The European showdown is back on and, as much as opinions are divided, we have to recognize that issues related to Greece are symptomatic of the deep-rooted flaws of Europe’s united economy (EU) and especially its monetary union (EMU). The cry for austerity by creditors may reflect a desire to heal conditions “on the go,” but the time may not be right to enforce principles that were largely disregarded during the good times, particularly the stability criteria laid out in the original Maastricht Treaty (a binding contract between EMU nations). As important as the debate regarding the accumulation of national debt is, we have to note that, for most countries, swelling government deficits and related additional accumulation of obligations were not the cause, but rather the result, of the 2007-08 Global Financial Crisis. Greece, however, has been different from the “get-go.”

Debt-to-GDP levels in Greece increased from 71.7 percent in 1990 to 112.9 percent in 2008 (essentially pre-financial crisis); this was “technically” in violation of the Maastricht Treaty criteria, which mandated a limit of 60 percent debt-to-GDP for member countries. BUT, the treaty also allowed member states to adopt a more flexible approach, as long as debt was “sufficiently diminished [and must be] approaching the reference value at a satisfactory pace.” The really problematic increase in Greece’s external obligations came at the height of 2011 market funding stress, when its debt-to-GDP reached 170.3 percent—a level which is still being exceeded today (177.1 percent at the end of 2014).

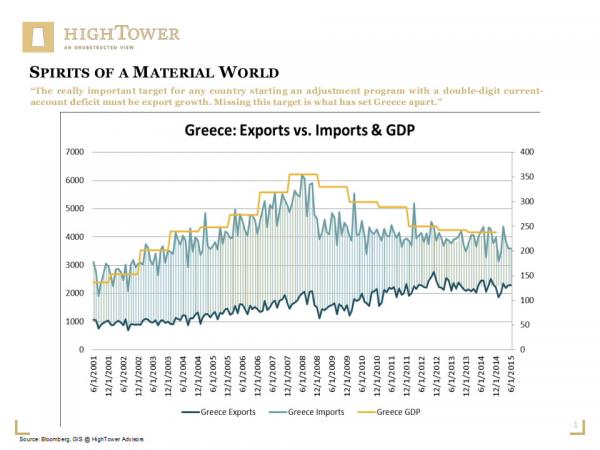

In an effort to stabilize the Greek economy, improve credit conditions, and lessen socioeconomic implications, the collaboration between the European Commission, the IMF, and the European Central Bank (aka Troika) mandated significant austerity measures alongside asset sales and economic reform. As a result of actions aimed at the reduction of external funding requirements, Greece’s current account deficit was downsized substantially, not by increasing exports, but by reducing the value of imports. Whereas Greek exports averaged EUR 1,562.37 million from 2001 until 2014, with an all-time high of EUR 2,767.10 million in November 2012, imports averaged EUR 4,016.98 million over the same time period, with an all-time high of EUR 6,198.80 million in June 2008, which was the year of the onset of the global recession.

Leading experts, however, have concluded that “what went wrong in Greece was not the fiscal adjustment. On the contrary, austerity was perhaps too successful (and painful). But it was the wrong target. The really important target for any country starting an adjustment program with a double-digit current-account deficit must be export growth. Missing this target is what has set Greece apart.” In comparison to other “troubled” economies, the PIIGS nations’ (Portugal, Ireland, Italy, Greece, Spain) export activity was a determinant factor in the reacceleration of economic growth.

What Investors Need to Consider

Although the issues in Greece are painfully real, especially for its ailing society, the EU and EMU require not only much broader reforms but also an effective “balancing act” between economic growth and austerity measures. To monitor the risk and opportunity, investors need to consider two aspects:

- An optimal currency area, considered one of the anchors of Europe, is based on economies that are similar in performance or even tied together—certainly not the case in Europe today. For comparison, in the U.S, it is a given fact that states produce different economic outcomes, but the free movement of labor helps to create equilibrium. In Europe, this balancing mechanism is a challenge because of language barriers and other factors.

- The EMU was set up with a design flaw: Policymakers cannot successfully operate a monetary union without a fiscal transfer union; i.e., it lacks a mechanism to address deficits between member states. Simply put, the “well-to-do” countries use their tax base to pay for less fortunate nations (one of the reasons why Germany has been under harsh critique).

It is not enough to measure progress in Europe by the “spirit” of a good idea, related policy work, or the size of a QE program, but is more important to understand the willingness of policymakers to adapt the right structural reforms. As long as current conditions are not addressed, the EU cannot heal effectively.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.