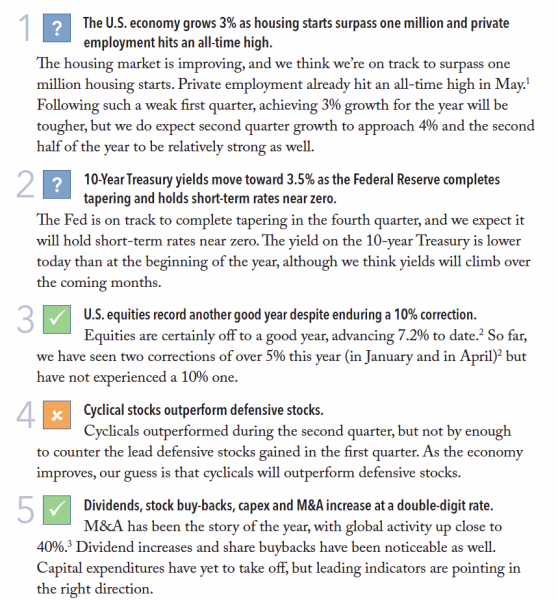

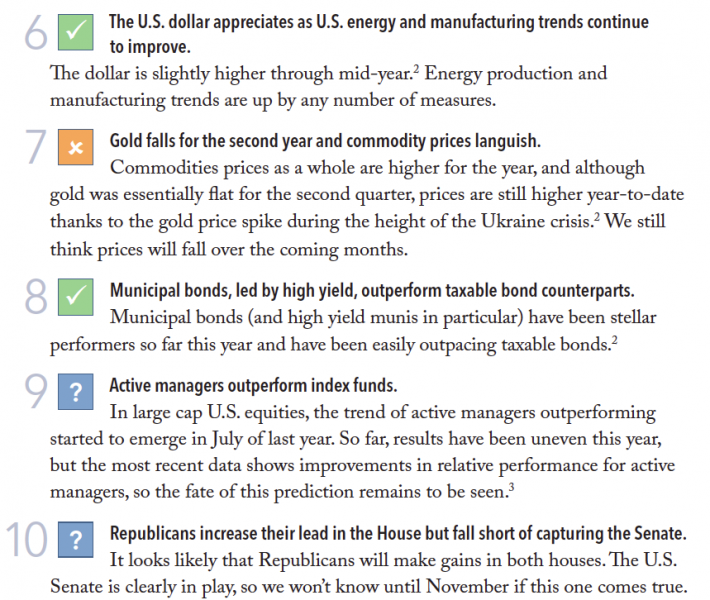

Equity markets experienced a strong first half of the year, and stock prices already advanced to where we originally thought they would be at year-end. Bond prices rose as yields fell, with the Federal Reserve continuing its monthly tapering of asset purchases. Economic growth was disappointing early in the year, but earnings growth remained reasonably solid. Outside of the U.S., the pace of growth and the direction of financial markets remained mixed. Meanwhile, financial market volatility has remained extremely low. So with this backdrop, following is a look at the ten predictions we made in January:

?= Too Early to Call, X= Heading in the Wrong Direction, √= A Good Start

Looking Ahead

For the coming months, the main issues to watch include the pace of economic and earnings growth, geopolitical hot spots and the continued debate on the Fed’s normalization process (tempered by the new discussion around inflation). Our topline view is that we expect bonds to reverse their first half strength, equity markets to be more volatile and stock selection to be a key driver of performance.

1 Source: Bureau of Labor Statistics http://www.bls.gov/news.release/empsit.htm.

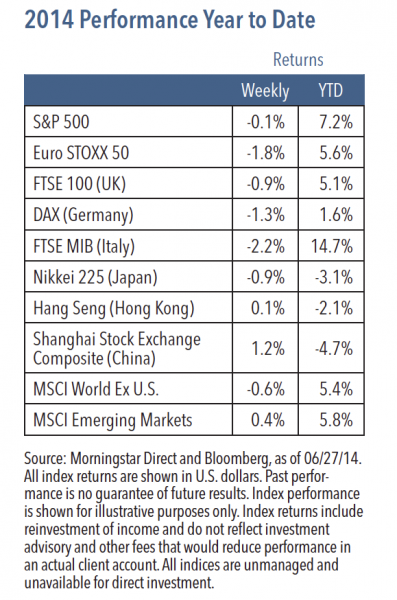

2 Source: Morningstar Direct and Bloomberg, as of 6/27/14.

3 Source: Bank of America Merrill Lynch Global Research.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy. Euro STOXX 50 Index is Europe’s leading Blue-chip index for the Eurozone and covers 50 stocks from 12 Eurozone countries. FTSE 100 Index is a capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange. Deutsche Borse AG German Stock Index (DAX Index) is a total return index of 30 selected German blue chip stocks traded on the Frankfurt Stock Exchange. FTSE MIB Index is an index of the 40 most liquid and capitalized stocks listed on the Borsa Italiana. Nikkei 225 Index is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. Hong Kong Hang Seng Index is a free-float capitalization-weighted index of selection of companies from the Stock Exchange of Hong Kong. Shanghai Stock Exchange Composite is a capitalization-weighted index that tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The MSCI World Index ex-U.S. is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets minus the United States. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

RISKS AND OTHER IMPORTANT CONSIDERATIONS

The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. All investments carry a certain degree of risk and there is no assurance that an investment will provide positive performance over any period of time. Equity investments are subject to market risk or the risk that stocks will decline in response to such factors as adverse company news or industry developments or a general economic decline. Debt or fixed income securities are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. Non-investment-grade bonds involve heightened credit risk, liquidity risk, and potential for default. Foreign investing involves additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. Past performance is no guarantee of future results.

Nuveen Asset Management, LLC is a registered investment adviser and an affiliate of Nuveen Investments, Inc.

©2014 Nuveen Investments, Inc. All rights reserved.

Robert C. Doll, CFA is Chief Equity Strategist and Senior Portfolio Manager for Nuveen Asset Management. Follow @BobDollNuveen on Twitter.