Last week, after writing my most recent commentary about market complacency, I was surprised that the latest Federal Reserve minutes revealed that the Federal Open Market Committee is also concerned investors are growing too complacent, raising the prospect of excessive risk taking. That followed remarks from Federal Reserve Bank of New York President William Dudley that low market volatility has made him nervous. Fed Chair Janet Yellen reinforced that view in her latest testimony to Congress, saying investors reaching for yield could increase the risk of market problems, and that some valuations, particularly lower-rated corporate debt, are stretched.

It is commendable that the Fed is acknowledging complacency and trying to remind investors of the uncertain path ahead; but perhaps the largest contributor to the rise in risk-taking has been the Federal Reserve itself. The Fed is far from alone in fueling complacency, as central bankers around the world have continued to provide easy money to prop up overleveraged economies with large structural imbalances. The Bank for International Settlements has summed the situation up saying that global central bank policies have reduced price swings and market volatility, encouraging greater risk taking.

The Fed and other central banks are to be commended for having avoided a global financial meltdown by pumping up economic activity through cheap money and inflated asset prices, but this approach is not without risks. Now, with unemployment falling to 6.1 percent, the U.S. economy is building a strong head of steam. Despite that, Dr. Yellen has dismissed as “noise” the possible signs of building U.S. inflation, notably evident in Consumer Price Index data showing inflation running at 2.1 percent. That “noise” may well be an alarm bell that the complacency created, and even promoted, by central bankers could eventually result in unintended adverse consequences in the coming years. As policymakers globally contemplate the source of today’s market complacency, I am reminded of the words of 17th century English poet and cleric John Donne: “Never send to know for whom the bell tolls; It tolls for thee.”

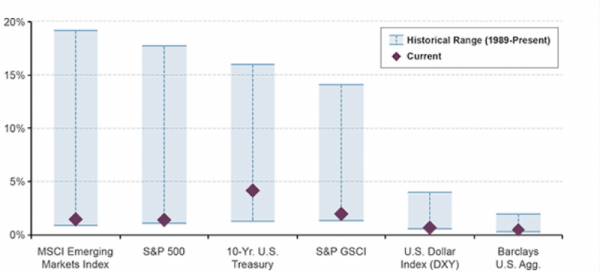

Low Realized Volatility Reflects Widespread Market Complacency

The past few years of central bank-induced liquidity have calmed markets to a degree that is nearly unprecedented in the last 25 years. From equities to fixed income to currency markets, volatility is near historically low levels. The last time such complacency was seen was the summer of 2007, suggesting investors should not be lulled by the current market calm, and instead prepare for choppier days ahead.

Annualized Realized Volatility By Asset Class

Source: Bloomberg, Guggenheim Investments. Data as of 7/16/2014. Volatility refers to annualized 30-day standard deviation. Volatility of the 10-Year U.S. Treasury is yield volatility. The MSCI Emerging Markets Index captures large and mid-cap representation across 23 Emerging Markets countries. The S&P 500 is a market-weighted stock market index comprised of the stocks of 500 U.S. corporations; the index is owned and maintained by Standard & Poor’s. The S&P GSCI® is recognized as a leading measure of general price movements and inflation in the world economy. The DXY is measured against major foreign currencies. The Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated and covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

This material is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2014, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Scott Minerd is Chairman of Investments and Global Chief Investment Officer at Guggenheim Partners