The Information Technology sector ranks 3rd out of the ten sectors as detailed in my sector roadmap. It gets my Neutral rating, which is based on aggregation of ratings of 28 ETFs and 151 mutual funds in the Information Technology sector as of April 16th, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog and the Trading Deck.

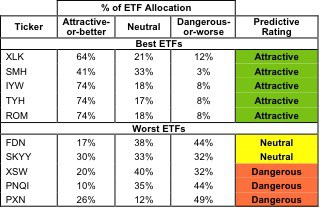

Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the sector. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Information Technology sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

Investors seeking exposure to the Information Technology sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Get my ratings and reports on all ETFs and mutual funds in this sector on my free ETF and mutual fund screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

The following mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards: PGTYX, PGTRX, PGTDX, ICTFX, ICTEX.

Technology Select Sector SPDR [s: XLK] is my top-rated Information Technology ETF and Vanguard World Funds: Vanguard Information Technology Index Fund [s: VITAX] is my top-rated Information Technology mutual fund. Both earn my Attractive rating.

International Business Machines Corp [s: IBM] is one of my favorite stocks held by Information Technology ETFs and mutual funds and earns my Very Attractive rating. Synthesizing the mass of data and information floating around in cyberspace is a big job, and IBM has proven to be a leader in the field. Not only is the company incredibly efficient, earning a return on invested capital (ROIC) of 15%, but the expectations embedded in the stock price are unduly low. IBM’s current stock price of $202.80 implies the company will grow its NOPAT by only 7% over its remaining life. Strong returns on invested capital and a cheap valuation are why I like this stock.

PowerShares Lux Nanotech Portfolio [s: PXN] is my worst-rated Information Technology ETF and IVY Funds: Ivy Science & Technology Fund [s: ISTEX] is my worst-rated Information Technology mutual fund. Both earn my Dangerous rating.

Aspen Technology, Inc [s: AZPN] is one of my least favorite stocks held by Information Technology ETFs and mutual funds and earns my Dangerous rating. Aspen’s management has a proven track record of poor capital allocation. The company’s dismal -6% return on invested capital (ROIC) places the company in the bottom 10th percentile of all Russell 3000 companies. Only twice during the 14 years I’ve covered the company has it generated a ROIC over its weighted average cost of capital (WACC). During that time, the company has written off 28 cents for every dollar of shareholders’ equity. And yet the stock’s valuation forecasts the company will succeed in a phenomenal turnaround. Specifically, the current stock price (~$19.57) implies in the company will grow revenues at over 20% compounded annually for 11 years while also improving its ROIC from -5.7% in 2011 to over 20%. Good luck with that.

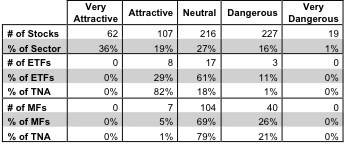

Figure 3 shows that 169 out of the 631 stocks (over 55% of the total net assets) held by Information Technology ETFs and mutual funds get an Attractive-or-better rating. However, only 8 out of 28 Information Technology ETFs (less than 82% of total net assets) and 7 out of 151 Information Technology mutual funds (1% of total net assets) get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and investors in Information Technology ETFs do a great job at identifying ETFs with great portfolio management and low costs as 82% of the Value of ETFs are allocated to Attractive-rated ETFs.

Figure 3: Information Technology Sector Landscape For ETFs, Mutual Funds & Stocks

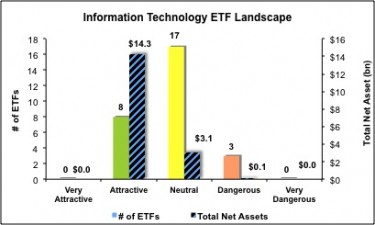

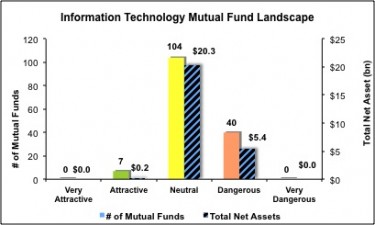

Investors need to tread carefully when considering Information Technology ETFs and mutual funds, as only 15 are worth buying. Only 8 Information Technology ETFs and 7 Information Technology mutual funds allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Figures 4 and 5 show the rating landscape of all Information Technology ETFs and mutual funds.

549 stocks of the 3000+ I cover are classified as Information Technology stocks, but due to style drift, Information Technology ETFs and mutual funds hold 631 stocks.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Figures 4 and 5 show the rating landscape of all Information Technology ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Review my full list of ratings and rankings along with free reports on all 28 Information Technology ETFs and 151 Information Technology mutual funds.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.