If we follow acclaimed hedge fund manager Michael Burry’s (one of the main characters from the book, The Big Short) investment path, the next big opportunity (or crisis, for that matter) will be related to water. In full agreement, we have been publishing our side of the story: first in our 2014 post, "Glass Half Full," establishing the investment thesis, and then in 2015, with "Dry Spell," offering a proprietary investment framework related to U.S. drought conditions (as per our own definition) and an investment in water vs. global small cap stocks in general.

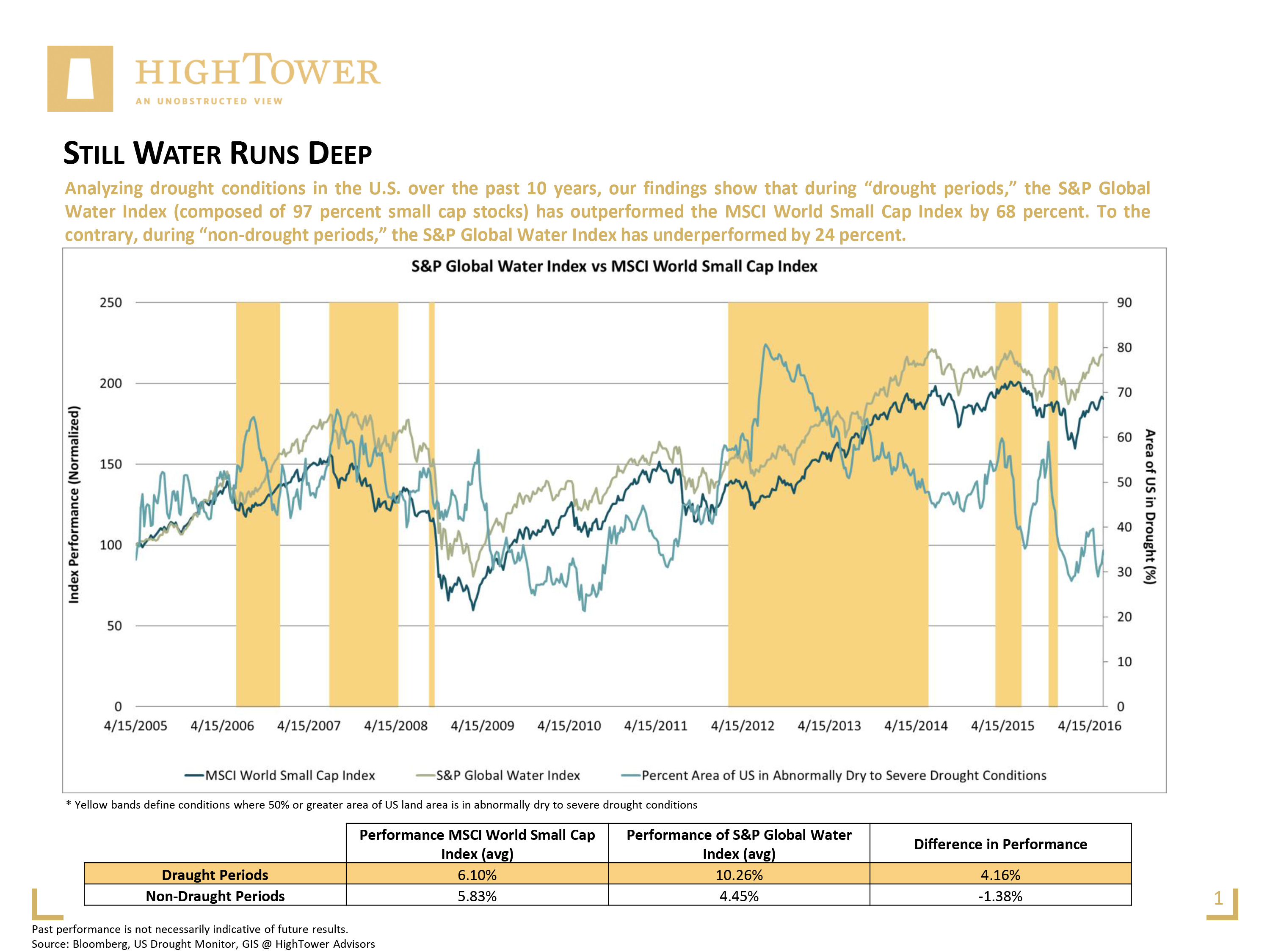

Analyzing drought conditions in the U.S. over the past 10 years, our findings show that during “drought periods,” the S&P Global Water Index (composed of 97 percent small cap stocks) has outperformed the MSCI World Small Cap Index by 68 percent. To the contrary, during “non-drought periods,” the S&P Global Water Index has underperformed by 24 percent; the difference in relative performance between those two periods is more than 90 percent!

Score Card: Ever since having introduced our work in 2015 via this blog, our model continues to be right 75 percent of the time in correctly identifying the out- or underperformance of water stocks vs. global small cap stocks. An exception, in this respect, remains the current period; as of 11/27/2015, the model triggered an overweight to global small cap stocks as opposed to water stocks, but the latter have relatively outperformed by nearly 3 percent since that time.

Undeniably, there are flaws to every model, but the current trend in favor of water stocks is likely linked to two aspects: 1) persistent drought conditions and water scarcity, especially as observed in California, paired with a forming public awareness, and 2) the water-related investment story (see our original thesis) may finally be coming through, with more mainstream investors considering this particular allocation choice. In my personal view, it still is an early-stage opportunity.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to high net worth and ultra-high net worth individuals, family offices and institutions. Follow him on Twitter @MoneyClipBlog.