The Consumer Discretionary sector ranks 5th out of the ten sectors as detailed in my sector roadmap. It gets my Neutral rating, which is based on aggregation of ratings of 18 ETFs and 27 mutual funds in the Consumer Discretionary sector as of April 16, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog and Trading Deck.

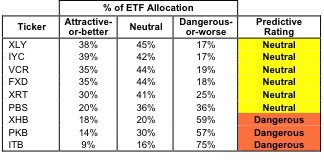

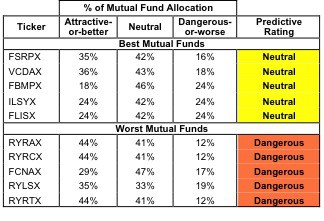

Figure 1 ranks from best to worst the nine Consumer Discretionary ETFs that meet our liquidity standards. Figure 2 shows the five best and worst-rated Consumer Discretionary mutual funds. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Consumer Discretionary sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

Investors should not buy any Consumer Discretionary ETFs or mutual funds because none get an Attractive-or- better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Get my ratings and reports on all ETFs and mutual funds in this sector on my mutual fund & ETF screener.

Figure 1: ETFs Ranked From Best To Worst

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

9 ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Consumer Discretionary Select Sector SPDR [s: XLY] is my top-rated Consumer Discretionary ETF and Fidelity Select Portfolios: Retailing Portfolio [s: FSRPX] is my top-rated Consumer Discretionary mutual fund. Both earn my Neutral rating.

iShares Dow Jones U.S. Home Construction Index Fund [s: ITB] is my worst-rated Consumer Discretionary ETF and Guggenheim Investments Retailing Fund [s: RYRTX] is my worst-rated Consumer Discretionary mutual fund. Both earn my Dangerous rating.

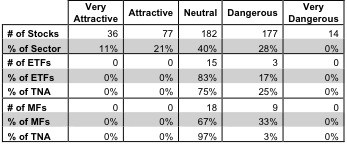

Figure 3 shows that 113 out of the 486 stocks (32% of the total net assets) held by Consumer Discretionary ETFs and mutual funds get an Attractive-or-better rating. However, none of the Consumer Discretionary ETFs or mutual funds allocate enough value to these stocks to earn an Attractive-or-better rating.

The takeaway is: mutual fund managers allocate too much capital to low-quality stocks.

Figure 3: Consumer Discretionary Sector Landscape For ETFs, Mutual Funds & Stocks

Again, investors should not buy any Consumer Discretionary ETFs and mutual funds. Instead, they should focus on individual holdings.

McDonald’s Corporation [s: MCD] is one of my favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns my Very Attractive rating. Very few companies have been able to establish brand recognition like McDonalds. But the company is more than just golden arches and a clown with a big red shoes; it is also a well-oiled cash-generating machine. McDonalds has generated free cash flow (FCF) of over $3 billion in each of the past six years. McDonald’s management has also generated positive and increasing returns on invested capital (ROIC) in each of the past 9 years, placing them in the top 87th percentile of all Russell 3000 companies. These are both indicators of a great stock.

Lennar Corporation [s: LEN] is one of my least favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns my Dangerous rating. Lennar’s current stock price of $26.11 implies that the company will grow profits by 25% compounded annually for 15 years. High expectations like these make me very wary especially when they exist for a company that hasn’t generated positive cash flows since 2008.

481 stocks of the 3000+ I cover are classified as Consumer Discretionary stocks, but due to style drift, Consumer Discretionary ETFs and mutual funds hold 486 stocks.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

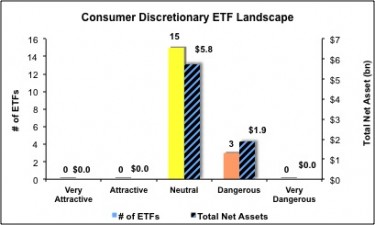

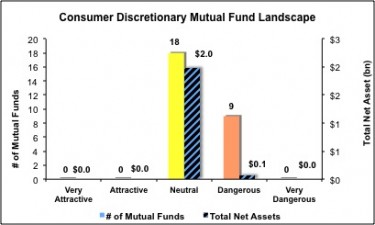

Figures 4 and 5 show the rating landscape of all Consumer Discretionary ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 18 ETFs and 27 mutual funds in the Consumer Discretionary sector.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.