The Utilities sector ranks eighth out of the ten sectors as detailed in my sector roadmap. It gets my Dangerous rating, which is based on aggregation of ratings of 9 ETFs and 39 mutual funds in the Utilities sector as of April 17, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog and Trading Deck.

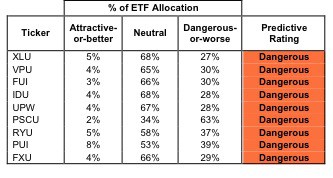

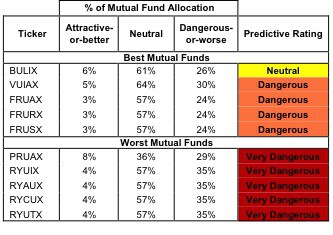

Figure 1 ranks from best to worst the eight Utilities ETFs that meet our liquidity standards. Figure 2 shows the 5 best and worst-rated Utilities mutual funds.

To identify the best and avoid the worst ETFs and mutual funds within the Utilities sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

Investors should not buy any Utilities ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Figure 1: ETFs Ranked from Best to Worst

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

All nine Utilities ETFs earn my Dangerous rating. American Century Quantitative Equity Funds, Inc: Utilities Fund [s: BULIX] is my top-rated Utilities mutual fund and is the only Utilities sector fund to earn my Neutral rating.

First Trust Utilities AlphaDEX Fund [s: FXU] is my worst-rated Utilities ETF and earns my Dangerous rating, along with all 8 other Utilities ETFs. Guggenheim Investments Utilities Fund [s: RYUTX] is my worst-rated Utilities mutual fund and earns my Very Dangerous rating.

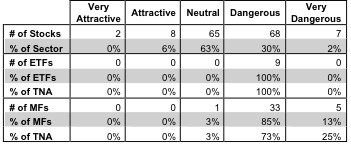

Figure 3 shows that 10 out of the 150 stocks (over 6% of the total net assets) held by Utilities ETFs and mutual funds get an Attractive-or-better rating. However, none of the 9 Utilities ETFs and or the 39 Utilities mutual funds get an Attractive-or-better rating.

Figure 3 shows mutual fund managers allocate too much capital to low-quality stocks and Utilities ETFs hold poor quality stocks.

Figure 3: Utilities Sector Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors should not buy any Consumer Discretionary ETFs and mutual funds. Instead, they should focus on individual holdings.

For example, Public Service Electric & Gas Company [s: PEG] is one of my favorite stocks held by Utilities ETFs and mutual funds. It earns my Attractive rating. PEG is a rarity in the Utilities sector – a business with positive economic earnings and a cheap valuation. PEG has generated a return on invested capital (ROIC) above its weighted average cost of capital (WACC) in four of the last five years. Its current stock price (~$30.02) implies the company’s profits will permanently decline by 38%. The market is setting a low bar, and PEG has demonstrated that it can generate cash flows.

Integrys Energy Group, Inc [s: TEG] is one of my least favorite stocks held by Utilities ETFs and mutual funds. It earns my Very Dangerous rating. In a bad sector, TEG is among the worst. TEG has misleading earnings – its economic earnings are negative and declining while its reported accounting earnings are positive and increasing. The positive accounting earnings shouldn’t mislead diligent investors; TEG is a regular value destroyer, with negative economic earnings in all but one of the last 14 years. TEG’s current valuation (~$52.21) implies that the company will grow its profits by 11% annually over the next 10 years, which seems quite unlikely given the company’s history. TEG’s price is too high for the risk it presents.

87 stocks of the 3000+ I cover are classified as Utilities stocks, but due to style drift, Utilities ETFs and mutual funds hold 150 stocks.

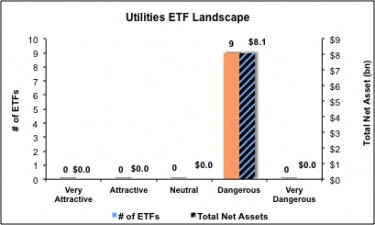

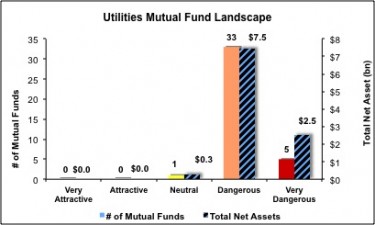

Figures 4 and 5 show the rating landscape of all Utilities ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Review my full list of ratings and rankings along with free reports on all 9 ETFs and 39 mutual funds in the Utilities sector.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.