Non-Traded REIT’s

2013 is on track to break records

With $12.9 billion raised through August 31 and projections of $18 billion by yearend, the non-traded REIT sector has outstripped its previous record of $11.7 billion, set in 2007. If the $18 billion increase is achieved—and all indications say that it will be—the sector’s market cap will grow by 20% year over year, toward $100 billion. This compares favorably with the larger exchange-traded REIT sector, which is expected to edge up by 5%. The growth drivers are familiar: investors in a low interest-rate world seeking income and capital stability. We believe that the factors underpinning this should be in place for some time, which implies continued strong growth for raising capital into next year.

A question of liquidity – recent listings

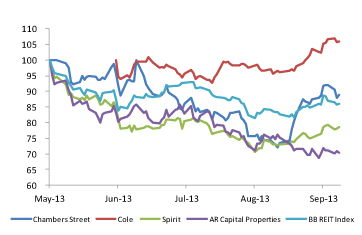

We have increasingly seen non-traded REITs find an exit through the public markets, either by listing outright or by being acquired by an affiliate. A number of recent listings have been impacted by the uncertainty surrounding the direction of interest rates (our views on the latest Fed comments can be found in the next section), as shown in the figure below.

Recent non traded REIT listings performance

Source: Bloomberg

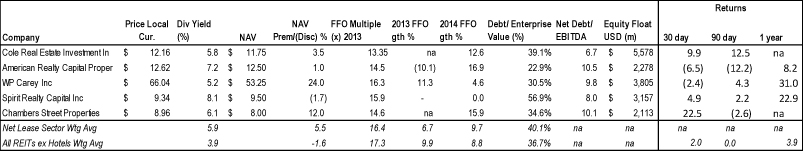

This decline has left investors with a difficult decision with respect to liquidating positions that they have held in non-traded REITs following their listing. As we are investors in both publicly traded and non-traded markets, our clients sometimes ask us how to determine whether liquidation is the right choice. Naturally, that is a question that must be answered in accordance with their individual criteria, time frame and liquidity needs. In the table below, we show relative performance and some yardsticks of valuation for the REITs that have come to market so far this year.

Recent non-traded REIT listings valuation metrics

Source: Bloomberg; RRE estimates. As of September 27, 2013.

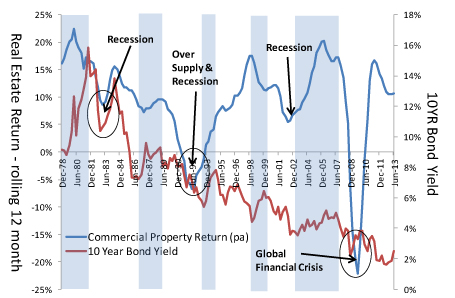

The impact of interest rates, recessions and supply on property cycles

Real estate values and interest rates are closely tied in investors’ minds, but that link can be tenuous. While higher interest rates can make other investment strategies more appealing, recessions and oversupply have historically played a much bigger role in real estate returns, as the figure below shows.

Property cycles and interest rates

Source: Bloomberg; NCREIF; RRE estimates

The left Y axis measures real estate returns on a 12-month rolling average from 1978 through June 2013, and the right Y axis similarly measures 10-year Treasury bond yields. The blue line tracks real estate returns through several recessions, culminating in the crash of 2008. The red line shows the 10-year Treasury bond yield and the blue shading shows periods of rising interest rates.

The inconsistency of a correlation between the two over time is stark.

This is because interest rates play only a partial role in commercial real estate returns. More impact arises from supply and recession. When excess supply intersects with a recession, property values decline, sometimes precipitously, as they did in the early 1990s.

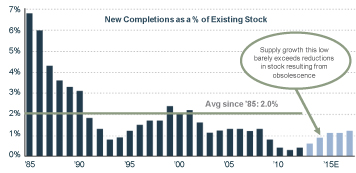

The crash of 2008 was a different matter altogether—its scope and severity threatened the collapse of all financial markets. Real estate, which had enjoyed a multi-year runup in prices, saw a significant correction. Construction came to an abrupt halt. Supply, which was already low, as the figure below indicates, tightened further.

Today’s environment is typified by low supply and growing demand. Construction starts are only now beginning to pick up, but it takes years to erect buildings. Meanwhile, many buildings are at or near capacity, and landlords are seeing a return to growth in rents. In our opinion, now is an excellent time to buy real estate.

Traded REIT’s

Our take on recent Fed comments

While underlying property markets tend to be resilient to interest rate fluctuations, REITs (which are traded daily on public exchanges) may continue to work through an adjustment phase to an anticipated increase in rates. We saw evidence of this in May. When Federal Reserve Chairman Bernanke discussed “tapering,” he said he would slow the Fed’s bond-buying program once the economy was on solid footing and employment gains were steady. A significant correction in REIT prices followed as

10-year Treasury yields increased on expectations that quantitative easing would end sooner than expected.

However, Bernanke recently clarified his position in September as Treasury yields approached 3%, indicating discomfort with the markets’ consensus that yields would reach 4% in 2014. An increase of that magnitude would have had a further significant impact on REIT prices, and we are pleased that it is, for now, off the table—with yields stabilizing in the ~2.6% area.

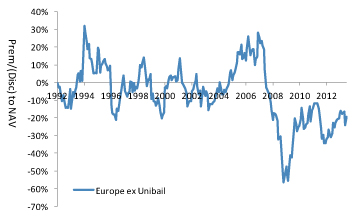

Europe turns a corner

Despite Europe’s challenges, our analysis shows we are now seeing the beginnings of a sustainable economic recovery. Underlying commercial real estate values have stabilized, debt is available and spreads are wide. As such we have made our first investment into Europe, through Corio NV, a Dutch retail company that owns shopping centers across Western Europe. We will add selectively to Europe as well as Asia as opportunities arise.

Note: we have excluded Europe’s largest REIT (Unibail) from the analysis, given its large index weight and substantial NAV premium

Source: JP Morgan; RRE estimates

Outlook

We are in the midst of a correction, with REIT prices down about 15% from their highs earlier this year. Uncertainty regarding the outlook for interest rates and investor overreaction to market events has driven this decline, but overlooks improving fundamentals.

This presents investors with a great opportunity to enter this real estate cycle at a discount. The economy is improving and interest rates are normalizing at a bit below 3%—which is excellent news for real estate values.

For this reason, we currently see the best opportunities within real estate securities in publicly traded REITs, targeting some of the most oversold sectors, including healthcare and net lease. We believe a real estate investment approach that focuses on several real estate securities markets, which gives access to the widest opportunity set, creates diversification, and enables access investments with lower correlations and higher yields.