“Summer Charts” is a series of current financial topics explained in dots, lines, and only a few words—just the right “mix” to concisely convey ideas for critical thinking about investing.

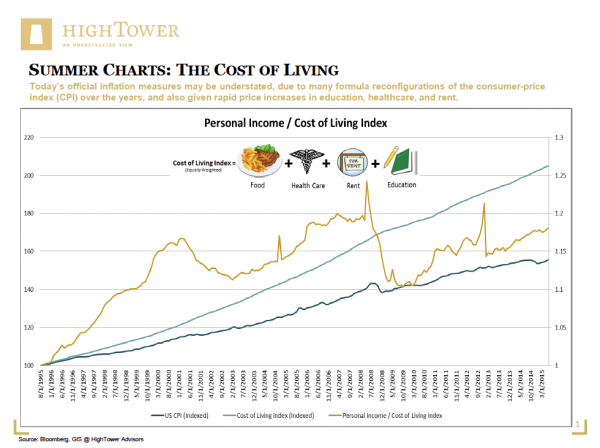

Judging by official inflation readings that are still at very modest levels (+0.2% YoY), rising prices appear to be a distant echo of the past—especially considering the substantial money creation that has taken place in recent years. Yet not much appears to be affordable any longer, particularly for the millions living in major metropolitan areas. The reason for this disconnect is that today’s official inflation measures may be largely understated, due to many formula reconfigurations of the consumer-price index (CPI) over the years, and also given rapid price increases in education, healthcare, and rent.

Inflation may have shown up in other areas, as observed in (continued) financial market appreciation—especially in equities and select commodities—or increases in real-asset markets, such as art, collectibles, and real estate. It is no coincidence that Americans still view real estate as their most important long-term asset. The perceived wealth effect (i.e., “feeling wealthier”) and resulting spending decisions could be a dangerous mix, as real income has been in decline since 2008.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.