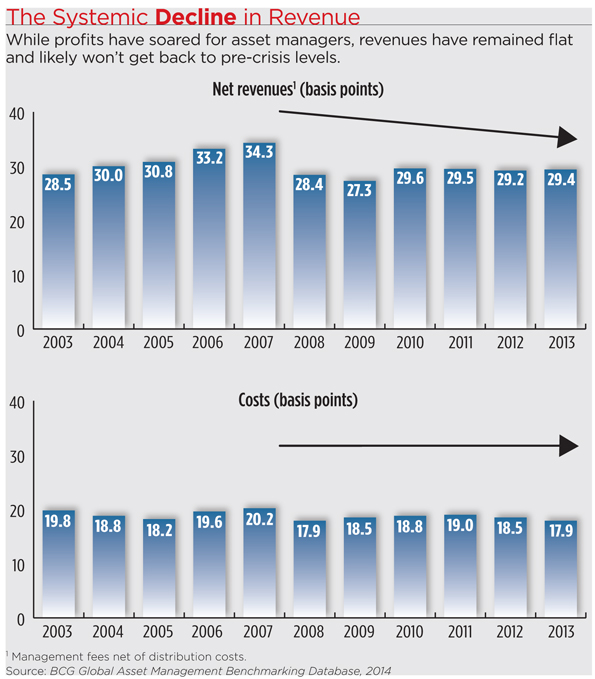

The global asset management industry had a pretty good 2013, with record assets under management and profits soaring 17 percent over 2012, a new Boston Consulting Group report shows. But the bright results perhaps belie the fact that since 2007, asset managers have seen a systemic decline in revenue margin, while costs inch higher.

"The asset management industry has not yet internalized or believed that there is a systemic decline in revenue realization or revenue margin in this industry," said Gary Shub, partner at Boston Consulting Group and lead author of the Global Asset Management 2014 report. "We don't anticipate or see net revenues returning to the levels that we saw prior to the financial crisis. So as a result, going forward the rate of cost growth in the industry is going to have to respond."

Net revenues declined to 29.4 basis points in 2013, compared to 34.3 in 2007 and 29.2 in 2012, the BCG report found. Costs were at 17.9 basis points in 2013, down from 20.2 in 2007 and 18.5 in 2012. In dollar terms, net revenues have only grown 2 percent since 2007, while costs were up 6 percent.

"This means that costs have been managed well relative to the size of asset growth, but asset managers haven't managed costs well in terms of revenue growth," Shub added.

Managers have been containing costs in the areas of sales and marketing as well as in overhead and corporate functions, said Achim Schwetlick, partner and core member of the insurance practice at BCG.

In addition, the global profit pool remains 7 percent below its pre-crisis high, driven by the continued market shift away from actively managed core assets to passive products as well as the growth in fixed income assets. The slow revenue growth is also attributed to increased pricing pressure in certain product categories. Fees of passive equity products, for example, were down 23 percent from 2012; money market fees declined 20 percent; and alternatives fees fell 11 percent over that time period. (Yet, high fees of alternative funds are still a sticking point for advisors, a recent Morningstar study shows.)

But managers were riding high on the strong equity markets of 2013, with global AUM hitting a record $68.7 trillion, up 13 percent from 2012. Profits grew 17 percent from 2012 to $93 billion. Net flows were 1.6 percent of prior-year AUM, up from 1.2 percent in 2012, driven mostly by investors' increased interest in the equity markets and the resilience of institutional investors, BCG said.

Net flows were limited in the U.S., where net flows represented 1 percent of prior-year AUM. North American assets grew 16 percent from 2012 to $34 trillion.

"Growth will continue to be a challenge and become even more challenging for asset managers than it's been in the past," Shub said. "Asset managers can't be complacent about growth, and asset managers can't continue to rely on the bull markets to indefinitely help them drive growth. More importantly, asset managers are going to have to get their operating models right."

Managers need to rethink the way they approach advisors and which advisor segments they go after, Shub added. For example, the needs of an RIA are different from those of a wirehouse advisor. RIAs want to see a higher level of value-added service from asset managers, so managers need to think about what kind of additional service they can bring to those advisors.