Interval Fund Investing - Mutual Fund Access to Alternative Investments

The global financial crisis has caused an important structural shift in investor preferences towards alternative investments and away from more volatile equity markets. In addition, bond yields have plummeted in the aftermath of the crisis leaving investors without the ability to generate income. In essence, the crisis highlighted a flaw in the way many investors approach portfolio diversification – having simply a range of mutual funds with access to different “sectors” may not be enough to create appropriate diversification. For instance, while the underlying investment of a publicly traded REIT may include real estate, an investor’s allocation can behave very much like the S&P500.

Institutions have implicitly acknowledged the limitations of equity market investments for decades, with most maintaining a large allocation to private investments, including real estate. The benefits of these allocations have been a decrease in portfolio volatility, lower correlations with equity markets and often increased returns from income. Historically, access to alternative private investments has been for the exclusive use of large institutional investors, but this is changing rapidly. The “mass affluent” are now demanding more sophisticated investment products.

Recognizing this trend, investment sponsors have developed new ways for individual clients to access alternative investments, including real estate equity and debt through non-traded REITs as well as corporate credit through Business Development Companies (BDCs). Now, a new product type, the Interval Mutual Fund (the “iFund©”), is providing the next evolution in alternative investment products.

As mutual funds did for equities, iFunds have the potential to unlock alternative investments to the widest possible investor base while simultaneously providing greater price transparency and liquidity. In addition, iFunds may increase the efficiency and lower the expenses of investments in alternative assets by aggregating capital, thus decreasing costs as a percentage of assets—a significant benefit given the imminent rule changes for commission and fee transparency on client statements for non-traded REITs and BDCs.

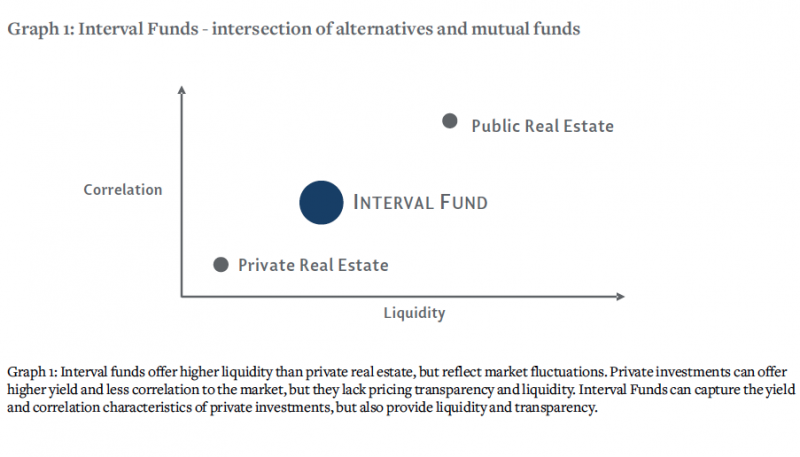

Interval Funds: the meeting point of alternative investments and mutual funds

The iFund is simply a mutual fund that offers daily investment opportunities and limited redemptions at specific intervals (usually quarterly). This change to the mutual fund structure creates large advantages however; it allows the fund to simultaneously invest both in private and public assets— with a structure that has both liquidity and a daily net asset value (NAV). In turn, the sponsor may create a portfolio of investments with high yield and low correlation to equities, but without the usual limitations of private investments (illiquidity and lack of price transparency).

The liquidity feature and price transparency, in conjunction with sufficient portfolio diversification, can make iFunds suitable for a large pool of investors. This also allows interval funds to be held in both fee-based and commission-based accounts—an important benefit given the growth of fee-based assets and the advisors’ need to access alternative investments that complement existing mutual fund options.

Replicating an Institutional Approach to Real Estate Investments

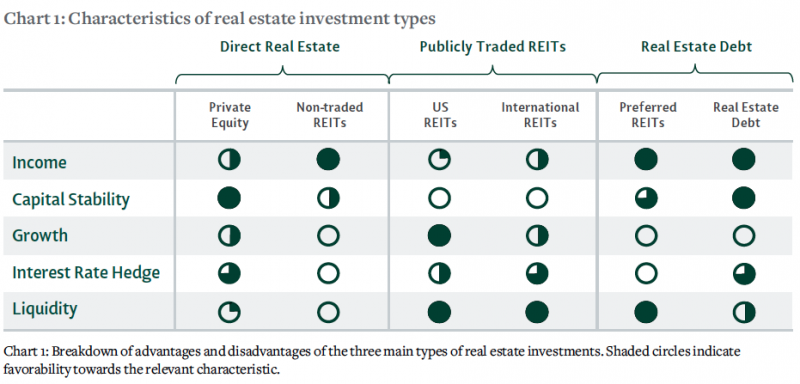

Individual investors' access to real estate has traditionally been limited to only publicly traded REITs and non-traded REITs. However, these products represent only a portion of the available access points to real estate investments that large institutions enjoy. Simultaneously accessing different real estate investment types can optimize a real estate allocation by capturing the benefits of listed and non-listed investments, while mitigating their individual disadvantages. For example, investing directly in real estate through institutional private equity can produce moderate yields, growth and sector diversity, but not liquidity. Publicly traded REITs are liquid and give access to global investment opportunities, non-traditional asset types and growth—but come with a lower yield and higher equity market correlation. Debt can give yield and principal protection, but can fall short on interest-rate hedging ability.

