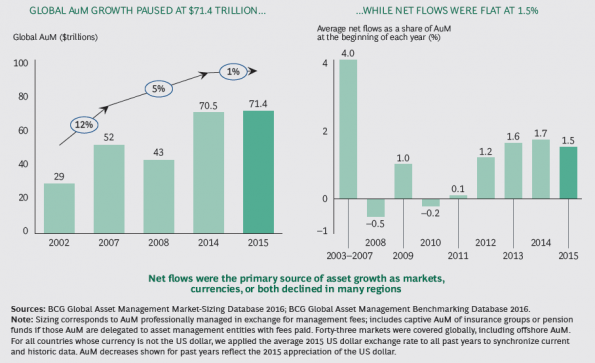

The asset management industry had its weakest year since the 2008 financial crisis, with global assets under management in 2015 growing a meager 1 percent from the prior year to $71.4 trillion, and net new flows into funds slowing for the third year in a row to just 1.5 percent, according to a new Boston Consulting Group report.

"Weak and turbulent global financial markets are today's reality - one recent example being the market response to Britain's 'Brexit' vote to leave the EU," said Brent Beardsley, a BCG senior partner based in Chicago, the global leader of the firm's wealth and asset management segment, and a co-author of the report. "Asset managers that depend on financial-market performance to drive increases in asset values are stuck in a model from the past."

While asset managers' operating margins continue to be strong at 37 percent, net revenue as a share of AUM is down to 27.7 basis points, compared to 29 basis points in 2010.

"The last couple years what we've seen is a pretty sustained decline in net revenue across the entire industry," Beardsley said during a press briefing in New York Monday morning.

That has been driven by a shift in the product mix, as investors continue to favor passive funds over active management, driving prices down. The popularity of alternative products has also contributed, Beardsley added.

A stagnant profit pool also stalled industry growth. While overall AUM is up 39 percent from 2007, profits remain flat, BCG says. Meanwhile, revenues are up only 14 percent from 2007, while costs have increased 20 percent.

The markets will have a huge impact on firms' topline growth, as they won't be able to count on new money, Beardsley said. If managers want to grow their market share, they'll have to steal it from others, he concluded.