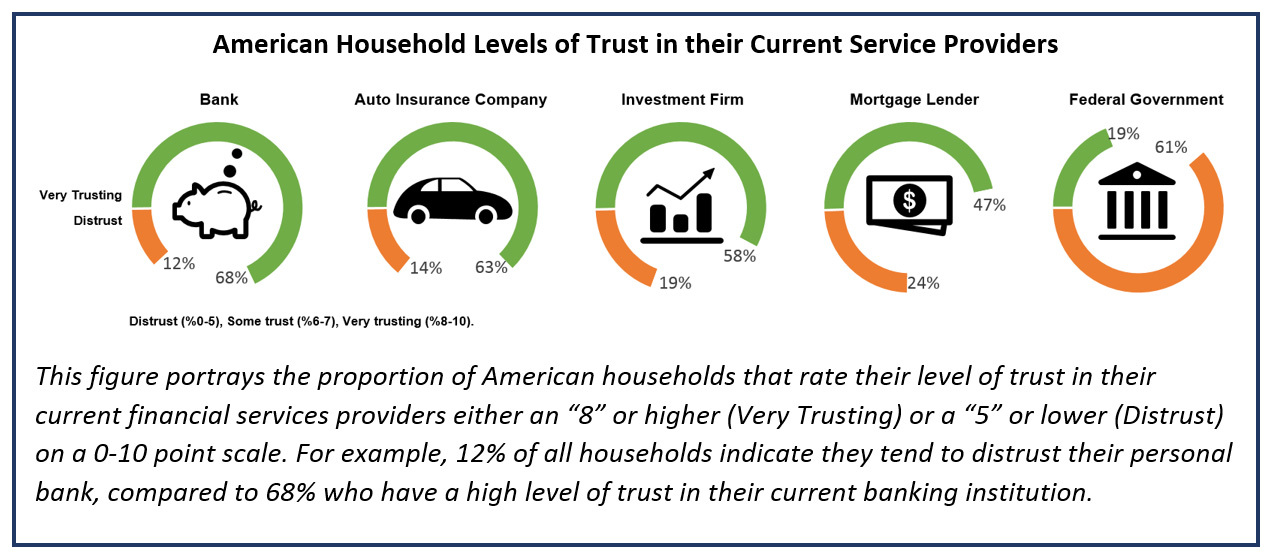

As with love, many people are stuck in bad relationships with financial services firms. According to a Market Strategies firms survey, 31 percent of American households feel obligated to continue doing business with financial companies that they distrust, including investment services. Market Strategies’ senior vice president Jeremy Bowler said this lack of trust represents a significant risk to profitability, as distrust makes it easier for clients to be persuaded to switch firms. Older customers tend to be more trusting, but a number of factors influence trust including service consistency and quality, so it would be misguided to assume that all millennials distrust financial services. The good news, according to Bowler, is that the distrust among consumers “creates greater opportunity for disruptive change, and with financial technology solutions rapidly emerging, this is a pool of consumers who are ripe for the picking.”

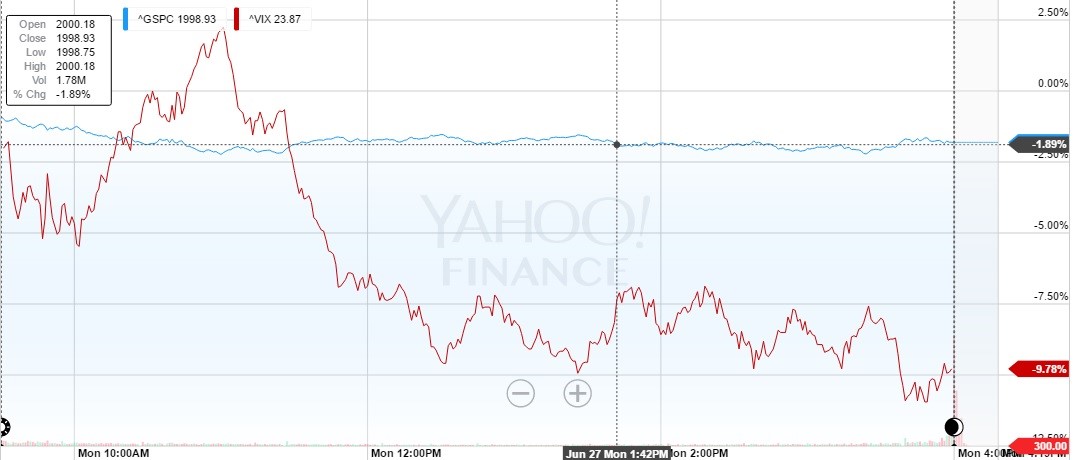

VIX - A Good, But Not Great, Hedge

AdvisorShares ETF strategist Roger Nusbaum writes that the VIX, the index that tracks market volatility, is a good hedge, except when it's not. Many use it as such because, the theory goes, as markets decline the "fear" index rises. But, Nusbaum writes, there are times when both the VIX and the markets move in tandem, as they did after the Brexit vote. "The equities/VIX relationship is not direct cause and effect, it’s more of a rule of thumb along the lines of equities/gold. Gold tends to go the other way from equities but it doesn’t have to," he writes. "A reason to allocate to alternatives in small slices using several different strategies (for people who believe in them at all)."

Signs a Couple May Need Financial Therapy

About one-third of couples who see a financial advisor report having marital issues, and about one-third of couples who see a marriage therapist say they also have financial problems. “I like to say, couples go to their marriage counselor and talk about money and go to their financial advisor to talk about their marriage,” writes Dr. Kristy Archuleta, program director of personal financial planning at Kansas State University and immediate past president of the Financial Therapy Association. So how do you know if your clients need financial therapy? In a white paper on HartfordFunds.com, Archuleta points to four signs a couple may need financial therapy: the couple argues but never resolves the issue; the couple plays the blame game; one or both partners displays uncontrollable worry, fear, anxiety or depressive symptoms around money; only one partner contributes to the planning process.