Where can investors find near 10% yields from predominantly investment-grade companies with stable cash flows that also happen to be trading at significant discounts to historical valuations? Look no further than North American midstream energy infrastructure, which includes master limited partnerships (MLPs), U.S. corporations and Canadian corporations.

Unlike other energy sectors, midstream companies primarily transport, store and process hydrocarbons for fees. This results in more stable cash flows for midstream and less direct exposure to commodity prices. These stable cash flows support generous income, which has only become harder to find in the current market environment. While yields for other sectors are below historical averages, the midstream space offers yields that are elevated relative to history.

The Alerian Midstream Energy Index (AMNA), the benchmark index for North American midstream, was yielding 8.3% in mid-August or approximately 200 basis points above its five-year average. Notably, over 80% of the index by weighting is investment-grade companies. The Alerian MLP Infrastructure Index (AMZI), which consists of MLPs, was yielding just under 12% at mid-month, which was an even wider variance from its historical norm. Despite lofty yields, payouts were steady for the recently announced second quarter dividends. Only one small MLP out of 42 dividend-paying companies in the universe lowered its second quarter distribution relative to the first quarter.

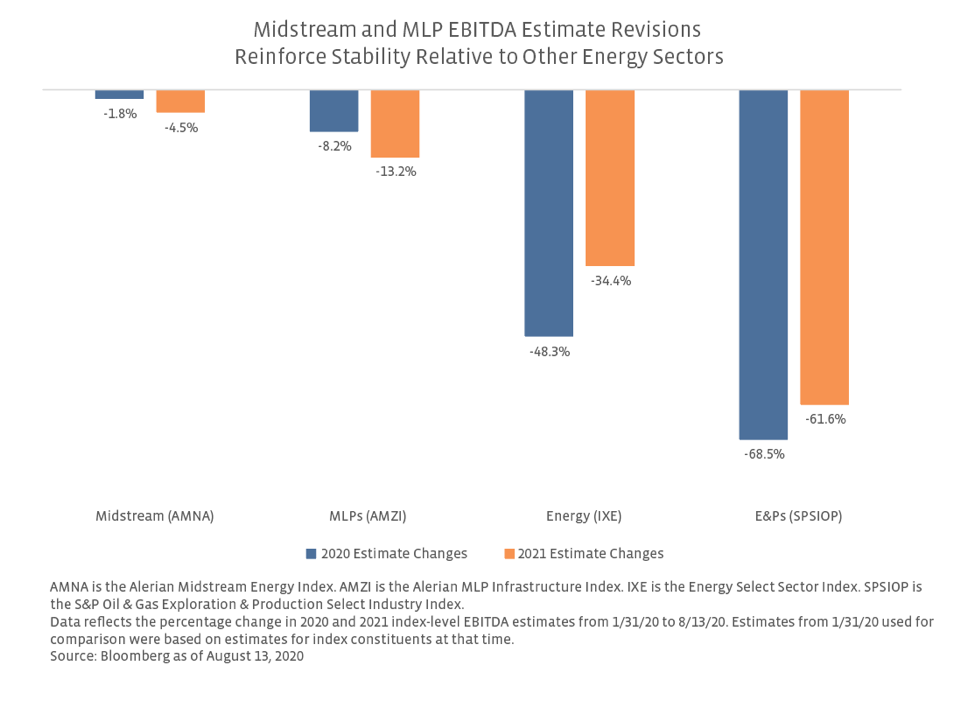

Despite the fee-based nature of midstream and more stable cash flows, the space has sold off this year as macro energy headwinds have weighed on sentiment, and persistent selling pressure has driven performance. As shown below, earnings expectations for midstream have barely budged since the collapse in oil prices, but AMNA is down 24.6% year to date through Aug. 14 on a total-return basis. MLPs, represented by AMZI, have fallen 35.5% over the same time period. By comparison, broader energy as represented by the Energy Select Sector Index (IXE) is down 34.3% over the same period, which is more in line with the estimate revisions for 2021. For broader midstream and particularly MLPs, there is a disconnect between resilient earnings expectations and weakness in equity price performance this year.

In addition to generous income supported by stable cash flows, midstream offers other attractive characteristics such as diversification, real asset exposure, and more defensive energy exposure. Midstream valuations are also noticeably discounted relative to history, which differentiates midstream from other income-oriented sectors and the broader market.

Investors interested in enhancing portfolio yield, diversifying an income portfolio, or adding more defensive energy exposure as oil and natural gas fundamentals improve have many options when it comes to investing in energy infrastructure. A direct investment in an MLP or a midstream corporation may be the most straightforward way to gain exposure to the space, but a direct investment in an MLP will result in a Schedule K-1 being issued at tax time. Some investors don’t mind them, and others view them as a hassle. For investors wanting diversified exposure in one product and a 1099 at tax time, there are several midstream investment products available, including exchange traded notes (ETNs), exchange traded funds (ETFs) and mutual funds.

There are two main types of MLP funds—funds that own less than 25% MLPs and funds that own predominantly MLPs. A fund that owns more than 25% MLPs is taxed as a corporation, which can result in tax drag when equity prices are rising. These MLP funds are best suited for investors wanting to maximize tax-advantaged yield. Keep in mind, typically 70%-100% of MLP distributions are a tax-deferred return of capital, and funds retain the tax character of distributions from their holdings. A fund owning mostly MLPs is more likely to provide distributions that are a tax-deferred return of capital.

A fund that owns less than 25% MLPs, which is structured as a regulated investment company (RIC), will have a lower yield given less exposure to MLPs but will more closely track underlying holdings since there is no tax drag. RIC funds are more suitable for investors seeking total return, though it is important to make sure the other 75% of the fund not invested in MLPs aligns with the investment objectives of the portfolio.

In a market environment where income has become scarcer and valuations are often stretched, midstream energy infrastructure provides compelling income at discounted valuations relative to history. Midstream could be an interesting opportunity for investors looking to play the ongoing recovery in energy with a defensive tilt.

Stacey Morris, the director of research at Alerian, recently participated in a WealthManagement.com webinar on midstream/MLPs.