In only nine days, the NFL regular season begins. Teams and coaches will be analyzing each other’s moves and plays, looking for any indication that can give them an edge to succeed. Some will play strong offense, others good defense from the moment of the first kickoff. Although some big plays could happen during the first kickoff or first hike, we know this is only the start of the game, and in turn only the start of the season. History suggests the same is true for the first Federal Reserve (Fed) interest rate hike as it relates to the stock market and economy.

While football teams are looking for an edge against their opponents on the field, investors will be keeping a close eye on the Fed to try and gain an edge as to when it will finish winding down its bond-buying program (quantitative easing 3) and eventually begin hiking short-term interest rates.

Investors appear to be comfortable with the end of quantitative easing following last year’s taper tantrum; however, the new fear is what impact Fed rate hikes will have on the market. Improving economic growth, as well as a lower unemployment rate and inflation moving closer toward the Fed’s target, has been supportive of higher stock market levels and valuations, as we see the S&P 500 Index continue to make new highs. Corporate revenue and earnings growth have also been supportive of the stock market’s hike higher. But when Chair Janet Yellen, as the Fed’s new quarterback, announces the first rate hike either to cool the economy or to curb inflation, what impact will we see in the market and economy? Will it be better to go on the offense or play good defense? We take a look back in this Weekly Market Commentary to provide evidence as to why we believe it is still time to play offense.

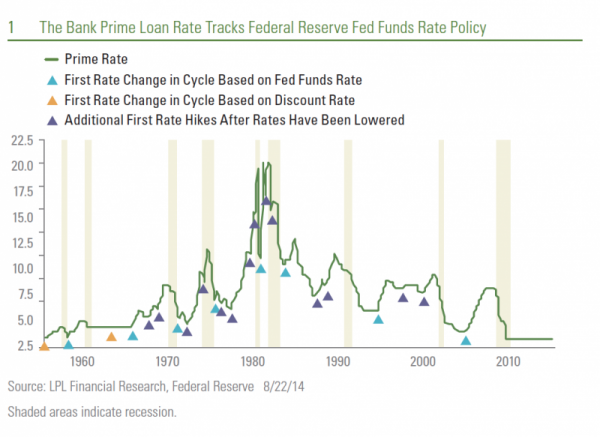

Looking at data going back to the 1950s, we see that following a recession, the first rate hike by the Fed has never been an indication of a market peak [Figure 1]. This should make sense, as the Fed typically begins to hike rates or tighten only when it starts to see growth improving or the economy getting too “hot,” as measured by inflationary pressures.

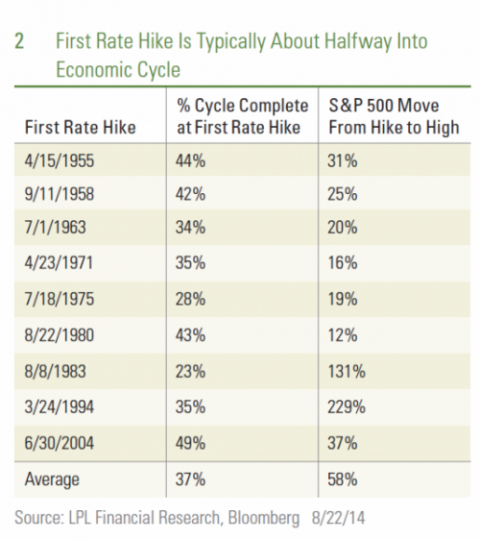

From an economic standpoint, as indicated by Figure 2, on average the first rate hike has taken place about 37%, or less than halfway into the economic cycle (measured peak to peak). This would only put us near our own 40-yard line. (While worth noting, this is only one data point.)

The S&P 500 has returned on average, another 58% after the first rate hike (price return) before the market peak for the economic cycle. The first rate hike has not marked a top in any of the prior nine economic cycles, with the S&P 500 advancing from a low of another 12% to a high of another 229%, leaving us relatively optimistic, given recent economic data and a strong earnings season, that a rate hike will provide us more opportunity to play offense before the final whistle blows for the current expansion.

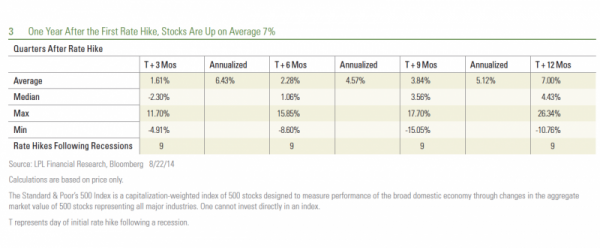

Stock market performance is really the name of the game and can be viewed through several different angles. The near-term view, as measured by one, two, three, and four quarters after the first rate hike, suggests that while there are some negative periods, on average returns are positive [Figure 3].

The Fed sometimes lowers and re-raises rates prior to the end of a recession to tweak policy, address economic weakness that does not develop into a recession, or in response to an initial rate hike that occurred too soon. Since this is a relatively small sample, we looked back at all scenarios when the Fed raised rates for the first time after rates had been lowered. Keep in mind, there were different reasons for some of these specific rate hikes that may not be as relevant to the current environment.

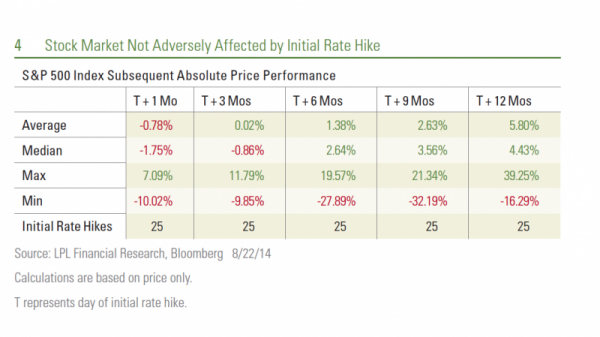

We also included a one-month forward look to see how equity markets responded in the very short term. As Figure 4 illustrates, on average the S&P 500 was flat one month and three months following an initial rate hike, but its pace over the rest of the year was in line with its historical average. The initial market reaction to a rate hike is, on average, negative, but the data show it may be a good time to be invested. Like losing a few yards on first down, the market reaction over the first one to three months is slightly negative. However, over longer-term periods of six months or more, the stock market has averaged gains following the Fed’s first interest rate hike and shows how it could pay to remain invested despite the possibility of Fed rate increases.

Consistent with our message in our Mid-Year Outlook 2014, we believe we are only roughly halfway through the current economic cycle, leaving more room for the economy to grow, the stock market to reach more new highs, and investors to play more offense as the Fed is only nearing the very early quarters of a tightening cycle to end the game.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Burt White serves as managing director and chief investment officer at LPL Financial.