Federal Reserve (Fed) Chairman Ben Bernanke surprised markets on September 18 by announcing a continuation of the Fed’s $85 billion-per-month bond purchases and more muted expectations for economic growth and inflation. With this proverbial monkey wrench thrown into the gears of financial markets, investors are now asking how the Fed’s new course changes the investment outlook.

The Facts

Markets expected the Fed to reduce quantitative easing by $10 to $15 billion per month starting in September. Instead, the Fed announced that the historic pace and volume of bond purchases would continue unchanged. The Fed also lowered its economic expectations, reducing its GDP* forecasts for 2013 and 2014 from 2.45% and 3.25% to 2.15% and 3.00%, respectively, and slightly reducing its inflation forecast for 2014. In addition, the Federal Open Market Committee (FOMC) lowered federal funds rate target expectations to an average of 1.25% through 2015 and 2.25% for 2016.

Explaining these shifts, the FOMC expressed concern about tightening financial conditions, as evidenced in particular by higher mortgage rates. The committee stated that it prefers to wait for further evidence that the economic recovery is sustainable before altering its highly accommodative approach. In his press conference, Chairman Bernanke also cited the current rancor in Washington, D.C. over the federal budget and debt ceiling, saying the political discord could be disruptive to financial markets.

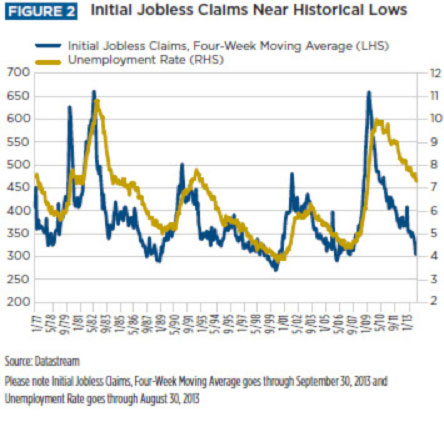

Finally, Chairman Bernanke provided new insights into the FOMC’s thinking about the reliability of headline employment figures as a measure of labor market health. During the past three years, the US unemployment rate has slowly declined. However, the drop is attributed in part to millions of people leaving the workforce, often discontinuing their job search or pausing their search to continue their education. As a result, according to the FOMC, headline unemployment data may not provide the most accurate picture of the state of the US labor market.

Market Reaction

Investors’ risk appetite soared in reaction to the announcement—at first.

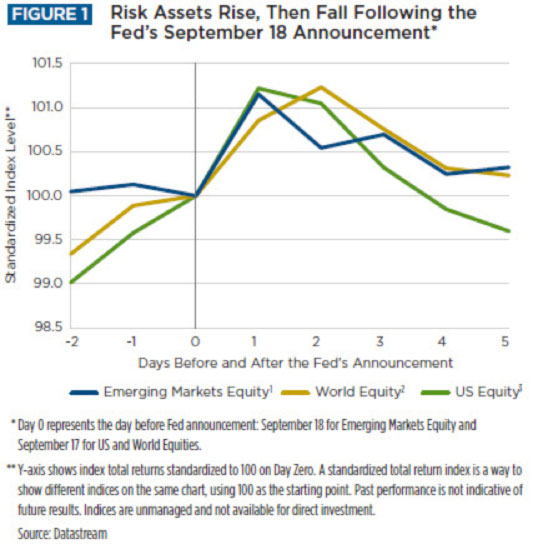

Figure 1 shows the equity market response in the days immediately following the Fed’s decision to delay tapering. The glow soon wore off, however, and by day three, investors once again appeared less sure of the Fed’s new course. Equity markets quickly surrendered their gains, nearly falling back to preannouncement levels within a week.

My Takeaways

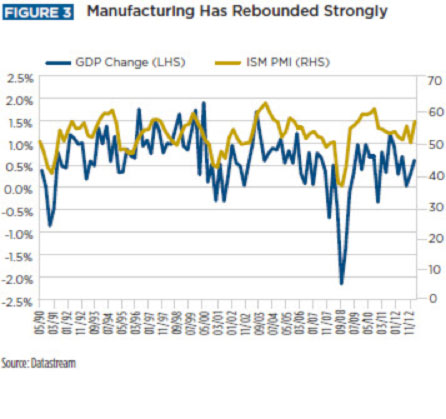

At first glance, it appears that markets interpreted the Fed’s updated course as postponing monetary tightening indefinitely, prolonging an environment of low interest rates and low market volatility. However, I believe there are two snags to this argument. First, I am confident that the Fed will respond to changes in economic data as they occur. Although the FOMC lowered its forecasts for GDP growth, the economy is showing signs of strengthening. Initial jobless claims, a leading economic indicator, are back to pre-crisis levels, the lowest they’ve been in many years (Figure 2). Falling initial jobless claims imply an eventual drop in unemployment. The Institute for Supply Management’s (ISM) Purchasing Managers’ Index (PMI), another leading indicator, has also increased recently, signaling stronger GDP growth (Figure 3).

