“Summer Charts” is a series of current financial topics explained in dots, lines, and only a few words—just the right “mix” to concisely convey ideas for critical thinking about investing.

After equity markets dropped from the highs of the dotcom bubble in 2000/2001, and while “climbing” the post-financial crisis “wall of worry” to recent record highs, global central bankers made it their mission to provide stability to financial markets by injecting liquidity—not only during volatile periods. Alan Greenspan became one of the first known advocates for this sort of risk modification, and the so-called “Greenspan Put” has been adopted all over the globe, ever since.

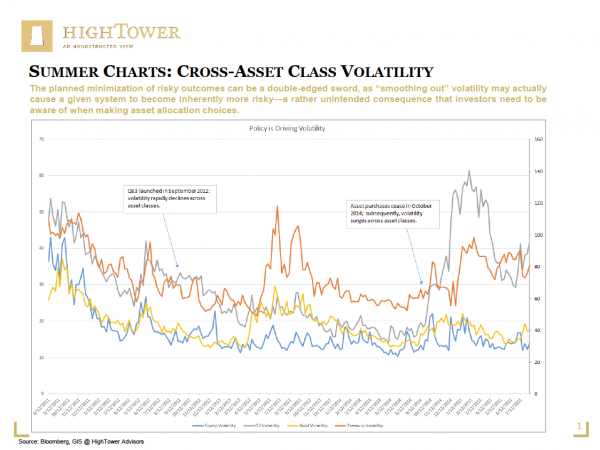

The planned minimization of risky outcomes can be a double-edged sword, as “smoothing out” volatility may actually cause a given system to become inherently more risky—a rather unintended consequence that investors need to be aware of when making asset allocation choices. The current increase in cross- asset class volatility, especially in bonds, may be foreshadowing what to expect for US equities.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.