Vinovest, a digital platform for investing in fine wine, has launched a fund for registered investment advisors, broker/dealers, family offices and institutional investors. Advisors and their clients can get access to fine wine through Vinovest’s flagship fund, an actively managed and diversified strategy benchmarked to the Liv-ex Fine Wine 1000 index, or bespoke strategies customized around a time horizon or ESG preferences.

“The purpose of the fund offering is to give professional investors—family offices, RIAs, broker/dealers—the opportunity to easily diversify into wine as an asset class for their clients,” said Anthony Zhang, CEO and co-founder of Vinovest. Zhang was recently a guest on The Healthy Advisor podcast, sharing his story of how becoming quadriplegic shaped his journey.

“When a manager is building out your portfolio, they’re looking for a mixture of high-growth stocks, maybe some emerging market ones, but then the backbone of your portfolio is going to be in more steady blue chips, for example,” Zhang added. “Same thing with wine. There’s your very established regions that can give you pretty predictable growth year over year with very low volatility and variance from year to year. But then there’s also your emerging market ones. Just like a traditional stock portfolio, we can construct a portfolio full of your blue chip stable ones and also emerging market ones, and then be able to assign essentially a risk to each one. That’s how we do our rebalancing. When things go below a certain score, we then decide to sell it. When things are above a certain score, we look to buy it.”

Zhang said his company, launched in 2020 with a direct-to-consumer offering, started offering a few one-off bespoke funds to RIAs last quarter. He found that with rising inflation, many advisors were looking for a deflationary asset, such as fine wine.

“We did one where people wanted certain amounts to be cash-yielding every single year, so we structured our strategy so that we were rebalancing and selling off x amount of our portfolio each year in order to give investors distributions after a certain point,” Zhang said. “Others were more so focused strategically on certain regions that they believed were more impacted by climate change—so more of an ESG strategy.”

But Vinovest is taking an even larger bet on the advisor market with its flagship fund. The fund, structured as a private placement, has a minimum investment of $50,000 for accredited investors. Management fees for the fund currently run at just under 2%, but there will be fee breaks as the fund gets larger. They’ve raised over $10 million in the fund so far, and Zhang expects to raise up to $100 million in the fund this year.

Vinovest has just under 10 RIAs invested in the fund offering so far, but there are more advisors invested through the retail platform, where, instead of investing in shares or membership interest of an entity, they invest directly in bottles and cases of wine.

Vinovest founder Anthony Zhang

Vinovest uses a proprietary algorithm to choose undervalued, appreciating wines based on type, region, historical pricing, risk-to-return ratio and other factors. The company works with a group of bonded warehouses, or custom-controlled warehouses, to store the wine in tax-free zones, so it can make transactions in a tax-efficient manner. Vinovest handles the custody and insurance of the wine through those warehouses. Their investment performance is compliant with Global Investment Performance Standards (GIPS).

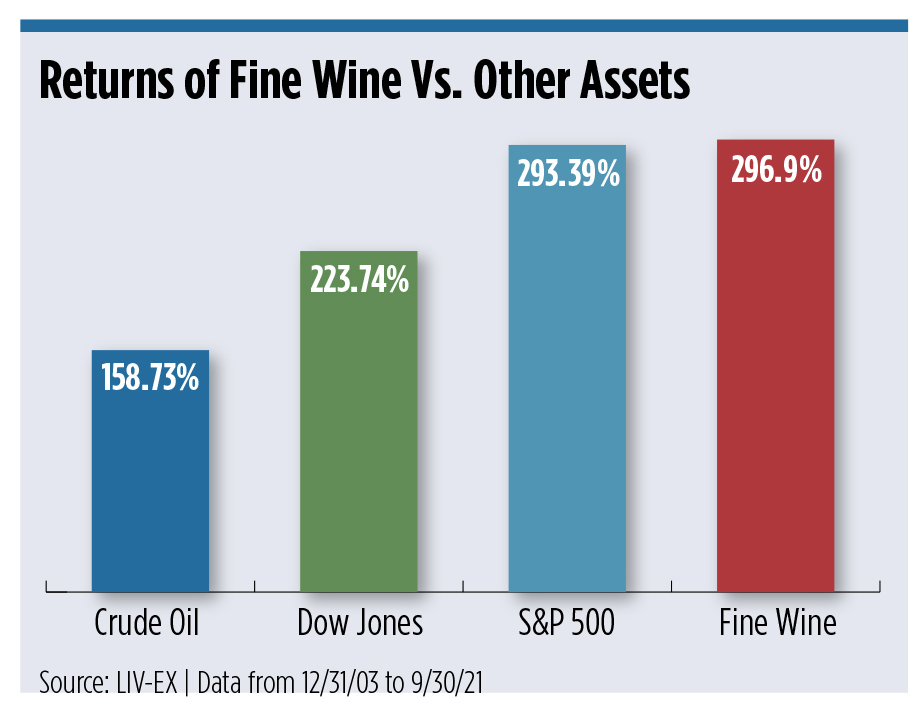

Over the past couple decades, wine has delivered double-digit annualized returns, beating out global equities, with about one-third of the volatility, Zhang said.

Chip Roame, managing partner of Tiburon Strategic Advisors, which researches wine investments, said the investment pitch is real here.

“Wine has a better return than the stock market, and is a great diversifier,” he said.

Many firms that launch in the business-to-consumer or direct-to-consumer market end up migrating to the wealth management market, Roame said, so he’s not surprised to see Vinovest doing so.

Tiburon research shows that there are 20,944 wineries worldwide, up from 13,400 in 2010. Globally, wineries and grape growers generated $370 billion in revenues and $148 billion in net profits in 2019, up from $150 billion in revenues in 1999 and $92 billion in profits in 2010.