Advisors know the importance of considering and managing tax implications when it comes to planning sound financial strategies, but many can do more to raise this important topic with clients. By taking a more hands-on approach to tax management, advisors can help preserve the investment assets and the emotional loyalties of their clients.

Taxes can directly affect investment outcomes, especially given some of the developments in recent years. The expiration of the 2001 tax cuts means the highest marginal tax rate returned to 1990s levels, and individuals filing jointly earning over $250,000 now pay a 3.8 percent Medicare tax on investment income, as well. Moreover, many investment returns coming out of the 2008 financial crisis gave many investors a substantial “tax holiday” by providing losses to offset against future capital gains, but that reprieve has likely ended with the market’s prolonged recovery since 2009.

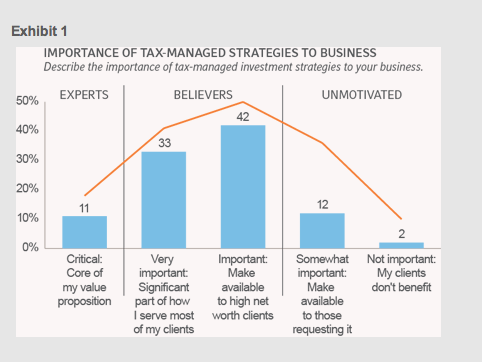

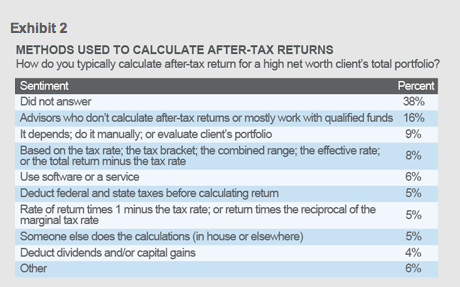

With these increasing tax impacts in mind, we recently surveyed advisors in our Financial Professional Outlook and asked about their tax management practices. Eighty six percent of advisors said tax-managed strategies are important or critical to their businesses— but only 29 percent said they’ve started a conversation about it with their clients during the last quarter, and only 10 percent say that their clients have raised the subject. Likewise, some 38 percent of advisors did not respond when asked about how they calculate after-tax returns and another 16 percent said they don’t do after-tax calculations at all.

The basics of being tax savvy

Many advisors are looking to better connect their tax-aware beliefs and their practices. As a starting point, advisors should make a point to understand the basics of each client’s total tax situation, including:

- Federal and state tax rates

- Medicare tax, if applicable

- Capital gains tax exposure

Advisors also need to understand not simply the aggregate rate-of-return of a client’s portfolio in a given year, but also if that return included any distributions and related tax impact. The character of those distributions — whether capital gains qualify as long-term or short-term, for instance — can make a big difference.

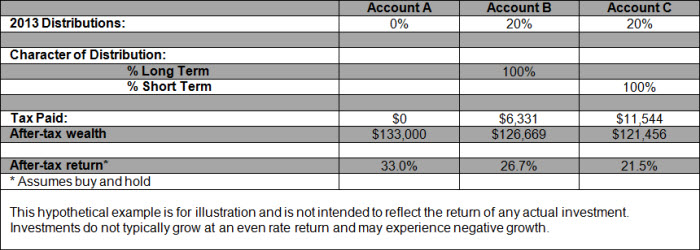

Consider the three hypothetical asset accounts below for a client in the current top marginal tax rate (now 43.4 percent, including the Medicare tax). All three pools of assets are valued at $100,000 and appreciated in 2013 in line with the U.S. equity market with a 33 percent rate-of-return.¹ We will assume a long-term capital gains tax of 23.8 percent and a short-term capital gains tax of 43.4 percent.

Account A, which deferred all gains, earned $33,000 in after-tax wealth. Meanwhile, Account B distributed 20 percent of its returns as long-term capital gains, paying $6,331 in taxes and earning only $26,669 in after-tax wealth. Account C distributed 20 percent of its returns as short-term capital gains, netting $21,456 in after-tax returns.

In other words, how gains are distributed can have a major impact on after-tax wealth. Deferring or reducing taxable distributions can have a powerful effect, and there are strategies that can help advisors and their clients navigate these decisions effectively.

Braving the great divide: CPAs and advisors

Many advisors are wary of wading into the complexities of tax policy and the letter of tax law — who can blame them? But developing tax insights can be an important differentiator in how an advisor provides value to their clients.

A collaborative relationship with clients’ accountants or tax professionals can also help advisors stay up-to-speed on their clients’ tax situations and goals. Likewise, accountants often benefit from consulting with advisors for clarity surrounding a client’s investment goals, transactions and distributions.

By considering a client’s overall tax situation, an advisor can protect existing wealth and open new avenues of potential growth. As a start, advisors can discuss tax-aware products, such as municipal bonds and tax-managed mutual funds, educate themselves and their clients on rebalancing strategies, and include tax professionals in the conversation.

Possible next steps for advisors

Ultimately, the most important thing advisors can do to encourage tax-aware investing is to bring it up with their clients for whom these strategies may be appropriate. Our Financial Professional Outlook survey showed that while advisors understand that taxes matter to bottom-line returns, some may be looking for new and better ways to help their clients in that regard.

Many financial advisors face more pressure than ever to deliver a higher level of service to their clients, and helping clients manage taxes effectively can be an excellent way to add value. With the right approach, advisors can help increase their clients’ after-tax wealth while also strengthening relationships for the benefit of their businesses.

¹As represented by the Russell 3000® Index (as of December 31, 2013).

Frank Pape is the director of consulting services for Russell’s U.S. advisor-sold business. To see this article in its original form, with more information and full disclosures, visit Russell's Latest Research.