An exasperated President Harry Truman once said, “Give me a one-handed economist! All my economists say, ‘on the one hand…on the other.’” Financial markets today probably have a lot of investors wishing for one-handed guidance from a trusted source. I am sensitive to this since I recently predicted a pullback in U.S. equities while also asserting that the bull market could go on for some time. I am known for my strong (sometimes even unpopular) views, so people might think I am talking out of both sides of my mouth when I say U.S. equities could correct further and U.S. equities are fairly priced and could move higher.

As I wrote earlier in the summer, we are nearing the speculative phase of this bull market. At such times, it is very hard to make blanket statements about being bullish or bearish. Decisions are nuanced and depend on whether you are a speculator or an investor. Fundamentally, a speculator invests thinking things will be more expensive tomorrow and an investor buys assets he or she expects will provide exceptional long-run returns.

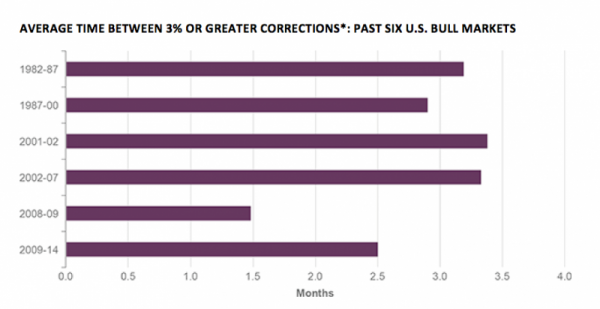

Do I think U.S. stocks will be higher or lower at the end of the year? The short answer is I think the likelihood is stocks will reach new highs by year end. This little flush over the past week is healthy and should set us up for a nice recovery. Indeed, the chart below suggests the consolidation was overdue. My advice to long-term investors is that this is not the time to fall victim to panic and sell. While market swoons such as last week’s are unsettling, it is worth remembering that while the Dow Jones Industrial Average dropped 22.6 percent on October 19, 1987, stocks ended that year slightly higher than where they were at the start of the year. In the end, “Black Monday” was just a temporary blip in the great bull run of the 1980s.

While volatility is likely to increase in the near term, the fundamentals offer comfort; the equity risk premium now sits at 5.4 percent, above the long-term average of 2.8 percent, suggesting equities are offering a reasonable return for risk. And the S&P 500 Index’s price-earnings multiple of 17.3 times also seems fair given low inflation levels. If you are an investor, avoid the temptation to be short-term focused.

I am reminded of the wise words of my friend Daniel Kahneman, a pioneer in behavioral finance who won the Nobel Prize in Economic Sciences in 2002 for research on decision making. He tells us how frequently we react to market moves is a key factor in how our fortunes fare. “All of us would be better investors if we just made fewer decisions,” says Kahneman. In the case of today’s market, this is good, one-handed advice for investors.

Bull Markets Dip Every 61 Trading Days on Average

Hand-wringing over a lasting U.S. equity market correction is rife, but our historical analysis indicates that current market volatility may be just a passing storm. Equity market consolidations of the magnitude we are experiencing are commonplace in bull markets, occurring every 61 trading days on average. The last downturn occurred in April, so the market was due for a drop. However, after a healthy selloff, we expect stocks to reach new highs by year end.

Source: Bloomberg, Guggenheim Investments. Data as of 8/6/2014. *Note: Decrease is measured on a rolling 10-day basis.

This material is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2014, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Scott Minerd is Chairman of Investments and Global Chief Investment Officer at Guggenheim Partners