More than 50 years have passed since President Richard Nixon “closed the gold window,” which led to the creation of the first free market in gold. During this period of time, gold has delivered capital appreciation equivalent to almost 8% a year on a compound annual growth basis. In light of these past results, the precious metal’s year-to-date drop of 6% has understandably been disappointing; however, it’s important not to lose sight of gold’s unique value proposition.

The historical benefits of gold for long-term investors have always been twofold: Over time, gold can reduce the overall risk of a properly balanced portfolio and, at the same time, enhance its return potential. That means an improvement in a portfolio’s Sharpe Ratio—the goal of all asset allocators.

Two key considerations that surround gold in our current market environment are its relationship with inflation and the misperception of cryptocurrency being an alternative portfolio protector.

Preserving Purchasing Power During Periods of High Inflation

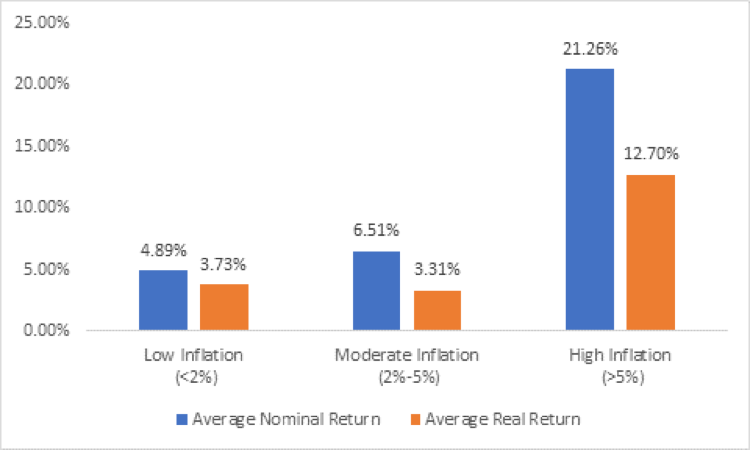

Looking back over the past five decades, when the rate of inflation has remained below 2% a year, gold has delivered returns averaging around 5% a year. During those periods when inflation was greater than 5% a year, the average return on gold has been over 20% a year, which equals an average real rate of return of around 12% during elevated inflationary periods—underscoring gold’s ability to provide protection against inflation for all types of investors.

Gold Performance During Various Inflation Regimes

Bloomberg Financial L.P. and State Street Global Advisors, date range from Aug. 31, 1971 to Sept. 30, 2021. Computed using average year over year gold returns and the most recent U.S. CPI Figures available from Aug. 31, 1971 to Sept. 30, 2021.

Notably, when comparing gold’s performance as a hedge against inflation with Treasury Inflation-Protected Securities, gold has historically offered better results. If you had allocated 5% of the assets in your portfolio to TIPS, you’d have protected 5% of your portfolio against inflation. However, if you had dedicated 5% of your portfolio’s assets to gold, you could have achieved superior inflation protection along with additional benefits of gold, including the potential for attractive long-term returns, enhanced diversification and downside protection that could mitigate losses during periods of market stress.

Crypto Misperception

Switching gears, the frequent comparisons between gold and cryptocurrencies suggest many market observers are missing the key fundamental differences between the two investments.

As previously mentioned, gold contributes to risk-adjusted returns by reducing the overall volatility of a portfolio and enhancing its return potential, while the contribution of cryptocurrencies to portfolio performance is based solely on returns. Unlike gold, cryptocurrencies can often add volatility to a portfolio. For example, in the 12 years since the launch of bitcoin, the first cryptocurrency, its annualized volatility has been eight times greater than that of gold, according to data from Bloomberg Financial and State Street Global Advisors as of Sept. 30, 2021.

The demand for cryptocurrencies is founded largely on investment and speculation, while the performance of gold, on the other hand, depends on its diverse demand characteristics.

In a typical year, between 20% and 30% of global gold demand is generated by investment from individuals and institutions. Approximately 10% of demand can be traced to industrial applications, primarily in electronics, and another 10% or so is absorbed in net purchases for official reserves by central banks, mainly in the emerging market countries. Finally, about one half of demand is for gold jewelry all around the world, according to the World Gold Council and State Street Global Advisors.

Given these very different sources of demand, it’s no surprise that gold’s historical correlation to major equity and bond markets remains low.

In the 50 years that followed the creation of a free market in gold, the precious metal has continued to be consistent with its overall historical performance and has proved to act as a reliable asset for portfolio protection through periods of high inflation and volatility. This track record, coupled with growing expectations for more volatility and uncertainty to penetrate our markets amid rising inflation, supply-chain slowdowns and a potential energy crunch, suggest now could be the time for investors to consider increasing their gold ETF allocations.

George Milling-Stanley is the chief gold strategist at State Street Global Advisors.