Non-Traded REIT’s

American Realty Capital Properties to acquire Cole Real Estate Investments

The price: $7.3 billion plus the assumption of $3.9 billion in debt, for a total of $11.2 billion. The acquisition, which is expected to close in the first quarter of 2014, will create the largest REIT in the net-lease sector, with 3,732 properties and an enterprise value of $21.5 billion—up from only $300 million at the beginning of the year.

The following 2013 transactions illustrate ARCP’s aggressive acquisition strategy.

-

On February 28, 2013, ARCP completed its merger with American Realty Capital Trust III, Inc., a public non-traded REIT, which lifted ARCP’s enterprise value to $3 billion.

-

In March it made an unsolicited offer to buy Cole Credit Property Trust III, another non-traded REIT, but was rejected. Cole Credit went on to merge with its management company before going public as Cole Real Estate Investments.

-

In May ARCP said it would buy CapLease for $2.2 billion, and also picked up two retail portfolios from GE Capital for $807 million.

-

In July it announced plans to buy American Realty Capital Trust IV, a non-traded REIT managed by ARCP executives, for $3.1 billion. (See more below.)

- In October ARCP unveiled the biggest transaction of all—the acquisition of Cole Real Estate Investments for $11.2 billion.

The Cole acquisition will not only make ARCP the largest net-lease REIT by far, but will also help ARCP deleverage. EBITDA is projected to go from 9X to 7X by the end of 2014.

For us, the biggest challenge for the deal is the lack of obvious accretion given the price paid—ARCP will have to find substantial synergies with Cole. For instance, whilst ARCP claim a forecast $70m in synergies, Cole only has $125m of G&A (in our estimation).

ARCP renegotiates its ARC IV deal

In July, ARCP agreed to acquire ARC IV in an all-cash deal pegged at a minimum of $13 per share. At the time, ARCP shares were trading near $15. But in September, they began trading below $13, making the transaction more dilutive, and ARCP introduced new, less favorable terms.

ARC IV shareholders will now receive a mix of 30% cash, 22% ARCP shares and 48% in ARCP 6.7% preferreds—a yield level we believe is significantly below where they may be able to issue in today’s market, in our view. In short, ARC IV shareholders lose the all-cash guarantee of $13 per share and will receive part of their remuneration in ARCP’s preferreds at what appears to us a tight yield.

View related content here.

Columbia Property Trust goes public

Columbia Property Trust (CXP), a $5 billion Atlanta-based REIT that invests primarily in suburban office properties, listed on the NYSE on October 11. In conjunction with the IPO, Columbia announced a $300 million share buyback priced at $22-25. The timing was not optimum, as REITs were trading below NAV.

During the height of the commercial real estate bubble, Columbia Property traded at about $10 per share. In 2008-2009 the price fell to $6 per share, and the company executed a reverse 4:1 stock split. Following the usual trading patterns, retail investors sold off and Columbia’s shares traded down, into the low $20s, but have not recovered. We believe the value is in the mid $20s.

This case illustrates the difficulties faced by non traded REITs that want to tap the public markets. Before they make that leap, we believe their management teams should answer the following questions.

-

Is the REIT market trading at a premium to NAV? At the moment REITs are trading at or below NAV, which means companies who choose this time to go public should temper their expectations.

-

What kind of assets do you own? Is the market paying a premium or a discount for them? Columbia Wells holds mostly suburban office properties, which are trading at a discount.

- Would a private market liquidation make more sense? When a public offering is unlikely to price at a premium valuation, whether due to market conditions or the kind of assets owned, a REIT can be left in a strategically difficult position. Whilst management is often motivated to grow the business, further share issuance may be dilutive. Instead of going public, management should consider the benefits of a private market liquidation, where it should be able realize at NAV.

Traded REIT’s

Resource Real Estate's View on Global Real Estate

We see great opportunities in global real estate.

-

The global economy is stabilizing ...

There have been a few false starts in this long and slow post-crash recovery, but we believe (and consensus concurs) that fundamentals have finally bottomed—and, in fact, have started to move up. Global economies appear to have stabilized and GDP is growing, even in some of the hardest-hit countries.

-

... and demand for commercial real estate is growing.

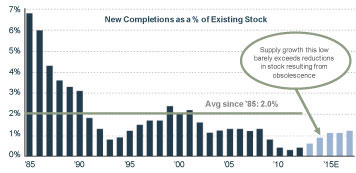

With the rise in investor and consumer confidence, demand for commercial real estate is on the upswing. But, as we pointed out last month, and as shown below, new construction all but stopped following the global economic crisis of 2008. With demand currently far outpacing supply, we are seeing sustained rental growth and value creation. While this has driven prices up, recent volatility in the REIT market is providing opportunities to buy selective securities at discounts to NAV.

- The result is an increase in opportunities to diversify by investing in global companies with strong management and sound business models. This recovery has highlighted the importance of investing in well-run companies that have demonstrated their ability to grow and compound cash flow and NAV. Global and sector diversification are other ways to maximize potential while keeping risk at acceptable levels.

Scott Crowe is the Global Portfolio Manager at Resource Real Estate. Previously, he was the lead Global Portfolio Manager for Cohen & Steers, where he led the investment and research team of over 20 portfolio managers and analysts. Mr. Crowe was accountable for over $10B in FuM across the global, international and emerging market portfolios. Prior to this, Mr. Crowe held the position of Head of Global Real Estate for UBS Equities Research where he built and managed the US REIT division while leading a global team of more than 40 analysts.

Scott began his career at Paladin Property Securities and was also an Associate Lecturer at the University of Technology Sydney. Scott holds an Honors Finance Degree from the University of Technology Sydney and a Bachelor of Commerce from the University of NSW/National University of Singapore.