As of this writing, investors are also grappling with the potential economic and market implications of the government shutdown that began on October 1 and the impending debt-ceiling deadline. While the probability of a technical default by the US government is low, the risk does exist, given how far apart congressional Democrats and Republicans appear to be. Markets seem to be pricing in a last-minute agreement that would avoid default on October 17. However, if default occurs, I believe the negative repercussions would be significant and the real economic impact prolonged. This risk is being reflected by recent declines in US equities and longer-maturity US Treasury yields. Ultimately, I believe the events in Washington, D.C., will lead to a temporary disruption in the economy and markets.

The second reason why I think the Fed’s new course may not endure has to do with its increasingly muddy communications approach. As recently as last summer, the Fed stated that the unemployment target at which it would be able to wrap up its bond-purchase tapering was 7%, and the threshold that would trigger monetary tightening was 6.5%. Today, investors can no longer count on those numbers, precisely because of the Fed’s recently stated views about the complications of relying solely on headline unemployment rates in setting policy. In my view, this back-and-forth has damaged the Fed’s credibility and, as a result, increased uncertainty in the markets. In future announcements, the Fed’s forward guidance may cite a lower unemployment rate or include an inflation target. Until then, however, I believe investors can consider current Fed targets to be transitory at best.

Investment Implications

In my view, the Fed has merely delayed stimulus tapering, not taken it off the table. UIltimately, economic fundamentals will guide the financial markets. As I stated last month, I see fundamentals improving globally, particularly in the US, and tail risks of unexpected market shocks declining. Please see “Happy Anniversary? Perspectives on the Financial Crisis Five Years Later” for details.

1. Near term, the dollar could come under pressure. In the coming months, political wrangling and delayed Fed tapering is likely to be negative for the US dollar.

2. Equities are still attractive long term. The macro situation creates a healthy backdrop for equities to outperform. From a valuation standpoint, I see better upside for European and Japanese equities than for US equities. Emerging markets face many challenges in coming years, regardless of any extension in market liquidity from the US. The key will be to differentiate based on each country’s fundamentals and debt dynamics.

3. Bonds remain a key portfolio diversifier. The rally in bond yields is a reminder of the important role that fixed income plays as a defensive asset and a diversifier to equities. Lower volatility and a low-interest-rate environment are positives for credit spreads. Liquidity concerns will again come to the fore, however, as soon as Fed tapering begins.

4. Proceed prudently. As with any period of change and uncertainty, investors should maintain a watchful eye on policy and market behavior. If the debt-ceiling debate is not resolved or if the Fed is forced to tighten suddenly in response to improving-growth signals, then jumping too deeply into risk assets could backfire in the near term. Eventually, against a more stable economic backdrop, episodes of market disruption are likely to prove temporary, and the risk-on/risk-off dynamic that has characterized markets for a long time will fade.

Investors should carefully consider the investment objectives, risks, charges, and expenses of Hartford Funds before investing. This and other information can be found in the prospectus and summary prospectus, which can be obtained by calling 888-843-7824 (retail) or 877-836-5854 (institutional). Investors should read them carefully before they invest.

A Word About Risk: All investments are subject to risks, including possible loss of principal. Fixed-income investments are subject to interest-rate risk (the risk that the value of an investment decreases when interest rates rise) and credit risk (the risk that the issuing company of a security is unable to pay interest and principal when due) and call risk (the risk that an investment may be redeemed early). Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities.

Foreign investments can be riskier than US investments. Potential risks include currency risk that may result from unfavorable exchange rates, liquidity risk if decreased demand for a security makes it difficult to sell at the desired price, and risks that stem from substantially lower trading volume on foreign markets. These risks are generally greater for investments in emerging markets, which are also subject to greater price volatility, and custodial and regulatory risks.

Forecasts are inherently limited and should not be used as the sole basis for investment decisions.

Indices are unmanaged and unavailable for direct investment.

*The Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country's borders in a specific time period.

1 MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity markets.

2 MSCI AC (All Country) World ex US Index is a broad-based, unmanaged, market capitalization weighted, total return index that measures the performance of both developed and emerging stock markets, excluding the U.S.

3 S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Indices are unmanaged and not available for direct investment.

The views expressed here are those of Wellington Management’s portfolio manager(s) and should not be construed as investment advice. They are based on available information and are subject to change without notice. Portfolio positioning is at the discretion of the individual portfolio management teams; individual portfolio management teams may hold different views and may make different investment decisions for different clients or portfolios. This material and/or its contents are current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management.

All information and representations herein are as of 10/13, unless otherwise noted.

114850