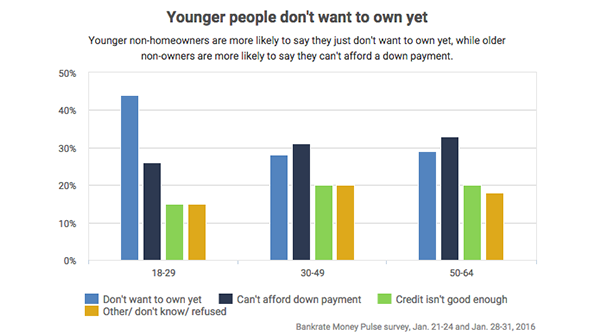

Why More Americans Aren't Buying Homes

Simply put, they can't afford it. According to a recent Bankrate survey, nearly have of those surveyed about why they're not homeowners right now said they can't afford a downpayment or their credit isn't good enough to qualify for a mortgage. The flip side of that, however, is that more than a third also said they just don't want to be homeowners. Hispanics were the ethnic group most likely to report that bad credit was holding them back, while millennials were the biggest age group stating they didn't want a house yet. That's not surprising, said to Pava Leyrer, chief operating officer of Northern Mortgage Services in Grandville, Mich., because millennials still have the pain of the housing meltdown and financial crisis fresh in their minds. "A lot of people went through some deep pains in the past 10 years or less," she said. "All of those things are traumatic in your life."

The roller-coaster ride the global markets are on this year has not one culprit, but a wide variety, writes Katy Barnato on CNBC. She lists the Bank of Japan's decision to introduce negative interest rates, the instability of European banks, slumping oil prices and China's questionable financial policies as all sharing the blame. Yet despite the falling markets, there are few signs that a U.S. recession is coming - even as stocks drop so fast it's hard to catch up – just take LinkedIn for example.