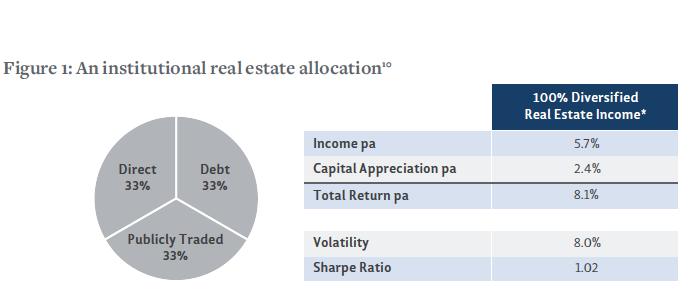

In the following example, replicating an institutional real estate allocation by including equal weights of direct real estate, credit investments (debt) and publicly traded REITs would have produced a yield of 5.7% and a total return of 8.1%, with a volatility of 8.0% over the last thirteen years. The Sharpe Ratio would have been 1.02.

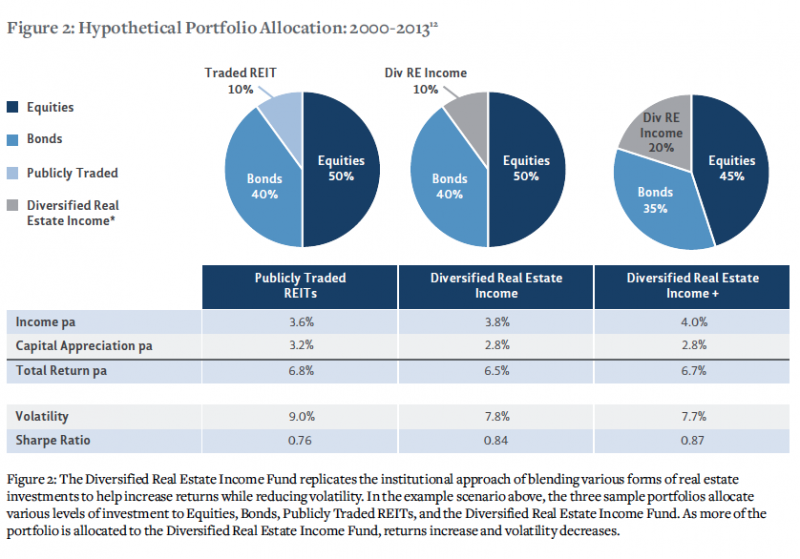

As shown below, the inclusion of either (1.) an ordinary publicly traded REIT allocation in a diversified portfolio of real estate, equities and bonds (first pie chart below in Figure 2) or instead (2.) the above institutional real estate allocation (middle pie chart) would have had a significant impact on an investor’s return outcome. Implementing an institutional approach, an investor would have enjoyed a higher income yield and improved risk adjusted return. Further increasing the institutional real estate allocation to 20% (the far right pie chart) would have further improved these metrics for the investor’s portfolio.

Inclusion of an institutional real estate allocation in a balanced portfolio

A tool for new FINRA client statement rules

The non-traded REIT industry faces a significant change with the expected implementation of new rules to client statement reporting. The changes for fee and commission transparency should have a significant impact on the non-traded REIT market and, in particular, its fee and commission structures. Coupled with an increase in transparency on the net value of client positions, this change is likely to make interval funds, which have return profiles similar to non-traded REITs, more attractive for both advisors and clients.

Interval Funds may be part of the solution for advisors impacted by the potential of lower commissions following the implementation of these new rules. iFunds already enjoy liquidity and transparency in pricing through a daily NAV. Advisors who have been reluctant to make use of more opaque alternative instruments may find iFunds suitable for more clients by virtue of their liquidity and transparency; and hence expanding the use of alternatives by their clients.

The ability to aggregate capital through iFunds provides a further advantage to the industry. Economies of scale and mutual fund implementation can help decrease costs related to due diligence, research and distribution. Just as mutual funds led to the broadening of equity investment over the last two decades (with simultaneous fee compression and expansion of the industry), iFunds may prove a similar catalyst for expanded market penetration by alternatives.

Analyzing Interval Funds

iFunds’ attractiveness to investors depends on the content of their portfolios. Strategies will differ, and indeed, some will include a range of alternative assets in addition to real estate. However, we believe there are a few essential aspects investors should consider when examining an iFund’s merits:

- Investment strategy: Understand what asset classes the portfolio comprises as well as the largest positions in the fund.

- Internal investment management versus fund of funds approach: Does the iFund outsource investment management or keep this function “in house”? We believe this important function should be performed by the fund’s sponsor, as it allows better risk control and more accountability, in addition to potentially lower costs.

- Level of liquidity and transparency: The liquidity feature of the iFund structure is an important characteristic; a significant level of liquid assets will ensure the ability to meet redemptions. Further, the allocation to liquid assets improves pricing transparency.

- Conflicts of interest: Conflicts can arise if the portfolio manager is allowed to invest in other funds of the sponsor. The most transparent way to ensure no conflicts is to preclude the iFund from investing in other funds of the sponsor.

Conclusion

The demand for uncorrelated income is leading to new ways for advisors and their clients to access alternative investments. iFunds help meet this growing demand through a portfolio of alternative investment securities. Such an approach can replicate the benefits of an institutional approach to real estate investment for an expanded set of investors. In addition, the flexibility of the mutual fund structure can help advisors adapt to an evolving regulatory landscape. Important aspects to consider when assessing the merits of an interval fund include the investment strategy, internal management, liquidity and lack of conflicts. As the demand for uncorrelated yield continues to increase, iFunds can offer an important tool to gain the widest possible access by the widest possible audience to alternative investments.

Scott Crowe is the Global Portfolio Manager for Resource Real Estate. Previously, he was the lead Global Portfolio Manager for Cohen & Steers.