Art and collectibles are becoming a more important aspect of wealth management, but less as an investment and more as preservation of capital. Seventy-eight percent of wealth managers think art-related services should be included as part of their wealth management services, up from 55 percent in 2014, according to the Art & Finance Report 2016 by Deloitte and ArtTactic. Seventy-three percent of wealth managers said their clients wanted to include art and other collectible assets in their wealth reports to have a consolidated view of their wealth. That is up from 58 percent in 2014. “The key interest is not the investment or yield-seeking aspect of it; rather it is more the preservation of the capital allocated to art and collectibles,” said Adriano Picinati di Torcello, art and finance practice director, Deloitte Luxembourg. The report found that in the next 12 months wealth managers will likely invest in art at a slower rate than in the past. Instead, they’ll focus on services that preserve their clients’ wealth tied up in art, including estate planning, philanthropy and art-secured lending.

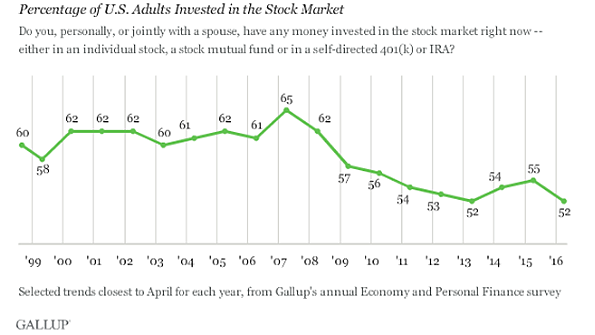

Less Americans Are Owning Stocks

Way back when, before the financial crisis and the Great Recession, nearly two-thirds of U.S. adults owned stocks. Now the number is down to 52 percent, writes Barry Ritholtz on Bloomberg View. He states that the steep decline—from 65 percent in 2007 to 52 percent in 2016—has substantial ramifications for retirement planning, demographics and income equality. The decline means that more Americans are failing to save for retirement or otherwise, and income inequality may be widening. As statistics from the Levy Institute show: The top 20 percent of earners own 85 percent of all financial assets, and among those that own stocks, most own only a modest amount, typically in a 401(k) or mutual fund. In addition, Ritholtz believes the drop in stock ownership is another example of the middle class falling behind and being unable to catch up following the Great Recession.

Can Financial Stress Lead to PTSD?

A new study has found a potential link between financial stress and post-traumatic stress disorder, and it may be affecting nearly a quarter of Americans. The study, by financial wellness firm Payoff, found that 23 percent of Americans and 35 percent of millennials experience a debilitating degree of stress over their finances. It affects their thoughts and feelings in ways that are most commonly associated with PTSD, according to Glamour.com. The research, which surveyed 2,011 American adults, found that 23 percent of them met criteria for three of required symptoms of diagnosed PTSD: intrusive thoughts, feelings of detachment and avoidance, and behavioral arousal. As a result, researchers named the condition Acute Financial Stress. “When we consider today’s reality of stagnant incomes, limited savings and high amounts of credit card and other debt, along with frequent financial traumas such as defaults, evictions and aggressive debt collection, these findings should trigger alarm bells for our society to address the challenges with debt millions are facing,” Payoff CEO Scott Saunders said.

Manulife Dipping Into Blockchain

Canadian insurer Manulife is looking at how it can use the blockchain, the public ledger technology that runs digital currencies like bitcoin. The company’s U.S. division, John Hancock, announced a collaboration with two technology firms, ConsenSys and BlockApps, to incorporate the technology—essentially an open and shared network that guarantees the validity of transactions—into its process for taking on new wealth management clients. The collaboration is a part of John Hancock’s Lab of Forward Thinking, which is looking to partner with other tech companies to figure out other ways that the blockchain can be useful for wealth and asset management.